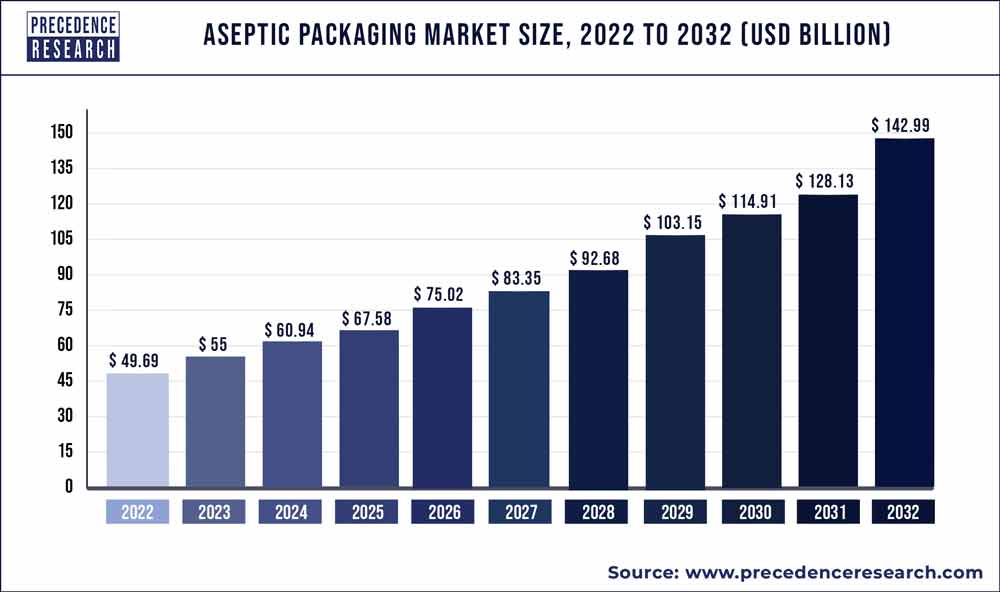

The global aseptic packaging market size is anticipated to reach around USD 142.99 billion by 2032 from USD 49.69 billion in 2022 and is poised to grow at a CAGR of 11.2% during the forecast period from 2023 to 2032.

The aseptic packaging market has experienced notable growth, propelled by several key factors. Aseptic packaging provides a sterile environment for food and beverage products, extending shelf life and maintaining freshness without the need for refrigeration or preservatives. This technology has gained traction due to increasing consumer demand for convenient, safe, and minimally processed products.

Additionally, aseptic packaging helps reduce food waste by preserving perishable items longer and enabling distribution to remote locations. Furthermore, advancements in packaging materials and sterilization techniques have enhanced the sustainability and efficiency of aseptic packaging solutions, aligning with industry efforts to minimize environmental impact. With the continuous expansion of the food and beverage industry, coupled with consumer preferences for healthier and more convenient products, the aseptic packaging market is poised for sustained growth in the foreseeable future.

Key Takeaways

- In 2022, Asia Pacific accounted for 36% of total sales.

- In 2022, Europe accounted for more than 26% of global revenue.

- In 2022, the cartons segment accounted for the highest revenue share, surpassing 58%.

- In 2022, the paper and paperboard segment provided the biggest revenue share of 56%.

Get a Sample: https://www.precedenceresearch.com/sample/2921

Report Scope of the Aseptic Packaging Market:

| Report Coverage | Details |

| Market Size in 2023 | USD 55 Billion |

| Market Size by 2032 | USD 142.99 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 11.2% |

| Largest Market | Asia Pacific |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Material, By Packaging Type, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Read More: Packaging Foams Market Size to Reach USD 28.7 Bn By 2032

Aseptic Packaging Market Dynamics

Driver

The aseptic packaging market is experiencing a significant uptick in demand, largely due to the increasing preference for eco-friendly packaging solutions. Consumers and businesses alike are becoming more aware of the environmental impact of traditional packaging materials, leading to a growing demand for sustainable alternatives. Aseptic packaging, known for its ability to extend the shelf life of products while maintaining their freshness and quality, is increasingly being sought after in eco-conscious markets.

