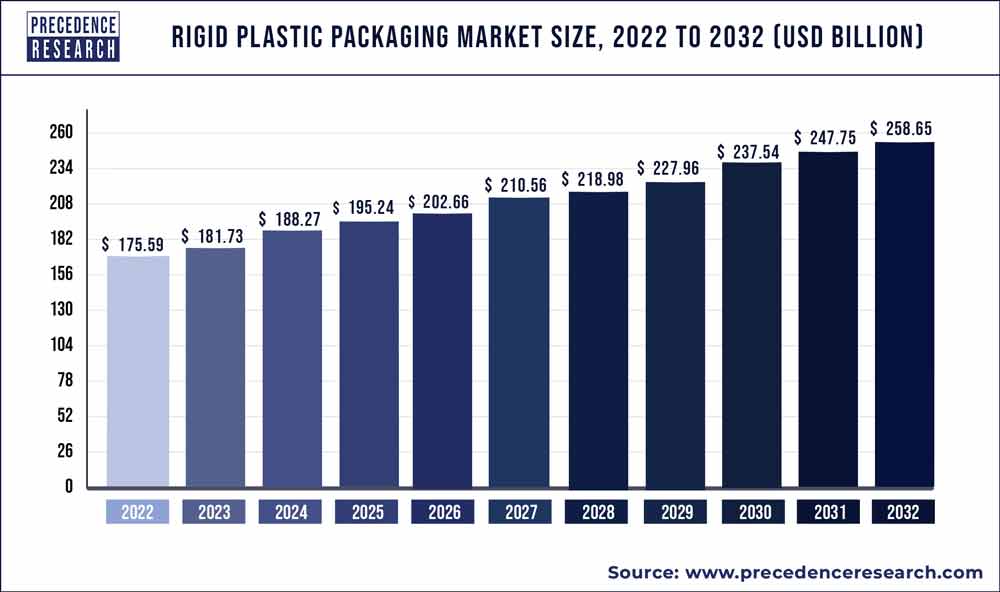

The global rigid plastic packaging market size surpassed USD 175.59 billion in 2022 and is expected to hit around USD 258.65 billion by 2032, poised to grow at a CAGR of 4% from 2023 to 2032.

The rigid plastic packaging market has witnessed significant growth driven by various factors. Rigid plastic packaging refers to containers, bottles, jars, and other packaging solutions made from rigid plastic materials such as PET, HDPE, PP, and PVC. With the increasing demand for lightweight, durable, and versatile packaging solutions across industries such as food and beverage, personal care, pharmaceuticals, and household products, there has been a growing adoption of rigid plastic packaging. These packaging solutions offer benefits such as excellent barrier properties, resistance to moisture and chemicals, and customizable shapes and sizes to meet specific product requirements.

Moreover, advancements in plastics technology, including additives, coatings, and recycling processes, have improved the sustainability and recyclability of rigid plastic packaging, addressing environmental concerns and regulatory requirements. Additionally, the rise of e-commerce and convenience-oriented lifestyles has further fueled demand for rigid plastic packaging solutions as companies seek to optimize product protection, shelf visibility, and branding opportunities. Furthermore, the COVID-19 pandemic has highlighted the importance of hygienic and tamper-evident packaging solutions, driving increased adoption of rigid plastic packaging for healthcare, personal protective equipment (PPE), and essential consumer goods. As industries continue to prioritize efficiency, sustainability, and consumer safety, the rigid plastic packaging market is expected to witness sustained growth, offering opportunities for innovation and advancement in packaging technologies.

Key Takeaways

- In 2022, the polyethylene terephthalate (PET) segment held a 61.5% share.

- In 2022, the injection molding segment accounted for the biggest revenue share, surpassing 38%.

- In 2022, the food and beverage category attained a 55% market share.

Get a Sample: https://www.precedenceresearch.com/sample/2091

Report Scope of the Rigid Plastic Packaging Market

| Report Coverage | Details |

| Market Size in 2023 | USD 181.73 Billion |

| Market Size by 2032 | USD 258.65 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 4% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Type, Production Process, Material, End User, and Geography |

Read More: Self-Heating Food Packaging Market Size to Hit USD 86.91 Billion by 2032

Rigid Plastic Packaging Market Dynamics

Driver

Increased package recycling rates are driving growth in the rigid plastic packaging market. As consumers, businesses, and governments prioritize sustainability and environmental responsibility, there is a growing emphasis on recycling and reducing the environmental impact of packaging materials.

