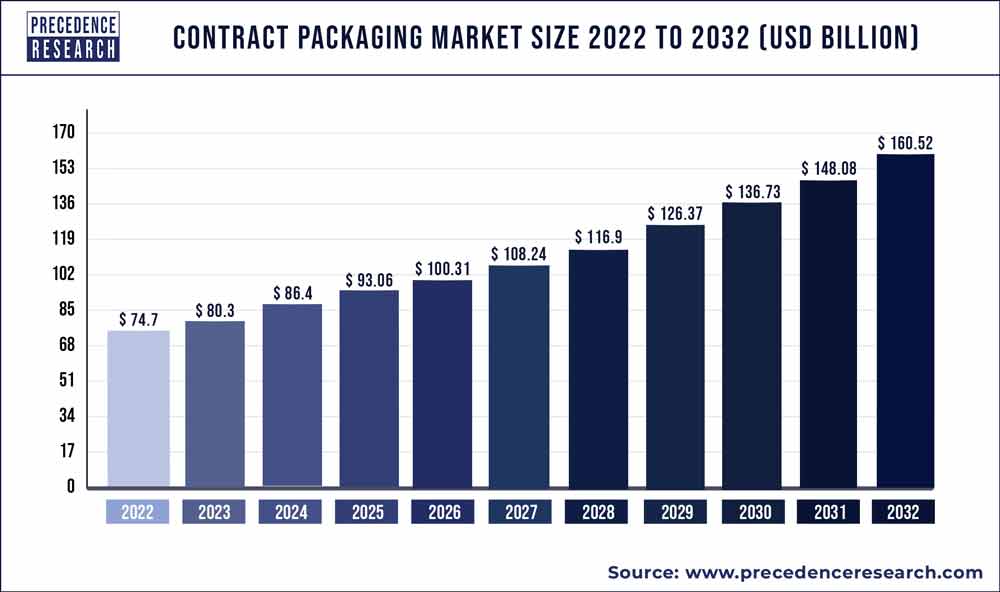

The global contract packaging market size reached USD 74.70 billion in 2022 and is projected to hit around USD 160.52 billion by 2032, expanding at a CAGR of 8% from 2023 to 2032.

The contract packaging market has experienced significant growth due to several factors. Contract packaging involves the outsourcing of packaging services to third-party providers, offering companies flexibility, scalability, and cost-effectiveness in their packaging operations. With the increasing complexity of packaging requirements, evolving consumer preferences, and competitive pressures, there has been a growing demand for specialized packaging solutions and services. Contract packaging providers offer a wide range of services including packaging design, material sourcing, labeling, assembly, and fulfillment, tailored to the specific needs of their clients across industries such as food and beverage, pharmaceuticals, cosmetics, and consumer goods.

Moreover, advancements in packaging technology, automation, and supply chain management have enabled contract packagers to offer innovative solutions and streamline operations, enhancing efficiency and speed to market for their clients. Additionally, the rise of e-commerce and direct-to-consumer (DTC) sales channels has driven increased demand for contract packaging services as companies seek to optimize packaging for online retail and meet the unique requirements of e-commerce fulfillment.

Furthermore, the COVID-19 pandemic has accelerated the adoption of contract packaging services as companies look to mitigate supply chain disruptions, manage inventory levels, and respond to changing consumer demand patterns. As companies continue to focus on core competencies and strategic partnerships, the contract packaging market is expected to witness sustained growth, offering opportunities for innovation and expansion in packaging solutions and services.

Key Takeaways

- From 2023 to 2032, the blisters & clamshells product segment is anticipated to develop at a compound annual growth rate (CAGR) of 9%.

- In 2022, the food and beverage segment is anticipated to account for 72% of the market.

- In 2022, the market share of the bottling segment was approximately 29.2%.

Get a Sample: https://www.precedenceresearch.com/sample/1879

Report Scope of the Contract Packaging Market

| Report Coverage | Details |

| Market Size by 2032 | USD 160.52 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 8% |

| North America Market Share in 2022 | 39% |

| Food & Beverage Segment Market Share in 2022 | 72% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Type, Material, Service, End User, Geography |

Read More: Medical Device Packaging Market Size to Hit USD 63.1 Billion by 2030

Contract Packaging Market Dynamics

Market Driver:

The increasing demand for contract packaging services is primarily driven by the growing complexity of supply chains and the need for companies to focus on their core competencies. Outsourcing packaging operations allows businesses to streamline their processes, reduce costs, and improve efficiency. Additionally, the rise of e-commerce has led to an uptick in the need for customized packaging solutions to meet the unique requirements of online retail, further fueling the demand for contract packaging services.

Market Restraint:

One significant restraint facing the contract packaging market is the potential loss of control over quality and brand image. Entrusting packaging responsibilities to third-party providers can sometimes lead to inconsistencies in product presentation and quality, which may negatively impact brand perception and customer satisfaction. Moreover, concerns regarding intellectual property protection and confidentiality may deter some companies from fully embracing contract packaging solutions, especially for sensitive or proprietary products.

Market Opportunity:

An opportunity for the contract packaging market lies in the growing trend towards sustainable packaging solutions. As consumers become increasingly environmentally conscious, there is a rising demand for eco-friendly packaging materials and practices. Contract packaging companies that can offer sustainable packaging options, such as biodegradable materials or optimized packaging designs that minimize waste, stand to capitalize on this trend. Additionally, the expanding global reach of consumer goods companies presents opportunities for contract packagers to offer their services in new regions and tap into emerging markets, thereby driving further growth in the industry.

Recent Developments

- In February 2020, Huge Beverages Contract Manufacturing announced the opening of its new drink co-pressing facility in North Carolina. At their new headquarters, BBCM will begin with a single high-velocity can line that can assemble 1,200 jars per minute. Over the course of the next 18 months, lines two and three will be added. BBCM intends to provide a wide range of canned beverage goods to both local and general public customers. Before the second quarter of 2020, BBCM will be fully operational, and its most iconic assembly line is currently 80% sold out.

- In January 2020, MSI Express, a US-based company backed by HCI Equity Partners, acquired Power Packaging. MSI Express is a contract bundling and contract production company that works with well-known brands in the pet and human food retail stables. MSI Express’s acquisition of Power Packaging has expanded its capabilities, clientele, and topographical reach. With Power, MSI Express expands into new culinary categories, encompassing powdered drinks, bases and soups, beverage blends, baking mixes, coffee and teas, foodservice beverages, meal portions, pasta, rice, side dishes, and salad dressings.

Contract Packaging Market Players

- Sharp Packaging

- Aaron Thomas Company Inc.

- AmeriPac Inc.

- Assemblies Unlimited Inc.

- Assured Edge Solutions

- co-pak packaging corp.

- Deufol

- DHL

- Green Packaging Asia

- Hollingsworth

- Jones Packaging

- Kelly Products Inc.

- Sonic Packaging Industries

- Stamar Packaging

- Sterling Contract Packaging Inc.

- Silgan Holdings Inc.

- Wepackit Inc.

Segments covered in the report

By Type

- Primary

- Secondary

- Tertiary

By Material

- Plastic

- Metal

- Glass

- Paper and Paperboard

By Service

- Bottling and Filling

- Bagging/Pouching

- Lot/Batch and Date Coding

- Boxing and Cartoning

- Wrapping and Bundling

- Labelling

- Clamshells and Blisters

- Others

By End User

- Pharmaceuticals

- Food & Beverage

- Agriculture

- Cosmetics

- Personal Care

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1879

Unlocking Market Insights through Data Excellence

The “Precedence Statistics” flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today’s dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit:

www.precedencestatistics.com