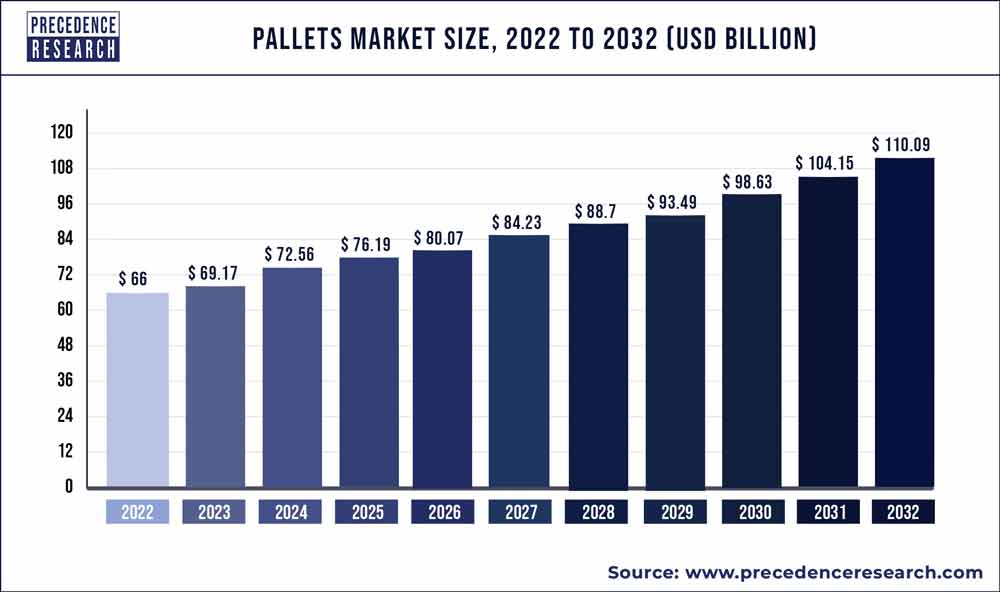

The global pallets market size reached USD 66 billion in 2022 and is projected to hit around USD 110.09 billion by 2032, expanding at a CAGR of 5.3% from 2023 to 2032.

The pallets market has experienced significant growth, driven by various factors. Pallets serve as essential tools for material handling, storage, and transportation across industries such as logistics, manufacturing, retail, and agriculture. With the increasing globalization of trade and the rise of e-commerce, there has been a growing demand for pallets to facilitate the movement of goods efficiently and safely throughout the supply chain. Pallets come in various materials such as wood, plastic, metal, and composite materials, each offering unique benefits in terms of durability, weight capacity, and compatibility with different handling equipment. Moreover, advancements in pallet design, such as ergonomic features, lightweight construction, and nestable or stackable configurations, have improved the efficiency and sustainability of pallet use.

Additionally, the growing emphasis on sustainability and environmental responsibility has led to increased interest in recyclable and reusable pallet options, as companies seek to minimize waste and carbon footprint in their operations. Furthermore, the COVID-19 pandemic has highlighted the importance of resilient and reliable supply chains, driving increased demand for pallets to support the movement and storage of essential goods and medical supplies. As industries continue to evolve and adapt to changing market dynamics, the pallets market is expected to witness sustained growth, offering opportunities for innovation and expansion in material handling solutions.

Get a Sample: https://www.precedenceresearch.com/sample/2121

Report Scope of the Pallets Market

| Report Coverage | Details |

| Market Size in 2023 | USD 69.17 Billion |

| Market Size by 2032 | USD 110.09 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 5.3% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Materials, Type, Application, Structural Design, End Use and Geography |

Read More: Disappearing Packaging Market Size to Surpass USD 9.78 Billion By 2032

Pallets Market Dynamics

Driver

The pallets market is experiencing a rise in awareness regarding the benefits of plastic pallets. As industries and supply chains become more cognizant of sustainability, efficiency, and safety considerations, there’s a growing recognition of the advantages offered by plastic pallets.

Plastic pallets offer several benefits compared to traditional wooden or metal pallets. Firstly, they are lightweight yet durable, making them easier to handle and transport while also reducing fuel consumption and carbon emissions during transportation. Additionally, plastic pallets are resistant to moisture, chemicals, and pests, ensuring the integrity and cleanliness of the goods being transported.

