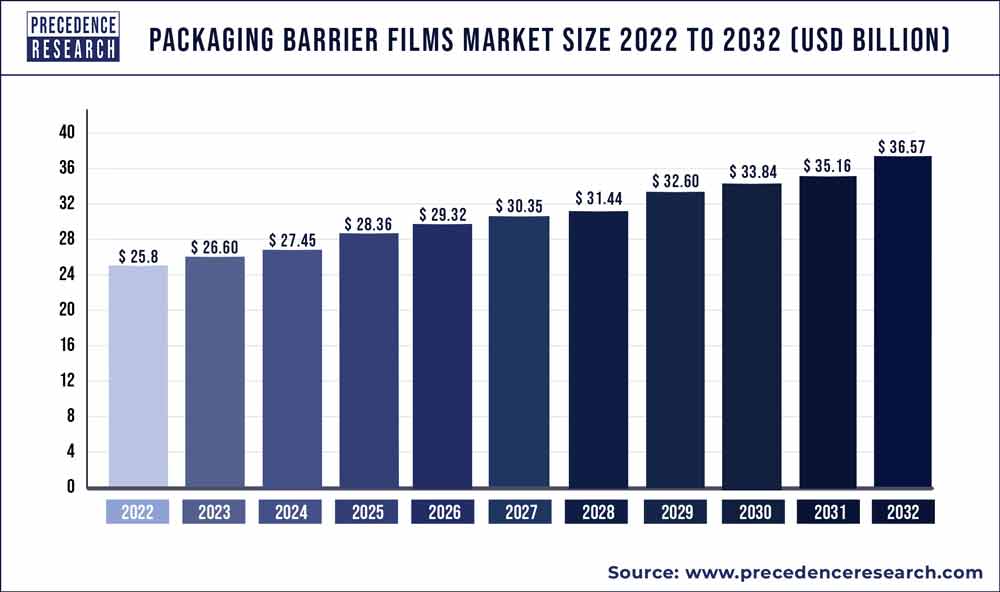

The global packaging barrier films market has witnessed significant growth, with an estimated valuation of USD 25.8 billion in 2022. Projections indicate that the market is poised to reach approximately USD 36.57 billion by 2032, reflecting a robust Compound Annual Growth Rate (CAGR) of 3.6% during the forecast period from 2023 to 2032. This article explores the key takeaways, regional insights, market dynamics, and recent developments that shape the landscape of the packaging barrier films industry.

Key Takeaways: North America’s Dominance: In 2022, North America emerged as a leader in the packaging barrier films market, commanding a substantial market share of 36%. The region is characterized by a growing emphasis on sustainability, compliance with food safety regulations, and an increased demand for innovative barrier technologies.

Asia-Pacific’s Rapid Expansion: The Asia-Pacific region is anticipated to observe the fastest expansion during the forecast period. Factors such as a burgeoning middle class, urbanization, and a surging demand for packaged goods are driving growth. Sustainability, particularly in eco-friendly and biodegradable barrier films, is a key focus in this region.

Product and Material Insights: Pouches dominated the market in 2022, holding a significant market share of 47%. Meanwhile, the liners segment is projected to experience notable growth with a CAGR of 5.8% during the forecast period. In terms of materials, PE accounted for over 29% of revenue share in 2022, while the PET segment is expected to exhibit the fastest CAGR over the projected period.

Market Overview: Packaging barrier films play a pivotal role in preserving the freshness and extending the shelf life of various products, including food, beverages, pharmaceuticals, and electronics. These specialized materials act as effective barriers against external elements such as moisture, oxygen, light, and contaminants. Comprising multiple layers with distinct properties, these films are tailored to meet the specific needs of packaged items, ensuring product quality, safety, and integrity throughout storage and transportation.

Regional Insights: North America: The U.S. packaging barrier films market, valued at USD 6.50 billion in 2022, is expected to grow at a CAGR of 3.70% to reach USD 9.30 billion by 2032. Noteworthy trends in North America include a focus on sustainability, the rise of e-commerce, and innovations in advanced barrier technologies.

