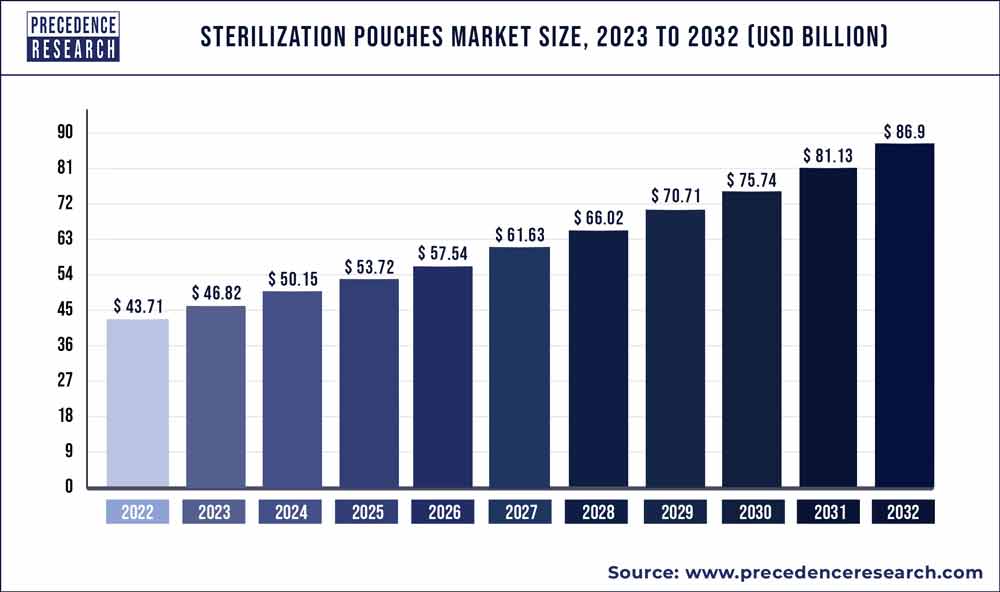

The global sterilization pouches market size reached USD 43.71 billion in 2022 and is projected to hit around USD 86.9 billion by 2032, expanding at a CAGR of 7.1% from 2023 to 2032.

The sterilization pouches market has experienced significant growth driven by several key factors. Sterilization pouches are essential packaging solutions used in medical and healthcare settings to maintain the sterility of instruments and equipment during storage and transportation. With increasing emphasis on infection control and patient safety, there has been a rising demand for effective and reliable sterilization pouches. These pouches are designed to provide a barrier against microbial contamination and maintain the sterility of packaged items until they are ready for use. Moreover, advancements in pouch design, materials, and sterilization processes have improved the efficiency and performance of sterilization pouches, making them essential components of medical facilities and healthcare settings.

Additionally, the COVID-19 pandemic has further underscored the importance of infection prevention measures, driving the demand for sterilization pouches and other protective equipment. Furthermore, stringent regulatory requirements and standards for sterilization and infection control have contributed to market growth, ensuring the quality and safety of sterilization pouches used in healthcare facilities. As healthcare facilities continue to prioritize patient safety and infection prevention, the sterilization pouches market is expected to witness sustained growth, offering opportunities for innovation and advancements in sterilization packaging solutions.

Key Takeaways

- In 2022, the hospital segment’s revenue share was 52%.

- In 2022, the Clinics segment accounted for nearly 22% of total revenue.

- In 2022, the other application category accounted for 16% of total revenue.

Get a Sample: https://www.precedenceresearch.com/sample/2713

Report Scope of the Sterilization Pouches Market

| Report Coverage | Details |

| Market Size in 2023 | USD 46.82 Billion |

| Market Size by 2032 | USD 86.9 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 7.1% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Type, By Application, and By End-Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Read More: Printing Packaging Market Size to Reach USD 500.32 Bn By 2032

Sterilization Pouches Market Dynamics

Driver

The sterilization pouches market is witnessing a significant boost in product adoption with the introduction of reusable medical equipment. This trend reflects a growing emphasis on sustainability and cost-effectiveness in healthcare settings.

