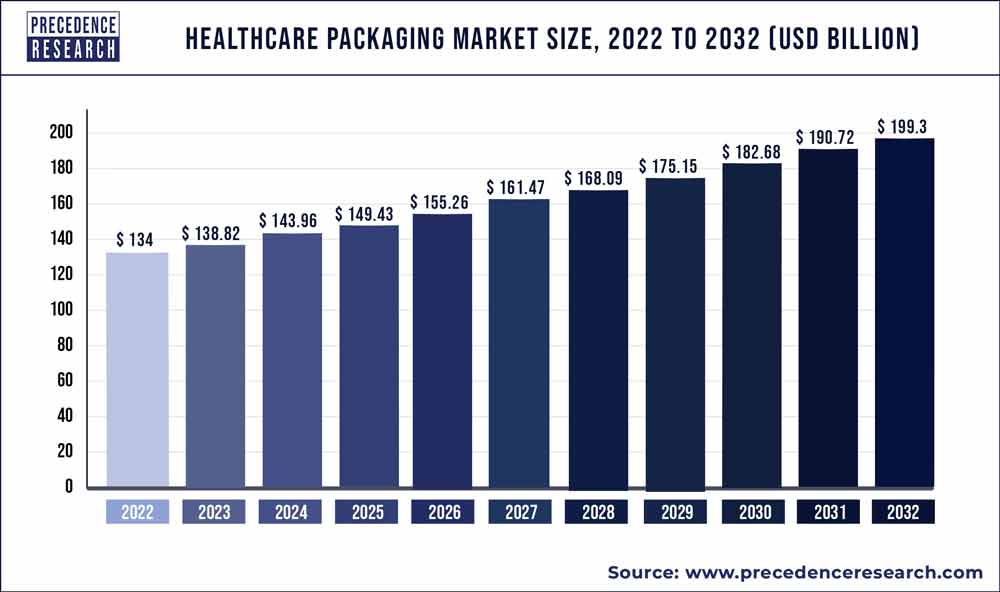

The global healthcare packaging market size was valued at USD 134 billion in 2022 and is expected to hit around USD 199.3 billion by 2032, growing at a CAGR of 4.1% from 2023 to 2032.

The healthcare packaging market has seen significant growth, influenced by several factors. Healthcare packaging encompasses a wide range of packaging solutions specifically designed for pharmaceuticals, medical devices, diagnostics, and other healthcare products. With the increasing demand for safe, secure, and compliant packaging in the healthcare industry, there has been a growing adoption of innovative packaging solutions to meet regulatory requirements and ensure product integrity. These packaging solutions include blister packs, vials, ampoules, bottles, pouches, and sterile packaging materials, among others, each tailored to the unique requirements of different healthcare products.

Moreover, advancements in packaging materials, such as polymer films, glass, and metals, have improved the performance and functionality of healthcare packaging, enhancing product protection, stability, and shelf-life. Additionally, the rise of biologics, personalized medicine, and specialty pharmaceuticals has driven demand for specialized packaging solutions capable of preserving the efficacy and safety of sensitive healthcare products.

Furthermore, the COVID-19 pandemic has underscored the importance of healthcare packaging in ensuring the safe and efficient distribution of medical supplies, vaccines, and diagnostic kits. As the healthcare industry continues to evolve and innovate, driven by advancements in medical technology and changing patient needs, the healthcare packaging market is expected to witness sustained growth, offering opportunities for innovation and collaboration among packaging manufacturers, pharmaceutical companies, and healthcare providers.

Key Takeaways

- In 2022, the rigid packaging market accounted for 81% of total revenue.

- In terms of material, the plastics industry held a 52% market share in 2022.

Get a Sample: https://www.precedenceresearch.com/sample/2106

Report Scope of the Healthcare Packaging Market

| Report Coverage | Details |

| Market Size in 2023 | USD 138.82 Billion |

| Market Size by 2032 | USD 199.3 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 4.1% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Material Type, Product, Application, Drug Delivery Mode, Packaging, Packaging Format, and Geography |

Read More: Pallets Market Size to Reach USD 110.09 Bn By 2032

Healthcare Packaging Market Dynamics

Driver

The healthcare packaging market is experiencing growth driven by the expansion of the pharmaceutical business in emerging markets. As pharmaceutical companies increasingly target emerging economies for growth opportunities, there is a growing demand for packaging solutions that meet the unique needs and requirements of these markets.

Emerging markets present significant opportunities for pharmaceutical companies due to factors such as population growth, rising disposable incomes, and increasing access to healthcare services. As a result, there is a growing need for healthcare packaging solutions that can ensure the safety, efficacy, and integrity of pharmaceutical products throughout the supply chain.