Asia-Pacific: The Asia-Pacific region is witnessing dynamic trends driven by a growing middle class, urbanization, and a focus on sustainability. The e-commerce sector’s rapid growth and advancements in barrier film technologies, especially in countries like China and India, are shaping the market.

Europe: In Europe, sustainable packaging solutions and compliance with environmental regulations are at the forefront. The market is experiencing a surge in demand for high-performance films catering to the growing e-commerce sector.

Growth Factors: The growth of the packaging barrier films market is fueled by the increasing demand for extended shelf life, product protection, and advancements in packaging technologies. Rising consumer awareness of food safety and sustainability, coupled with innovations in materials and technologies, contribute to market expansion. Key trends include a shift towards sustainable and recyclable materials, the demand for convenient packaging solutions, and the exploration of emerging markets.

Market Scope and Dynamics: The market is projected to grow at a CAGR of 3.6%, reaching USD 36.57 billion by 2032 from USD 26.6 billion in 2023. North America holds the largest market share, and the forecast period spans from 2023 to 2032. Segments covered include Product, Material, and End Users, with regions encompassing North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

Market Drivers: Extended Shelf Life and Advancements: Consumers and industries value products with extended shelf life, driving the demand for packaging barrier films. Constant innovations in packaging technologies allow for precise control over barrier characteristics, enhancing both product quality and packaging aesthetics.

Market Restraints: Environmental Concerns and Regulatory Compliance: Increasing awareness of environmental sustainability puts pressure on the industry to adopt eco-friendly materials. Stringent regulations, especially in the food and pharmaceutical sectors, require compliance, impacting market demand.

Market Opportunities: Sustainable Solutions and Advanced Technologies: Growing consumer demand for sustainable packaging options presents an opportunity for eco-friendly barrier films. Advanced barrier technologies, offering precise control over permeability, meet the evolving needs of industries, driving substantial market demand.

Impact of COVID-19: The pandemic initially disrupted the packaging barrier films market but eventually led to increased demand for packaged goods. Heightened awareness of hygiene and food safety, coupled with the growth of e-commerce, accelerated the need for effective and protective barrier films.

Product Insights: Pouches Segment: Pouches, holding 47% revenue share in 2022, represent a growing trend towards water-based solutions, aligning with sustainability and environmental regulations. Water-based coatings are becoming popular for their eco-friendly nature.

Liners Segment: The liners segment is anticipated to grow significantly at a CAGR of 5.8%, with a shift towards sustainable, solvent-free, and water-based barrier coatings to address environmental concerns.

Material Insights: PE Segment: PE materials, adaptable to various product shapes, dominate the market with a share of 29%. The demand for flexible barrier films to enhance the shelf life of perishable goods and meet on-the-go packaging needs is on the rise.

PET Segment: The PET segment, focusing on labeling and branding, is expected to grow rapidly. High-quality, visually appealing labels and sustainable labeling solutions align with consumer and industry sustainability trends.

Recent Developments:

- In 2019, Amcor and Bemis partnered to create innovative sustainable packaging solutions, culminating in Amcor’s successful acquisition of Bemis, establishing itself as a global leader.

- In the same year, Berry Global Group, Inc. finalized its acquisition of RPC Group Plc, expanding its global presence.

Packaging Barrier Films Market Players

- Amcor Limited

- Berry Global Group, Inc.

- Sealed Air Corporation

- Mondi Group

- Winpak Ltd.

- Toray Plastics (America), Inc.

- Mitsubishi Chemical Holdings Corporation

- Coveris Holdings S.A.

- Daibochi Berhad

- Uflex Ltd.

- Schur Flexibles Group

- Bemis Company, Inc. (Now part of Amcor Limited)

- Huhtamäki Oyj

- Glenroy, Inc.

- Innovia Films

Segments Covered in the Report

By Product

- Pouches

- Bags

- Liners

- Lidding Film

- Wraps

- Others

By Material

- PC

- PE

- PET

- Others

By End Users

- Consumer Durable

- Chemicals

- Pharmaceutica

- Food & Beverages

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/3443

Unlocking Market Insights through Data Excellence

The “Precedence Statistics” flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today’s dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit:

www.precedencestatistics.com