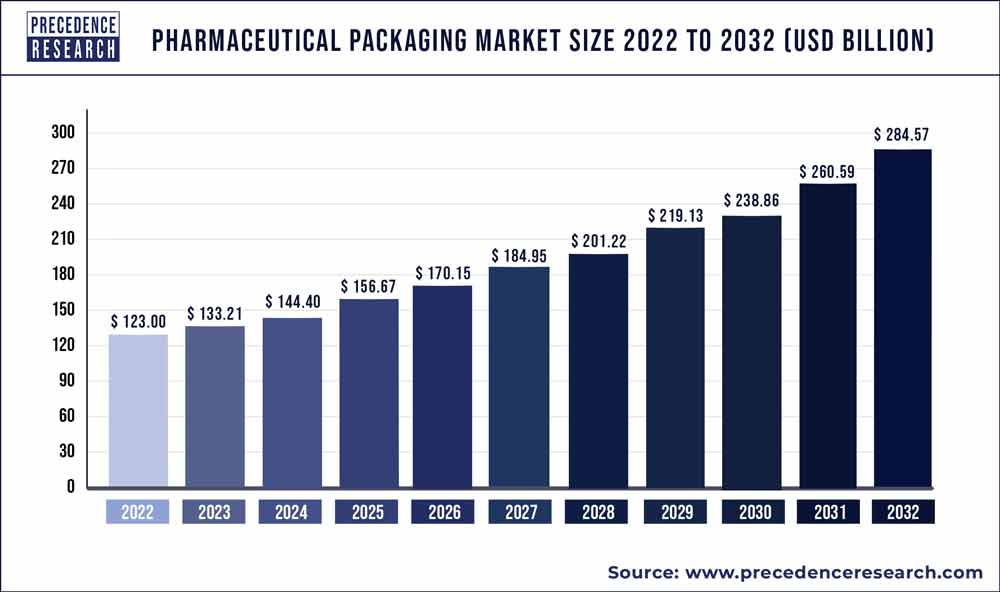

The global pharmaceutical packaging market size was estimated at USD 123 billion in 2022 and is projected to hit around USD 284.57 billion by 2032, growing at a CAGR of 8.8% from 2023 to 2032.

The pharmaceutical packaging market has witnessed substantial growth due to various factors. Pharmaceutical packaging refers to the specialized packaging solutions designed to contain and protect pharmaceutical products, including medications, drugs, and medical devices. With the increasing demand for safe, secure, and compliant packaging solutions in the pharmaceutical industry, there has been a growing adoption of advanced packaging technologies and materials. These solutions offer benefits such as tamper-evident features, child-resistant closures, barrier protection against moisture, oxygen, and light, and compliance with regulatory standards for labeling and serialization.

Moreover, advancements in packaging technology, such as blister packaging, strip packaging, and unit dose packaging, have enabled pharmaceutical companies to improve medication adherence, reduce medication errors, and enhance patient safety. Additionally, the rise of personalized medicine, biologics, and specialty drugs has driven increased demand for specialized packaging solutions that can accommodate the unique requirements of these products.

Furthermore, the COVID-19 pandemic has underscored the importance of resilient and agile supply chains, driving increased investment in pharmaceutical packaging solutions that can ensure the safe and efficient distribution of vaccines, diagnostics, and other medical supplies. As pharmaceutical companies continue to prioritize product quality, patient safety, and regulatory compliance, the pharmaceutical packaging market is expected to witness sustained growth, offering opportunities for innovation and expansion in packaging technologies and services.

Key Takeaways

- In 2022, North America accounted for about 38% of the revenue share.

- Between 2023 and 2032, Asia-Pacific is predicted to grow at the highest CAGR of 12.3%.

- In terms of product, the main market share leader in 2022 was the pharmaceutical packaging category, with 76% of the market.

- Between 2023 and 2032, the secondary product market is expected to increase at an impressive compound annual growth rate (CAGR) of 7.6%.

- In 2022, the pharmaceutical manufacturing category accounted for almost 49.7% of revenue share based on application.

Get a Sample: https://www.precedenceresearch.com/sample/1136

Report Scope of the Pharmaceutical Packaging Market

| Report Highlights | Details |

| Market Size in 2023 | USD 133.21 Billion |

| Market Size by 2032 | USD 284.57 Billion |

| Growth Rate From 2023 to 2032 | CAGR of 8.8% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Product, Application, Material |

| Regional Scope | North America, APAC, Europe, Latin America, MEAN, Rest of the World |

Read More: Liquid Packaging Market Size to Worth USD 723.66 Bn by 2032

Market Dynamics

Driver

There is a growing emphasis on recyclable packaging within the pharmaceutical packaging market. With increasing awareness of environmental sustainability and concerns about plastic pollution, pharmaceutical companies are seeking alternative packaging solutions that minimize environmental impact and promote recycling.