Moreover, plastic pallets are reusable and recyclable, contributing to a more sustainable supply chain by reducing the need for single-use packaging materials and minimizing waste generation. They can withstand multiple trips and handling cycles, providing a long-term and cost-effective solution for companies looking to optimize their logistics operations.

Restraint

The pallets market faces challenges due to the volatility of raw material prices. Pallets, essential for the storage and transportation of goods, are typically manufactured from various materials such as wood, plastic, metal, or composite materials. The prices of these raw materials can fluctuate significantly due to factors such as supply and demand dynamics, changes in global market conditions, and geopolitical events.

The volatility of raw material prices presents several challenges for stakeholders in the pallets market. Manufacturers may struggle to predict and manage production costs, leading to uncertainties in pricing and profitability. Moreover, sudden increases in raw material prices can squeeze profit margins and impact the competitiveness of pallet manufacturers, especially if they are unable to pass on the cost increases to customers.

Additionally, the volatility of raw material prices can disrupt supply chains and lead to shortages or delays in pallet availability. This can create challenges for industries reliant on pallets for their operations, such as logistics, manufacturing, and retail.

Opportunity

The pallets market is experiencing growth due to increasing freight volumes. As global trade and logistics operations expand, there is a rising demand for pallets to facilitate the storage and transportation of goods. Pallets serve as a fundamental component of supply chain logistics, enabling efficient handling, stacking, and movement of cargo in warehouses, distribution centers, and transportation vehicles.

With the growth of e-commerce, manufacturing, and retail industries, freight volumes have been steadily increasing, driving the need for pallets to support the movement of goods throughout the supply chain. Pallets offer advantages such as standardized sizing, ease of handling with forklifts and pallet jacks, and compatibility with various storage and transportation equipment.

Moreover, the adoption of automated material handling systems and advancements in pallet design and materials have further fueled the demand for pallets in modern logistics operations. Innovative pallet solutions, such as lightweight and durable plastic pallets or collapsible and reusable pallets, are becoming increasingly popular to optimize space utilization, reduce transportation costs, and enhance sustainability.

Recent Developments

- Cabka and Target, a major US general merchandise retailer with around 2,000 outlets, inked a contract in May 2022. The deal was worth a lot to Cabka in terms of prospective future profits. The agreement between Cabka and Target illustrated Cabka’s plan for US growth, which includes leveraging the opportunities in the large container and custom solutions sectors.

- The pooling company RECALO and Menasha’s subsidiary ORBIS Europe collaborated in September 2021. Regardless of whether they opted to employ the complete range of RECALO pooling services or use the load carriers, ORBIS planned to provide its clients additional benefits with the cooperation.

Market Players

- DS Smith Plc

- Smurfit Kappa group

- Conitex Sonoco

- Oji Holdings Corporation

- Multi-wall Packaging

- KraftPal Technologies Ltd.

- Europal Packaging

- Tat Seng Packaging Group Ltd.

- Dopack

- Interpal Industries Pte Ltd.

- Pheng Hoon Honeycomb Paper Products Pte. Ltd.

- Mabuchi Singapore Pte Ltd.

- The Alternative Pallet Company Ltd.

- Kimmo (Pty) Ltd.

- Tri-Wall Holdings Limited

- GreenLabel Packaging

- Palletkraft Europe Ltd.

- Packprofil Sp. z.o.o.

- The Corrugated Pallet Company

- Elsons International.

Segments Covered in the Report

By Materials

- Wood

- Plastic via Injection Molding

- Plastic via Other Methods

- Corrugated Paper

- Metal

By Type

- Rackable

- Nestable

- Stackable

- Display

By Application

- Rental

- Non-rental

By Structural Design

- Block

- Stringer

- Others

By End Use

- Food & Beverage

- Pharmaceuticals

- Cosmetics & Personal Care

- Consumer Electronics

- Engineering Products

- Chemicals

- Textile and Handcraft

- Agriculture and Allied Industry

- Building & Construction

- Automotive

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Unlocking Market Insights through Data Excellence

The “Precedence Statistics” flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today’s dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit:

www.precedencestatistics.com