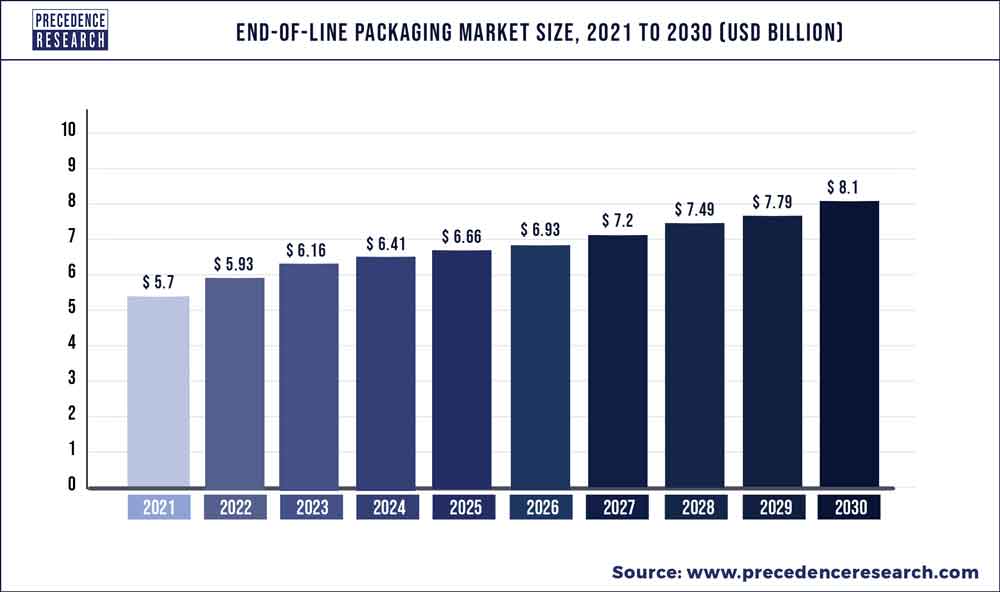

The global end-of-line packaging market size surpassed USD 5.93 billion in 2022 and is expected to hit around USD 8.1 billion by 2030, poised to grow at a CAGR of 3.98% from 2022 to 2030.

The end-of-line packaging market has witnessed significant growth driven by various factors. End-of-line packaging refers to the final stage of the packaging process, where products are grouped, packaged, and prepared for distribution or storage. With the increasing demand for efficiency, automation, and cost-effectiveness in packaging operations, there has been a growing interest in end-of-line packaging solutions across industries such as food and beverage, pharmaceuticals, cosmetics, and consumer goods. These solutions include case packers, palletizers, stretch wrappers, and labeling systems designed to streamline packaging processes, reduce labor costs, and improve overall productivity.

Moreover, advancements in robotics, artificial intelligence (AI), and machine learning have enhanced the capabilities and performance of end-of-line packaging systems, enabling businesses to achieve higher throughput, flexibility, and customization in their packaging operations. Additionally, the rise of e-commerce and omni-channel distribution models has further fueled the demand for end-of-line packaging solutions as companies seek to meet the growing expectations of consumers for fast and efficient order fulfillment. Furthermore, the COVID-19 pandemic has accelerated the adoption of end-of-line packaging automation as businesses look for ways to adapt to changing consumer behaviors and market dynamics. As industries continue to prioritize efficiency, scalability, and agility in packaging operations, the end-of-line packaging market is expected to witness sustained growth, offering opportunities for innovation and investment in automated packaging solutions.

Key Takeaways

- Europe led the global market with the highest market share in 2022.

- By Technology, the automatic segment has held the largest market share in 2022.

- By Function, the standalone segment captured the biggest revenue share in 2022.

- By End-User, the food and beverages segment is estimated to hold the highest market share in 2022.

Get a Sample: https://www.precedenceresearch.com/sample/2212

Report Scope of the End-of-Line Packaging Market

| Report Coverage | Details |

| Market Size in 2022 | USD 5.93 Billion |

| Market Size by 2030 | USD 8.1 Billion |

| Growth Rate from 2022 to 2030 | CAGR of 3.98% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segments Covered | Technology, Order Type, Function, Source, Product, End User, and Geography |

Read More: Fresh Food Packaging Market Size to Hit USD 174.6 Billion by 2032

End-of-Line Packaging Market Dynamics

Driver

The end-of-line packaging market is experiencing an increased demand for automation. As businesses seek to optimize efficiency, reduce costs, and improve productivity in their packaging operations, there is a growing emphasis on implementing automation solutions at the end of the packaging line.

