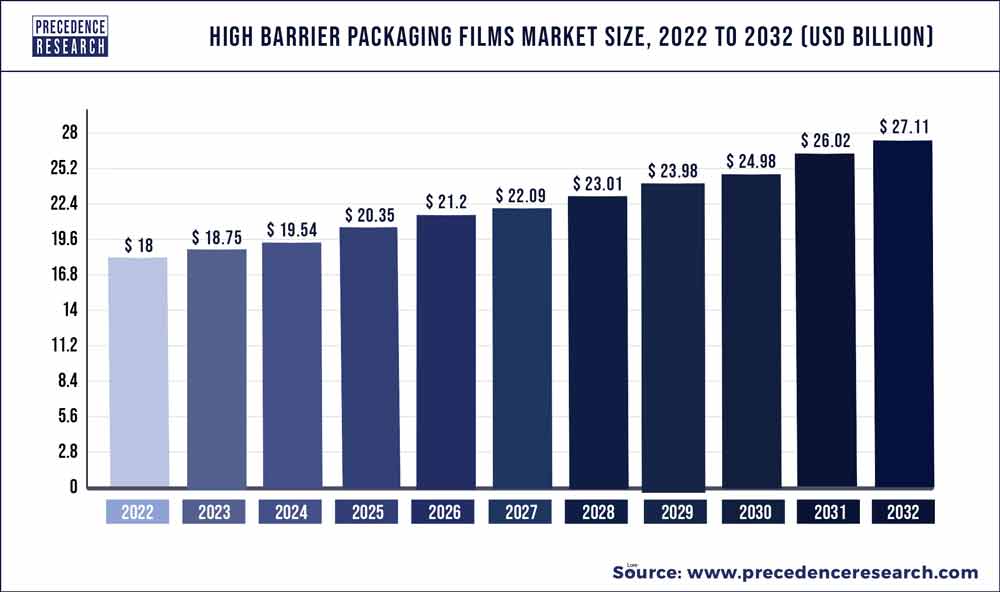

The global high barrier packaging films market size was estimated at USD 18 billion in 2022 and is projected to hit around USD 27.11 billion by 2032, growing at a CAGR of 4.18% from 2023 to 2032.

The high barrier packaging films market has seen substantial growth in recent times, driven by several key factors. The increasing demand for extended shelf life and enhanced protection of perishable goods, particularly in the food and pharmaceutical industries, has propelled the adoption of high barrier packaging films. These films, known for their exceptional barrier properties against moisture, oxygen, and other external factors, address the industry’s growing need for effective preservation solutions.

Moreover, heightened consumer awareness regarding food safety and the rising trend of convenient, on-the-go packaging have further contributed to the market’s expansion. As sustainability becomes a pivotal concern, the development of eco-friendly high barrier packaging films has gained prominence, aligning with global efforts to reduce environmental impact. The ongoing innovations in materials and technologies within the packaging industry, combined with the increasing emphasis on product quality and safety, position the high barrier packaging films market for continued growth in the foreseeable future.

Key Takeaways

- The growing demand for packaged and consumer goods in North America is expected to drive significant growth in the market for high-barrier packaging films.

- The majority of sales were made in the plastics industry.

- The market is predicted to be led by the bags and pouches sector.

- It is projected that multi-layer film sales will expand at the fastest rate.

- The high barrier packaging films market is expected to be driven by the food and beverage industry.

Get a Sample: https://www.precedenceresearch.com/sample/2995

Report Scope of the High Barrier Packaging Films Market:

| Report Coverage | Details |

| Market Size in 2023 | USD 18.75 Billion |

| Market Size by 2032 | USD 27.11 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 4.18% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Material, By Product, By Technology, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Read More: Punnet Packaging Market Size to Reach USD 4.13 Bn By 2032

High Barrier Packaging Films Market Dynamics

Driver:

The high barrier packaging films market is experiencing a substantial increase in demand, primarily propelled by the rising need for multi-layer packaging that effectively restricts the entry of oxygen and water. This surge in demand is fueled by the desire to enhance the shelf life and freshness of packaged products, particularly in industries where the preservation of quality is critical, such as food and pharmaceuticals. Manufacturers are responding to this demand by developing advanced high barrier packaging films with multiple layers that create an impermeable barrier, preventing the ingress of oxygen and moisture. The emphasis on maintaining product integrity and extending shelf life is driving innovation in the high barrier packaging sector. As a result, businesses are increasingly adopting these multi-layer solutions to meet the stringent packaging requirements of perishable goods, ensuring they reach consumers in optimal condition while addressing the evolving needs of industries with high standards for product protection.

Restraint:

A significant challenge faced by the high barrier packaging films market is the vulnerability to degradation. High barrier films, designed to protect contents from external factors like moisture, oxygen, and light, may themselves be susceptible to degradation over time. Exposure to environmental conditions, such as prolonged sunlight or extreme temperatures, can compromise the integrity of these films, leading to a reduction in their barrier properties. This vulnerability raises concerns about the long-term effectiveness of high barrier packaging in preserving the quality and shelf life of packaged products. To address this issue, continuous research and development are essential to formulate more resilient materials and coatings for high barrier films. Manufacturers must prioritize advancements in material science and engineering to enhance the durability of these films, ensuring prolonged efficacy in safeguarding the integrity of packaged goods.

Opportunity:

The high barrier packaging films market is witnessing a substantial uptick in demand, driven by the escalating need for packaging that is consumer-friendly. As consumers become more discerning and environmentally conscious, there is a heightened emphasis on packaging solutions that offer convenience, sustainability, and user-friendly features. High barrier packaging films address these evolving demands by providing a combination of extended shelf life, protection from external factors, and ease of use. With a focus on retaining the freshness and quality of packaged goods, these films offer a practical solution for consumers seeking products with longer durability.

Additionally, advancements in technology have allowed for the development of high barrier films that are not only effective in preserving the contents but are also designed with user-friendly features such as easy opening, resealability, and eco-friendly materials. This surge in the demand for consumer-friendly packaging positions the high barrier packaging films market at the forefront of innovation, catering to the changing preferences and expectations of today’s consumers.

Recent Developments

- June 2022: Cosmo Films Limited’s Aurangabad, India, manufacturing facility now has 25,000 MT of annual rated capacity.

- January 2022: Klockner Pentaplast, a major player in the pharmaceutical, consumer health, and food packaging industries, announces intentions to expand its sustainable innovation portfolio and boost its post-consumer recycled content (PCR) capacity in North America.

High Barrier Packaging Films Market Players

- ACG Worldwide Pvt., Ltd.

- Amcor Ltd.

- Bemis Co., Inc.

- Berry Global Group, Inc.

- Bischof + Klein GmbH & Co. KG

- Dunmore Corporation

- Flex Ltd.

- Huhtamaki Oyj

- LINPAC Packaging

- Mondi plc

- Polyplex Corporation Ltd.

- ProAmpac

- Schur Flexibles Holding GesmbH

- Sealed Air Corporation

- Shrinath Rotopack Pvt Ltd.

- Toray Plastics (America), Inc.

Segments Covered in the Report

By Material

- Plastic

- Metal

- Oxide

By Product

- Bags And Pouches

- Trays Lidding Films

- Wrapping Films

- Blister Packs

- Others

By Technology

- Multi-Layer Films

- Sustainable Barrier Coating Films

- Besela Barrier Films

- Others

By Application

- Food And Beverages

- Pharmaceutical

- Personal Care And Cosmetics

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Unlocking Market Insights through Data Excellence

The “Precedence Statistics” flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today’s dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit:

www.precedencestatistics.com