Recyclable packaging refers to packaging materials that can be collected, processed, and reused or repurposed into new products. In the pharmaceutical industry, recyclable packaging offers several benefits, including reducing the use of virgin materials, minimizing waste generation, and lowering carbon emissions associated with packaging production.

One of the key drivers behind the emphasis on recyclable packaging is the growing demand from consumers, healthcare professionals, and regulatory agencies for more sustainable packaging options. As stakeholders become increasingly aware of the environmental impact of packaging waste, there is a growing expectation for pharmaceutical companies to adopt more eco-friendly packaging solutions.

Additionally, regulatory agencies such as the FDA and EMA are placing greater emphasis on sustainable packaging practices and encouraging pharmaceutical companies to incorporate recyclable materials into their packaging designs. Regulatory guidelines and initiatives promoting sustainability and recycling are driving pharmaceutical companies to reevaluate their packaging strategies and explore recyclable alternatives.

Restraint

The pharmaceutical packaging market is facing challenges due to the rising prices of raw materials. Raw materials play a crucial role in the production of pharmaceutical packaging materials such as glass, plastic, aluminum, and paperboard. However, fluctuations in the prices of these raw materials can significantly impact the overall cost of manufacturing pharmaceutical packaging solutions.

One of the primary reasons for the rising prices of raw materials is the volatility in global commodity markets. Factors such as supply chain disruptions, geopolitical tensions, natural disasters, and changes in demand can lead to fluctuations in the prices of raw materials used in pharmaceutical packaging. For example, disruptions in the supply of raw materials due to trade disputes or production shutdowns can lead to shortages and price increases.

Moreover, increasing demand for raw materials from other industries, such as automotive, electronics, and consumer goods, can also contribute to higher prices in the pharmaceutical packaging market. Competition for limited resources, coupled with growing demand from emerging markets, can drive up prices and create supply chain challenges for pharmaceutical packaging manufacturers.

Opportunity

The pharmaceutical packaging market is experiencing a surge in innovation, with the development of cutting-edge packaging solutions aimed at enhancing product safety, efficacy, and patient convenience.

One area of innovation is the development of smart packaging technologies. These technologies incorporate features such as RFID (Radio Frequency Identification), NFC (Near Field Communication), and QR codes to enable real-time tracking and authentication of pharmaceutical products throughout the supply chain. Smart packaging solutions provide enhanced visibility and transparency, helping to combat counterfeiting, diversion, and tampering while ensuring product integrity and authenticity.

Additionally, advancements in materials science are driving the development of more sustainable and eco-friendly packaging options for pharmaceutical products. Biodegradable and compostable materials, as well as recycled and recyclable plastics, are being used to create packaging solutions that minimize environmental impact and reduce waste. Furthermore, innovations in barrier materials and coatings are improving the stability and shelf life of pharmaceutical products, protecting them from moisture, oxygen, and light degradation.

Pharmaceutical Packaging Market Players

- Becton, Dickinson and Company

- Amcor Plc

- AptarGroup, Inc.

- Gerresheimer AG

- Drug Plastics Group

- Schott AG

- West Pharmaceutical Services Inc.

- Owens Illinois Inc.

- Berry Global, Inc

- SGD S.A.

- WestRock Company

- International Paper Company

- CCL Industries Inc.

- COMAR LLC

- Vetter Pharma International

Segments Covered in the Report

By Product

- Tertiary

- Secondary

- Pharmaceutical Packaging Accessories

- Prescription Containers

- Primary

- Caps & Closures

- Plastic Bottles

- Parenteral Containers

- Prefillable Inhalers

- Blister Packs

- Medication Tubes

- Pouches

- Others

By Material

- Paper & Paperboard

- Plastics & Polymers

- Polyethylene (PE)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Polystyrene (PS)

- Polyvinyl Chloride (PVC)

- Others

- Glass

- Aluminum Foil

- Others

By Application

- Retail Pharmacy

- Pharmaceutical Manufacturing

- Institutional Pharmacy

- Contract Packaging

- Others

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1136

Unlocking Market Insights through Data Excellence

The “Precedence Statistics” flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today’s dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit:

www.precedencestatistics.com