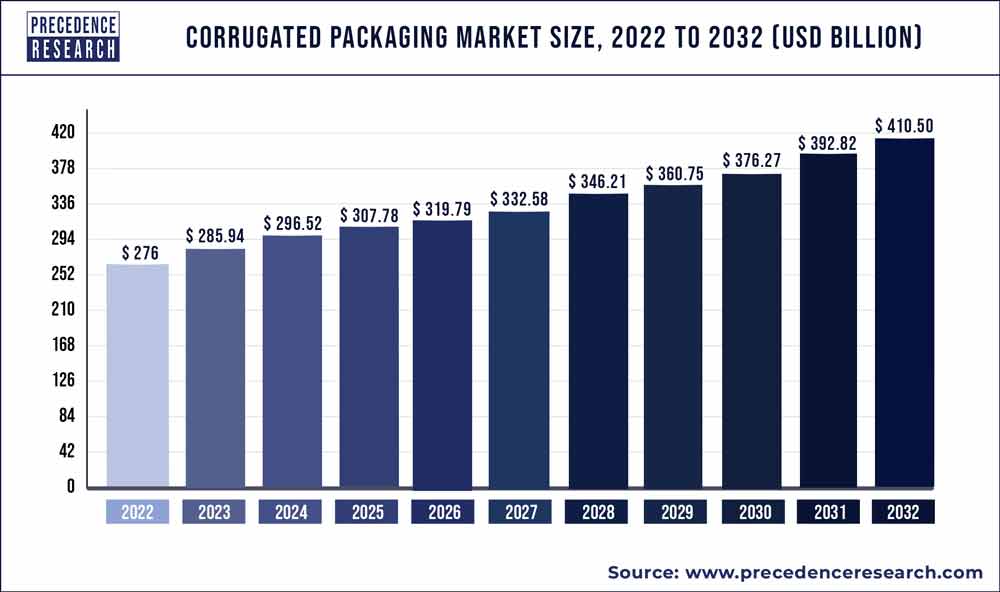

The global corrugated packaging market size was estimated at USD 285.94 billion in 2023 and is projected to hit around USD 410.5 billion by 2032, growing at a CAGR of 4.1% from 2023 to 2032.

The corrugated packaging market has seen significant growth due to various factors. Corrugated packaging refers to cardboard boxes and containers made from layers of corrugated paperboard, which provide strength, durability, and protection for a wide range of products during storage, transportation, and distribution. With the increasing demand for efficient and sustainable packaging solutions, there has been a growing adoption of corrugated packaging across industries such as food and beverage, e-commerce, retail, electronics, and manufacturing. These packaging solutions offer benefits such as lightweight, recyclability, and customization, making them versatile and cost-effective options for packaging different types of products.

Moreover, advancements in corrugated manufacturing technology have led to the development of innovative packaging designs, such as customized shapes, sizes, and printing options, allowing companies to enhance their branding and shelf appeal. Additionally, the rise of e-commerce and online shopping trends has driven increased demand for corrugated packaging as companies seek sturdy and protective packaging solutions for shipping products to customers.

Furthermore, the COVID-19 pandemic has accelerated the shift towards online shopping and home delivery services, further boosting demand for corrugated packaging solutions that are resilient, sustainable, and adaptable to changing consumer behaviors. As industries continue to prioritize efficiency, sustainability, and product protection in their packaging strategies, the corrugated packaging market is expected to witness sustained growth, offering opportunities for innovation and expansion in packaging solutions.

Key Takeaways

- In terms of package type, the sector with the biggest market share in 2022 was single wall boards.

- Over the estimated period, the double wall boards segment is anticipated to grow at the fastest CAGR among all package types.

- The food and beverage industry had the largest revenue share by application in 2022.

- According to Application, throughout the estimated time, the e-commerce industry is anticipated to grow at the fastest CAGR.

Get a Sample: https://www.precedenceresearch.com/sample/1526

Corrugated Packaging Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 285.94 Billion |

| Market Size by 2032 | USD 410.5 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 4.1% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Package Type, Application, Region |

Read More: Green Packaging Market Size to Hit USD 524.70 Billion by 2032

Corrugated Packaging Market Dynamics

Driver:

The e-commerce boom is a significant driver for the corrugated packaging market. With the rapid growth of online retail channels, there has been a corresponding increase in the demand for shipping and logistics packaging solutions. Corrugated packaging, known for its durability, strength, and versatility, is widely used for shipping products safely and securely. The rise of e-commerce platforms has led to a surge in parcel shipments, creating a growing need for corrugated boxes and packaging materials. As consumers continue to embrace online shopping trends, the demand for corrugated packaging is expected to remain strong, particularly in sectors such as electronics, consumer goods, and pharmaceuticals.

Restraint:

One of the key restraints facing the corrugated packaging market is the fluctuation in raw material prices, particularly for paper and pulp. Corrugated packaging is primarily made from paperboard, which is derived from wood fibers. Fluctuations in the prices of wood pulp and other raw materials can impact the manufacturing costs for corrugated packaging manufacturers. Additionally, supply chain disruptions, such as those caused by natural disasters or geopolitical tensions, can further exacerbate price volatility and create challenges for producers. Managing these cost pressures while maintaining product quality and competitiveness poses a significant challenge for players in the corrugated packaging market.

Opportunity:

An emerging opportunity for the corrugated packaging market lies in sustainable packaging solutions. With increasing concerns about environmental sustainability, there is a growing demand for packaging materials that are recyclable, biodegradable, and made from renewable resources. Corrugated packaging, being primarily made from paperboard, offers inherent advantages in terms of recyclability and environmental friendliness. By leveraging these attributes and investing in sustainable practices such as using recycled fibers and minimizing waste, corrugated packaging manufacturers can capitalize on the growing preference for eco-friendly packaging solutions. Additionally, innovations in printing and design technologies allow for the customization and personalization of corrugated packaging, providing added value to customers and enhancing brand visibility. By embracing sustainability and innovation, the corrugated packaging market can position itself for long-term growth and competitiveness.

Recent Developments

- The Mondi Group expanded in September 2021 by adding new machinery to their corrugated box production facility in Poland.

- DS Smith created a completely recyclable e-commerce package in April 2021. In order to serve the online retail sector, this initiative aims to achieve sustainability and eco-friendly packaging solutions.

Corrugated Packaging Market Players

- Mondi Group

- WestRock Company

- International Paper Company

- DS Smith PLC

- Smurfit Kappa Group

- Nine Dragons Paper (Holdings) Limited

- Georgia-Pacific Equity Holdings LLC.

- Oji Holdings Corporation

- Lee & Man Paper Manufacturing Ltd.

- Packaging Corporation of America

Segments Covered in the Report

By Package Type

- Single Wall Boards

- Double Wall Boards

- Triple Wall Boards

- Single Face Boards

By Application

- Electronics & Electricals

- Food & Beverages

- Transport & Logistics

- E-Commerce

- Personal Care Goods

- Healthcare

- Homecare Goods

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1526

Unlocking Market Insights through Data Excellence

The “Precedence Statistics” flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today’s dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit:

www.precedencestatistics.com