Reusable medical equipment offers several advantages over single-use devices, including reduced waste generation, lower costs, and enhanced environmental sustainability. By opting for reusable equipment, healthcare facilities can minimize their environmental footprint while also saving on procurement and disposal expenses.

Sterilization pouches play a critical role in ensuring the safety and efficacy of reusable medical equipment by providing a barrier against contamination during storage and transportation. The introduction of sterilization pouches specifically designed for reusable devices further enhances the value proposition of these products, ensuring optimal sterilization and protection of equipment between uses.

Restraint

The rising risk of infectious illness is attributed to faulty container design and complex instrumentation in the sterilization pouches market. Inadequate container design and intricate instrumentation may compromise the effectiveness of sterilization processes, leaving medical instruments and devices vulnerable to contamination. Such flaws can result in incomplete sterilization, leading to the presence of pathogens or infectious agents on surfaces intended to be sterile. Consequently, healthcare facilities and practitioners face heightened risks of transmitting infections to patients during medical procedures. To address this pressing issue, stakeholders in the sterilization pouches market must prioritize product design and manufacturing practices that ensure reliable and efficient sterilization. This includes optimizing container designs for proper airflow and steam penetration, as well as simplifying instrumentation to streamline the sterilization process.

Additionally, stringent quality control measures and adherence to regulatory standards are imperative to guarantee the safety and efficacy of sterilization pouches. Collaborative efforts among industry players, healthcare professionals, and regulatory authorities are essential to mitigate the risk of infectious illness associated with faulty container design and complex instrumentation in the sterilization pouches market, safeguarding patient safety and public health.

Opportunity

In the sterilization pouches market, there is a noticeable increase in demand. This uptick is driven by several factors, including the growing emphasis on infection control in healthcare settings, the rise in surgical procedures, and the need for reliable and efficient sterilization methods. Sterilization pouches play a crucial role in ensuring the sterility of medical instruments and equipment by providing a barrier against contaminants during storage and transportation.

Additionally, advancements in sterilization technologies and materials used in pouch manufacturing have led to improved performance, convenience, and safety. As healthcare facilities prioritize patient safety and infection prevention measures, the demand for sterilization pouches is expected to continue growing, driving innovation and market expansion in the coming years.

Recent Developments

- As of October 2019, AMD The purchase of Hedy Canada Inc. by Medicom Inc., a renowned Canadian provider of infection control and preventive solutions with its headquarters located in Canada, involves the acquisition of Hedy Canada Inc. The result has been an improvement in Medicom’s reputation both domestically and internationally.

- December 2019: M&Q Packaging, a US-based manufacturer and supplier of a broad range of packaging solutions, demonstrated its ability to provide custom sterilising solutions to its client. The customer had brought up the issue of steam heat sterilisation pouches not sealing to the product development team at M&Q Packaging. In a press release, the business claimed that by providing the required custom product, it has successfully displayed its creative ability.

Sterilization Pouches Market Players

- Amcor plc

- Mondi Group

- Berry Global

- YIPAK

- 3M

- Dynarex Corporation

- PMS Healthcare Technologies

- Getinge Group

- Smurfit Kappa

- STERIS

- Certol International

- Wihuri

- Shanghai Jianzhong Medical Equipment Packing Co., Ltd.

- Prompac

- Cardinal Health

- AMD Medicom Inc.

- STERIMED

Segments Covered in the Report

By Type

- Sterilization Pouches

- Paper Pouches

- Plastic Pouches

- Sterilization Wrapping

- Sterilization Containers

- Others

By Application

- Hospitals

- CSSDs

- Clinics

- Others

By End-Use

- Food & Beverages

- Healthcare

- Cosmetics

- Household Goods

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Unlocking Market Insights through Data Excellence

The “Precedence Statistics” flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today’s dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit:

www.precedencestatistics.com