Automation in end-of-line packaging encompasses a range of technologies and systems designed to streamline the final stages of the packaging process, including case erecting, case sealing, palletizing, and labeling. By automating these tasks, companies can achieve higher throughput rates, minimize manual labor, and enhance overall packaging efficiency.

The increased demand for automation in the end-of-line packaging market is driven by several factors. Firstly, automation helps businesses meet the growing demands of modern supply chains, which require faster turnaround times and greater flexibility to respond to changing market conditions.

Secondly, automation enables companies to improve product quality and consistency by reducing the risk of human error in the packaging process. Automated systems can perform repetitive tasks with precision and accuracy, resulting in fewer defects and less waste.

Restraint

The end-of-line packaging market aims to provide reasonably priced, high-quality goods to meet the diverse needs of consumers and businesses. End-of-line packaging refers to the final stage of packaging where products are prepared for distribution, storage, and sale. It includes processes such as case packing, palletizing, and labeling, which are essential for ensuring products reach their destination safely and efficiently.

In the end-of-line packaging market, the focus is on offering products that strike a balance between affordability and quality. Manufacturers and suppliers strive to provide cost-effective packaging solutions without compromising on the integrity, durability, or presentation of the packaged goods. This involves leveraging efficient production methods, economies of scale, and strategic sourcing of materials to keep prices competitive while meeting stringent quality standards.

Opportunity

The end-of-line packaging market is experiencing significant growth driven by the expanding e-commerce and retailing industries. As more consumers turn to online shopping for convenience and accessibility, the demand for efficient and reliable end-of-line packaging solutions is on the rise. End-of-line packaging refers to the final stage of packaging where products are prepared for shipment and distribution. In the e-commerce sector, end-of-line packaging plays a crucial role in ensuring that products are securely packaged for transit, protecting them from damage and ensuring they arrive in optimal condition to the customer.

Additionally, in traditional retailing industries, end-of-line packaging is essential for streamlining logistics operations, optimizing shelf space, and enhancing product presentation. With the increasing volume of goods being shipped and distributed globally, there is a growing need for automated end-of-line packaging solutions that can handle high throughput and accommodate diverse packaging requirements. As a result, the end-of-line packaging market is witnessing innovation and advancements in technology to meet the evolving needs of the e-commerce and retailing industries, driving growth and market expansion in this sector.

Recent Developments

- Michael Odom will take over as CEO of Schneider Packaged, an industrial automation provider for packaged food end-of-line systems, effective July 20, 22. The business operations and strategies of the company will be overseen by Michael Odom.

- ProMach acquired Serpa Packing in 2021, a leading provider of end-of-line systems and cartooning. Serpa strengthens ProMach’s line connectivity and unique corrugated box integral approach for the rapidly growing pharmaceutical firms, and it compliments ProMach’s portfolio of automation cartooning equipment.

End-of-Line Packaging Market Players

ADCO Manufacturing, Akash Packtech (P) Ltd. (India), B&R (Austria), Busch Machinery Inc (US), Clear pack India Pvt. Ltd., Coesia Group (Italy), Combi Packaging Systems, LLC (US), DS Smith (UK), Duravant. Company (US), EndFlex, (US), Endoline Machinery Ltd (UK), Festo Inc (Germany), FlexLink (Sweden), Fromm Group (Switzerland), Gebo Cermex, Hualian Machinery Group Co., Ltd, Ima S.p.A., INFINITY AUTOMATED SOLUTIONS PVT. LTD, J+P Maschinenbau GmbH, Krones AG, Lantech, (US), Massman Automation Designs, LLC (US), Venia LLC, OPTIMA packaging group GmbH (Germany), ProMach (US), Quin Systems Ltd, RADPAK (Europe), Robert Bosch GmbH (Germany), Rovema GmbH, Schneider Packaging Equipment Company, Inc (US), Shemesh Automation LTD. (UK), Stevanato Group, Synerlink ( A Barry-Wehmiller Company), Syntegon (Bosch Packaging Technology), Tekpak Automation, Uhlmann Pac-System, WestRock Company

Segments Covered in the Report

By Technology

- Automatic

- Semi-Automatic

By Order Type

- Customized

- Standard

By Function

- Stand Alone

- Integrated

- Labelling

- Palletizing

- Stretch wrapping

- Carton Erecting Sealing

- Packing

- Others

By End User

- Food and Beverages

- Pharmaceutical

- Electronics and Semiconductor

- Automotive

- Chemical Products

- Consumer Products

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Unlocking Market Insights through Data Excellence

The “Precedence Statistics” flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today’s dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit:

www.precedencestatistics.com