Healthcare packaging plays a crucial role in protecting pharmaceutical products from environmental factors, contamination, and tampering during storage, transportation, and distribution. In emerging markets where infrastructure and regulatory frameworks may be less developed, there is a heightened emphasis on the importance of robust and reliable packaging solutions to maintain product quality and compliance with regulatory standards.

Moreover, healthcare packaging also serves as a means of differentiation and branding for pharmaceutical companies operating in emerging markets. Packaging design, labeling, and messaging can play a key role in building trust with consumers and healthcare professionals, as well as communicating product information and usage instructions effectively.

Restraint

The healthcare packaging market is experiencing challenges due to stringent regulatory changes. Regulations governing healthcare packaging are designed to ensure the safety, efficacy, and quality of medical products and devices, as well as to protect patients and healthcare professionals from potential risks and hazards. However, frequent updates and revisions to regulatory requirements can create complexities and uncertainties for manufacturers and suppliers in the healthcare packaging industry.

Stringent regulatory changes often involve stricter standards, new guidelines, or updated compliance requirements related to packaging materials, labeling, sterilization methods, and traceability systems. These changes may necessitate modifications to manufacturing processes, product designs, and quality assurance procedures to ensure compliance and maintain regulatory approval.

Additionally, regulatory changes can increase the time and cost involved in bringing healthcare packaging products to market. Manufacturers may need to conduct additional testing, documentation, and regulatory submissions to demonstrate compliance with updated requirements. Delays in regulatory approvals or non-compliance with regulatory standards can disrupt production schedules, limit market access, and result in financial penalties or product recalls.

Opportunity

The healthcare packaging market is experiencing growth in disposable kits. These kits typically include a variety of single-use medical supplies and equipment needed for specific medical procedures or treatments. The increasing demand for disposable kits can be attributed to several factors.

Firstly, there is a growing emphasis on infection prevention and control in healthcare settings, particularly in light of the COVID-19 pandemic. Disposable kits help minimize the risk of cross-contamination and the spread of infectious diseases by ensuring that medical supplies are used only once and then properly disposed of.

Secondly, disposable kits offer convenience and efficiency for healthcare providers. They eliminate the need for sterilization and reprocessing of reusable medical equipment, saving time and resources. Additionally, disposable kits can be customized to contain all the necessary supplies for a particular procedure, reducing the need for healthcare workers to gather and assemble individual items.

Recent Developments

- In May 2019, Amcor Limited unveiled AmLite Ultra Recyclable, a new packaging product. This new product’s high-barrier polyolefin film significantly reduced the packaging’s carbon impact.

- As of January 2019, Amcor Limited is focused on producing recyclable packaging materials and recyclable packaging products. The market for new products in healthcare packaging is growing, and so is their clientele, thanks to the development of new items and improvements made to them.

Market Players

- Amcor plc

- Gerresheimer AG.

- DS Smith Plc

- Huhtamäki Oyj

- Berry Global Inc.

- Sonoco Products Company

- Sealed Air Corporation

- Constantia Flexibles Group GmbH

- Winpak Ltd.

- CCL Industries Inc.

- 3M Company

- Dunmore Corporation

- Toray Plastics . Inc.

- WestRock Company

- Mondi Group

- BillerudKorsnäs AB

- Ball Corporation

- Honeywell International

- Klöckner Pentaplast Europe GmbH & Co. KG

- Avery Dennison Corporation.

Segments Covered in the Report

By Material Type

- Glass

- Plastic

- Metal

- Paper and Paperboard

By Product

- Bottles and Containers

- Vials and Ampoules

- Cartridges and Syringes

- Pouches and Bags

- Blister Packs

- Tubes

- Paper Board Boxes

- Caps and Closures

- Labels

- Other

By Application

- Medical Tools & Equipment

- Medical Devices

- In-Vitro Diagnostic Product

By Drug Delivery Mode

- Oral

- Injectable

- Dermal/Topical

- Inhalable

- Others

By Packaging

- Primary Packaging

- Secondary Packaging

By Packaging Format

- Flexible Packaging

- Bags & Pouches

- Envelopes

- Tubes

- Sachets

- Rigid Packaging

- Trays

- Boxes & Folding Cartons

- Clamshells

- Blisters

- Bottles & Jars

- Containers

- Aerosol Cans

- Ampoules & Vials

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/2106

Unlocking Market Insights through Data Excellence

The “Precedence Statistics” flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today’s dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit:

www.precedencestatistics.com