Manufacturers in the aseptic packaging industry are responding to this demand by developing and offering packaging solutions made from renewable and recyclable materials. These eco-friendly alternatives not only reduce the environmental footprint of packaging but also resonate with consumers who prioritize sustainability in their purchasing decisions. As the awareness of environmental issues continues to grow, the demand for eco-friendly aseptic packaging is expected to further drive innovation and expansion in the market, meeting the evolving needs of both consumers and businesses committed to sustainable practices.

Restraint

The aseptic packaging market faces significant challenges due to complex manufacturing processes, resulting in high production expenses. Aseptic packaging requires precise sterilization of both packaging materials and the product to be packaged, often involving sophisticated equipment and meticulous quality control measures. These stringent requirements increase production costs significantly, encompassing expenses related to specialized machinery, energy consumption, labor, and quality assurance protocols. Additionally, the use of advanced materials and technologies further adds to the overall manufacturing expenses.

Consequently, the high production costs associated with aseptic packaging can impact its affordability and competitiveness in the market. To address this challenge, stakeholders in the aseptic packaging industry must focus on optimizing manufacturing processes, investing in innovative technologies, and exploring cost-effective alternatives without compromising product safety and quality, thereby ensuring sustained growth and market viability.

Opportunity

The aseptic packaging market is undergoing transformation with the integration of electronic logistics processing. This evolution is driven by the need for greater efficiency, accuracy, and traceability in the handling and distribution of aseptically packaged products. Electronic logistics systems enable real-time monitoring and tracking of inventory, shipments, and deliveries, streamlining the entire supply chain process. By digitizing logistics operations, manufacturers and distributors in the aseptic packaging market can enhance inventory management, reduce errors, and improve order fulfillment speed.

Furthermore, electronic logistics facilitate better communication and collaboration among stakeholders, ensuring seamless coordination from production to delivery. As the industry embraces digitalization, the integration of electronic logistics processing in aseptic packaging operations offers numerous benefits, including improved productivity, cost savings, and enhanced customer satisfaction.

Recent Developments

- Leading dairy-based beverage manufacturer Balanda, situated in Qatar, announced in March 2023 a strategic alliance with packaging solution provider SIG to introduce a new aseptic packaging solution. As per the agreement, businesses will produce carton-style aseptic packaging, particularly for white cheese.

- Greatview stated in June 2022 that it would be working with INEOS and UPM Biofuels to develop an aseptic carton packaging solution that uses paperboard that has been certified FSC and is laminated with polymers.

Aseptic Packaging Market Players

- Tetra Laval International S.A.

- Amcor Limited

- Jpak Group

- Robert Bosch GmbH

- Bemis Company, Inc.

- Ecolean AB

- Reynolds Group Holding Limited

- E.I. du Pont de Nemours and Company

- DS Smith

- Industria Machine Automatiche S.P.A

- Becton Dickinson and Company

- ELOPAK Group

- SIG Combibloc Group AG

- Sealed Air Corporation

- Goglio S.p.A

- Krones AG

- IPI srl

- Printpack Inc.

- Agropour Cooperative.

- Shanghai Skylong Packaging Machinery Co., Ltd.

- Scholle Ipn

- Schott AG

- Lamican International AY

Segments Covered in the Report:

By Material

- Plastic

- Glass

- Wood

- Metal

- Paper & Paperboard

By Packaging Type

- Cartons

- Bottles and Cans

- Bags and Pouches

- Ampoules

- Others (Cup, Tray, Containers, etc)

By Application

- Food

- Beverage

- Dairy

- Pharmaceuticals

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/2921

Unlocking Market Insights through Data Excellence

The “Precedence Statistics” flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today’s dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit:

www.precedencestatistics.com