Rigid plastic packaging, which includes containers, bottles, jars, and trays made from materials such as PET, HDPE, and PP, is increasingly being recycled due to its recyclability and potential for circularity. Manufacturers and brand owners are investing in recyclable and recycled-content plastic packaging to meet consumer demand for sustainable packaging solutions.

Moreover, advancements in recycling infrastructure, technology, and processes are making it easier and more cost-effective to recycle rigid plastic packaging. Improved collection systems, sorting technologies, and recycling facilities enable more efficient recovery and processing of rigid plastic packaging waste, increasing recycling rates and reducing reliance on virgin plastics.

Restraint

The rigid plastic packaging market faces significant environmental-related effects. Rigid plastic packaging, such as containers, bottles, and trays, is widely used in various industries due to its durability, versatility, and cost-effectiveness. However, the environmental impact of rigid plastic packaging is a growing concern due to its contribution to pollution, resource depletion, and waste management challenges.

One major environmental-related effect of rigid plastic packaging is its contribution to plastic pollution. Improper disposal of rigid plastic packaging, such as littering or inadequate recycling, can result in plastic waste entering waterways, oceans, and ecosystems, where it poses threats to wildlife, marine life, and ecosystems. Plastic packaging can take hundreds of years to degrade in the environment, leading to long-term environmental harm and visual pollution.

Additionally, the production of rigid plastic packaging relies on finite fossil fuel resources, such as petroleum and natural gas, contributing to resource depletion and greenhouse gas emissions. The extraction, refining, and manufacturing processes involved in producing plastic packaging generate carbon dioxide emissions and other pollutants, contributing to climate change and environmental degradation.

Opportunity

The rigid plastic packaging market is experiencing a surge in demand, particularly in the cosmetics and personal care sector. This uptick in demand can be attributed to several factors.

Firstly, rigid plastic packaging offers several advantages for cosmetics and personal care products. It provides excellent protection against external factors such as moisture, light, and air, helping to preserve the quality and integrity of the products. Additionally, rigid plastic packaging is durable and lightweight, making it ideal for packaging fragile or delicate items such as cosmetics and skincare products.

Secondly, consumer preferences for sustainable packaging options are driving the adoption of rigid plastic packaging in the cosmetics and personal care sector. Many rigid plastic packaging materials are recyclable, and advancements in technology have led to the development of bio-based and biodegradable plastics, further enhancing the sustainability credentials of rigid plastic packaging.

Furthermore, the cosmetics and personal care industry is characterized by constant innovation and product differentiation. Rigid plastic packaging offers versatility in design and customization, allowing brands to create unique and eye-catching packaging solutions that stand out on store shelves and resonate with consumers.

Recent Developments

- As of September 2020, ALPLA Group continued to expand its recycling operations globally. The Austrian family-owned company is currently building an HDPE recycling plant in Mexico. It is anticipated that 15,000 tons of post-consumer recycled material will be generated annually.

- In November 2020, Amcor modified its state-of-the-art engineering and design technology to manufacture the lightweight 900-ml Polyethylene Terephthalate edible oil bottle in Brazil. Bunge, the massive food and agriculture company based in São Paulo, uses a uniquely designed container that is 22% lighter than similar bottles and offers more ecological benefits and increased production.

Rigid Plastic Packaging Market Players

- ALPLA-Werke Alwin Lehner GmbH & Co KG

- Amcor Limited

- DS Smith Plc

- Berry Plastics Corporation

- Klöckner Pentaplast

- Plastipak Holdings, Inc.

- Pactiv Evergreen Inc

- Sealed Air Corporation

- Silgan Holdings, Inc.

- Sonoco Products Company.

Segments Covered in the Report

By Type

- Bottles & Jars

- Rigid Bulk Products

- Trays

- Tubs, Cups, & Pots

- Others

By Production Process

- Extrusion

- Injection Molding

- Blow Molding

- Thermoforming

- Others

By Material

- Polyethylene (PE)

- Polyethylene Terephthalate (PET)

- Polystyrene (PS)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Expanded Polystyrene (EPS)

- Bioplastics

- Others (PC, Polyamide)

By End User

- Food

- Meat, Seafood, and Poultry

- Ready to Eat Meals

- Dairy Products

- Bakery and Confectionery

- Other Food Products

- Beverages

- Alcoholic Beverages

- Non-alcoholic Beverages

- Healthcare

- Cosmetics & Toiletries

- Industrial

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/2091

Unlocking Market Insights through Data Excellence

The “Precedence Statistics” flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today’s dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit:

www.precedencestatistics.com