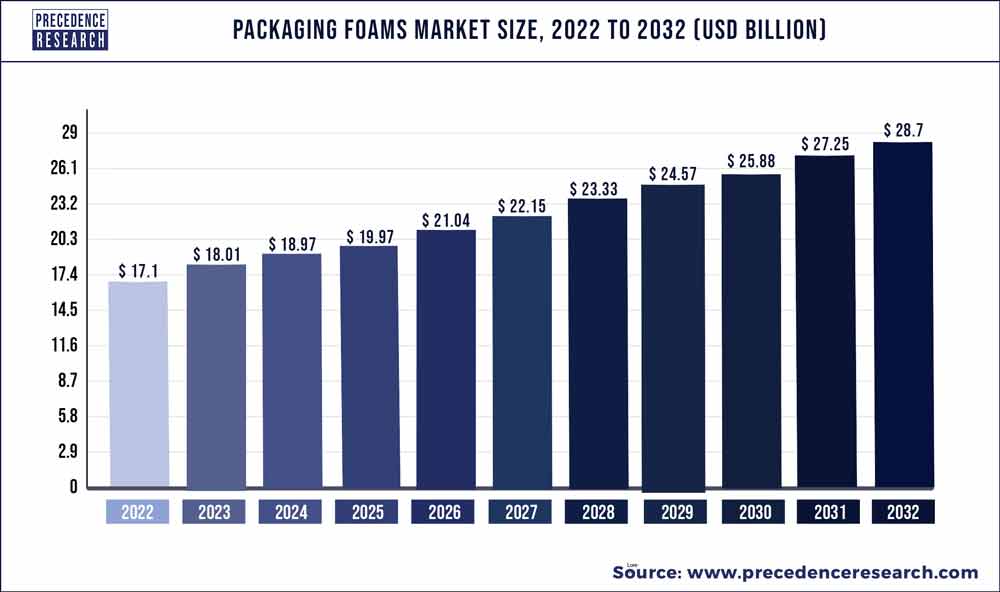

The global packaging foams market size surpassed USD 17.1 billion in 2022 and is expected to hit around USD 28.7 billion by 2032, poised to grow at a CAGR of 5.31% from 2023 to 2032.

The packaging foams market has witnessed significant growth, driven by various factors. With increasing demand across industries such as electronics, automotive, pharmaceuticals, and food & beverage, packaging foams have become indispensable for ensuring product safety during transportation and storage. The versatility of foam materials, including expanded polystyrene (EPS), polyethylene (PE), and polyurethane (PU), allows for customized solutions catering to specific packaging requirements. Moreover, the rising focus on sustainability has spurred innovations in eco-friendly foam alternatives, such as bio-based and recycled materials, addressing environmental concerns and regulatory requirements.

Additionally, advancements in foam manufacturing technologies, such as foam molding and extrusion processes, have enhanced production efficiency and product performance, further driving market growth. As industries continue to prioritize lightweight, cost-effective, and protective packaging solutions, the packaging foams market is poised for sustained expansion, offering a wide range of applications across diverse sectors.

Key Takeaways

- In 2022, the revenue share contributed by the Asia Pacific Market was 41%.

- In 2022, the polyurethane category accounted for 52% of total sales.

- In 2022, lexible foam will command the highest market share of 79%.

- It is expected that the antistatic electrostatic discharge (ESD) market will grow.

- The combined rate of growth of North America is 3.9% between 2023 and 2032.

- It is anticipated that the industrial packaging market will grow at a CAGR of 4.7%.

- Through 2032, the flexible segment will grow at a compound annual growth rate (CAGR) of 5.1%.

Get a Sample: https://www.precedenceresearch.com/sample/2928

Report Scope of the Packaging Foams Market:

| Report Coverage | Details |

| Market Size in 2023 | USD 18.01 Billion |

| Market Size by 2032 | USD 28.7 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 5.31% |

| Largest Market | Asia Pacific |

| Second Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Material Type, By Product Type, By Application, and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Read More: Automotive Parts Packaging Market Size to Worth USD 12.82 Bn by 2032

Driver

The packaging foams market is witnessing a notable surge in demand and expanding business opportunities, particularly driven by the consumer goods electronics sector. This growth is fueled by the increasing demand for electronic devices such as smartphones, tablets, laptops, and other gadgets across global markets. As consumers seek products that offer both functionality and protection, there is a growing emphasis on packaging solutions that ensure the safe transportation and storage of these delicate electronic items. Packaging foams, known for their cushioning and shock-absorbing properties, are becoming increasingly indispensable in this context.

