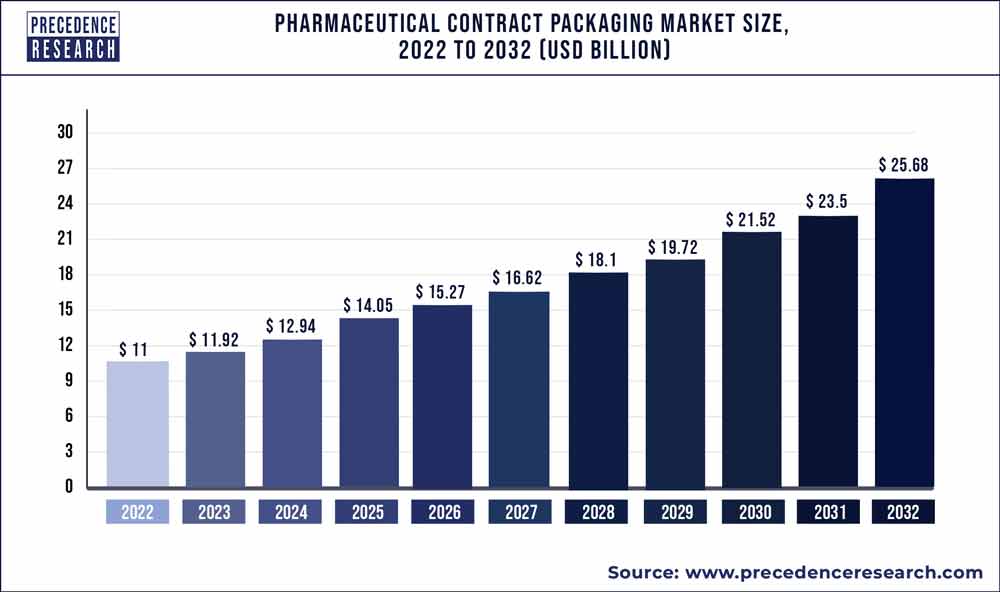

The global pharmaceutical contract packaging market size surpassed USD 11.92 billion in 2023 and is expected to hit around USD 25.68 billion by 2032, poised to grow at a CAGR of 8.9% from 2024 to 2033.

The pharmaceutical contract packaging market has experienced notable growth due to several factors. Pharmaceutical contract packaging involves outsourcing packaging services to specialized third-party providers, offering pharmaceutical companies flexibility, scalability, and cost-effectiveness in their packaging operations. With the increasing complexity of pharmaceutical packaging requirements, evolving regulatory standards, and the need for specialized packaging solutions, there has been a growing demand for contract packaging services in the pharmaceutical industry. These services encompass a wide range of packaging solutions, including primary packaging (such as blister packs, bottles, and vials), secondary packaging (such as cartons and labels), and tertiary packaging (such as bundling and palletizing), tailored to the specific needs of pharmaceutical products.

Moreover, outsourcing packaging operations to contract packaging providers allows pharmaceutical companies to focus on core competencies such as research, development, and marketing, while benefiting from the expertise and capabilities of packaging specialists. Additionally, the rise of biologics, specialty drugs, and personalized medicines has further driven demand for contract packaging services that can accommodate the unique requirements of these products.

Furthermore, the COVID-19 pandemic has underscored the importance of supply chain resilience and flexibility, driving increased adoption of contract packaging services as pharmaceutical companies seek to mitigate disruptions and expedite product launches. As pharmaceutical companies continue to prioritize efficiency, compliance, and patient safety, the pharmaceutical contract packaging market is expected to witness sustained growth, offering opportunities for innovation and collaboration in packaging solutions and services.

Key Takeaways

- In 2022, North America held the largest market share worldwide.

- In terms of products, the main packaging category had the biggest market share in 2022.

- In terms of material, the glass category had the largest revenue share in 2022—35%.

Get a Sample: https://www.precedenceresearch.com/sample/1171

Pharmaceutical Contract Packaging Market Scope

| Report Highlights | Details |

| Market Size in 2023 | USD 11.92 Billion |

| Market Size by 2032 | USD 25.68 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 8.9% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Product Type, Material Type, Region Type |

Read More: Paper Cups Market Size to Surpass USD 17 Billion By 2032

Pharmaceutical Contract Packaging Market Dynamics

Driver:

The pharmaceutical contract packaging market is driven by several factors, with one of the primary drivers being the increasing complexity of pharmaceutical products and regulatory requirements. Pharmaceutical companies are faced with the challenge of ensuring compliance with stringent regulations while also meeting the demands for specialized packaging formats, such as blister packs, sachets, and unit-dose packaging. Outsourcing packaging services to contract packaging organizations (CPOs) allows pharmaceutical companies to leverage the expertise and capabilities of specialized providers, enabling them to focus on core competencies like research, development, and marketing.

Restraint:

One of the key restraints for the pharmaceutical contract packaging market is the risk of supply chain disruptions and quality control issues. Pharmaceutical products require meticulous handling, storage, and packaging to maintain product integrity and safety. Any lapses in quality control or deviations from regulatory requirements can lead to product recalls, regulatory fines, and damage to brand reputation. Therefore, pharmaceutical companies must carefully evaluate the reliability and capabilities of CPOs to mitigate these risks and ensure consistent quality throughout the packaging process.

Opportunity:

The growing demand for personalized medicine, biologics, and specialty pharmaceuticals presents a significant opportunity for the pharmaceutical contract packaging market. These products often require specialized packaging solutions, including cold chain logistics, tamper-evident packaging, and patient-friendly formats, to ensure product stability, safety, and compliance. Contract packaging organizations that can offer tailored packaging solutions and flexible manufacturing capabilities are well-positioned to capitalize on this opportunity.

Additionally, the increasing outsourcing of packaging services by pharmaceutical companies to reduce costs, streamline operations, and access specialized expertise fuels market growth for contract packaging providers. Furthermore, the emergence of innovative packaging technologies, such as smart packaging and track-and-trace systems, offers opportunities for CPOs to differentiate their services and provide added value to pharmaceutical clients. Overall, the pharmaceutical contract packaging market is expected to experience continued growth driven by evolving industry trends and the increasing demand for specialized packaging solutions.

Pharmaceutical Contract Packaging Market Players

- AmerisourceBergen Corp.

- SCHOTT AG

- WestRock Co.

- Becton, Dickinson and Co.

- Constantia Flexibles Group GmbH

- Bilcare Ltd.

- CCL Industries Inc.

- Berlin Packaging

- FedEx Corp.

- Others

Segments Covered in the Report

By Product

- Primary Packaging

- Ampoules

- Bottles

- Blister Packs

- Others

- Secondary Packaging

- Tertiary Packaging

By Material

- Paper & Paperboard

- Plastics & Polymers

- Aluminum Foil

- Glass

- Others

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- Germany

- United Kingdom

- France

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- South Africa

- North Africa

- Rest of Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1171

Unlocking Market Insights through Data Excellence

The “Precedence Statistics” flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today’s dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit:

www.precedencestatistics.com