Manufacturers in the packaging foams market are capitalizing on this trend by developing innovative foam solutions tailored to the specific requirements of consumer electronics packaging. These solutions not only provide excellent protection against impact and vibration but also offer lightweight and cost-effective packaging options for businesses. As the consumer goods electronics industry continues to expand and evolve, the packaging foams market is poised for sustained growth, driven by the ongoing demand for reliable and efficient packaging solutions that safeguard electronic devices throughout the supply chain.

Restraint

Polystyrene-based packaging foams pose a significant concern for both the environment and human health within the packaging foams market. Environmentally, these foams are notorious for their non-biodegradable nature, contributing to long-term pollution and littering of ecosystems, including oceans and landfills.

Additionally, the manufacturing process of polystyrene-based foams often involves the use of harmful chemicals and greenhouse gases, further exacerbating environmental degradation and climate change. Furthermore, from a human health perspective, polystyrene-based packaging foams can release toxic substances, such as styrene, especially when exposed to heat or during disposal processes like incineration, potentially leading to respiratory issues and other health complications for individuals exposed to these substances. Given these adverse effects, there is a pressing need for alternative, more sustainable packaging foam materials and technologies to mitigate the environmental and health risks associated with polystyrene-based foams.

Opportunity

The packaging foams market is experiencing expansion with the increased production of bio-based polypropylene. This surge is fueled by the growing demand for sustainable packaging solutions across various industries. Bio-based polypropylene offers a renewable and eco-friendly alternative to traditional petroleum-based plastics, aligning with the global shift towards greener packaging materials. As companies prioritize environmental sustainability, the use of bio-based polypropylene in packaging foams presents an opportunity to reduce carbon footprint and mitigate environmental impact.

Additionally, bio-based polypropylene maintains the performance and functionality required for packaging foams, ensuring optimal protection and cushioning for packaged goods. This expansion in bio-based polypropylene production not only meets the growing demand for sustainable packaging solutions but also drives innovation and competitiveness in the packaging foams market.

Recent Developments

- Earth-friendly packaging material solutions were introduced by Cruiz Foam, a circular material firm, in February 2023. The company has introduced a foam for packing temperature-sensitive products in addition to a new range of environmentally friendly packaging products. In the near future, Cruiz Foam’s revolutionary packaging foam is intended to take the place of plastic bubble wrap.

- The packaging industry leader Stora Enso introduced Papira Pulp foam packaging material in September 2022. This is the company’s newest pulp-fiber-based packaging solution. The company hopes to provide an eco-friendly, recyclable, and substitute for plastic foam packaging solutions with the introduction of this product.

Packaging Foams Market Players

- JSP Corporation

- UFP Technologies Inc.

- Synbra Holding bv

- UFP Technologies

- Armacell LLC

- Tosoh Corporation

- ACH Foam Technologies

- FoamCraft Packaging Inc

- Hanwha Corporation

- Plastifoam Company

- Marko Foam Products Inc.

- TotalEnergies

- NCFI Polyurethanes

- Huebach Corporation

- Wasatch Container

- Dongshing Industry Inc.

- Zotefoams Plc.

- Borealis

- Arkema

- Kaneka Corporation

- Recticel

- Sealed Air Corporation

- BASF SE

- Synthos SA

- FoamPartner Group

- Rogers Corporation

Segments Covered in the Report:

By Material Type

- Polystyrene

- Polyethylene

- Polyurethane

- polypropylene

- Poly Vinyl Chloride

By Product Type

- Flexible Foam

- Rigid Foam

By Application

- Inserts

- Corner and edge protectors

- Anti-Static ESD Foam

- Liners

By End User

- Medical and Pharmaceutical

- Food and Beverages

- Aerospace and Defence

- Automotive

- Electrical and Electronics

- Personal Care

- Consumer Packaging

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/2928

Unlocking Market Insights through Data Excellence

The “Precedence Statistics” flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today’s dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit:

www.precedencestatistics.com