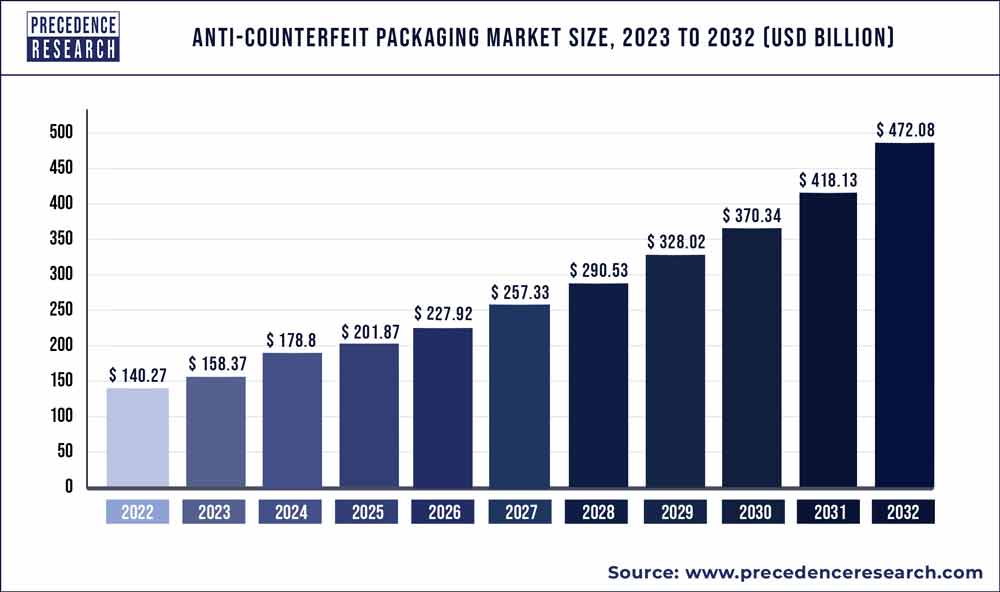

The global anti-counterfeit packaging market size was valued at USD 140.27 billion in 2022 and is expected to hit around USD 472.08 billion by 2032, growing at a CAGR of 12.9% from 2023 to 2032.

The anti-counterfeit packaging market has seen significant growth, driven by various factors. Counterfeiting poses a serious threat to industries such as pharmaceuticals, food and beverages, electronics, and luxury goods, leading to revenue loss, brand reputation damage, and risks to consumer safety. Anti-counterfeit packaging solutions are designed to deter counterfeiters and protect products from tampering and unauthorized reproduction. These solutions include features such as holograms, tamper-evident seals, unique identification codes, and track-and-trace technologies, enabling brand owners and consumers to verify product authenticity and trace its origin throughout the supply chain. Moreover, stringent regulations and enforcement measures against counterfeit activities have spurred the adoption of anti-counterfeit packaging solutions by companies seeking to safeguard their products and brands.

Additionally, advancements in printing technologies and materials science have enabled the development of sophisticated anti-counterfeit packaging solutions with enhanced security features and customization options. Furthermore, the rise of e-commerce and online retail platforms has increased the vulnerability of products to counterfeiting, driving the demand for robust anti-counterfeit packaging solutions. As industries continue to combat counterfeit activities and protect consumer trust, the anti-counterfeit packaging market is expected to witness sustained growth, offering opportunities for innovation and collaboration in the fight against counterfeit products.

Key Takeaways

- North America led the global market with the highest market share in 2022.

- In 2022, the market was dominated by the mass encoding category.

- In 2022, the pharmaceuticals segment held the most market share.

Get a Sample: https://www.precedenceresearch.com/sample/2701

Report Scope of the Anti-counterfeit Packaging Market

| Report Coverage | Details |

| Market Size in 2023 | USD 158.37 Billion |

| Market Size by 2032 | USD 472.08 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 12.9% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Technology, By Packaging Format and By End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Read More: Sterilization Pouches Market Size to Hit USD 86.9 Billion by 2032

Anti-Counterfeit Packaging Market Dynamics

Driver

The anti-counterfeit packaging market is experiencing a notable increase in the number of counterfeit products. This trend poses significant challenges for manufacturers, consumers, and regulatory authorities alike.

Counterfeit products, including counterfeit pharmaceuticals, electronics, luxury goods, and consumer goods, pose serious risks to public health, safety, and brand reputation. They often lack the quality, efficacy, and safety standards of genuine products, putting consumers at risk of harm or financial loss.

In response to the growing threat of counterfeiting, manufacturers are increasingly turning to anti-counterfeit packaging solutions to protect their products and brand integrity. Anti-counterfeit packaging technologies, such as tamper-evident seals, holograms, RFID tags, and unique serialization codes, help authenticate genuine products and deter counterfeiters.

Restraint

The anti-counterfeit packaging market faces significant challenges due to the high cost of production and investment. Developing and implementing anti-counterfeit packaging solutions involves substantial expenses related to research and development, specialized equipment, materials, and technology infrastructure. Additionally, stringent quality control measures, testing, and certification processes further contribute to production costs.

Moreover, ongoing investments in innovation and technology upgrades are necessary to stay ahead of counterfeiters who continuously adapt and develop sophisticated methods to counterfeit packaging. The high cost of production and investment can pose barriers to entry for smaller companies and startups, limiting innovation and market competition. To address this challenge, stakeholders in the anti-counterfeit packaging market must focus on driving efficiencies in production processes, optimizing resource utilization, and exploring cost-effective materials and technologies.

Collaboration among industry players, regulatory bodies, and technology providers is essential to develop standardized solutions and best practices that enhance the effectiveness and affordability of anti-counterfeit packaging while ensuring consumer safety and brand protection. By addressing the high cost of production and investment, stakeholders can unlock the full potential of anti-counterfeit packaging solutions and mitigate the risks associated with counterfeit products in the market.

Opportunity

The anti-counterfeit packaging market is experiencing a surge in demand from emerging markets. This increase is fueled by several factors, including rising consumer awareness of counterfeit products, stringent regulatory requirements, and the expansion of industries such as pharmaceuticals, electronics, and luxury goods in these regions. As emerging markets continue to grow economically and urbanize, the prevalence of counterfeit products has become a significant concern for both consumers and manufacturers. Anti-counterfeit packaging solutions, such as holograms, tamper-evident seals, RFID tags, and unique serialization codes, are increasingly being adopted to protect brands, ensure product authenticity, and safeguard consumer health and safety.

Furthermore, governments and regulatory bodies in emerging markets are implementing stricter enforcement measures and regulations to combat counterfeiting, driving the adoption of anti-counterfeit packaging technologies. As a result, the demand for anti-counterfeit packaging solutions is expected to continue rising in emerging markets, presenting opportunities for growth and innovation in the industry.

Recent Developments

- August 2021: Avery Dennison Corporation paid USD 1.45 billion to acquire Vestcom. The acquisition will enable the business to provide the retail and consumer packaged products sectors with additional branded labelling choices.

- May 2020 – SICPA Holdings unveiled a new integrated product security label with cutting-edge, secure, traceable, and counterfeit-resistant codes to protect consumers and the brand’s reputation. With the aid of this solution, brand owners can support their supply chain controls, customer interactions, and enforcement and investigative activities.

Anti-Counterfeit Packaging Market Players

- Avery Dennison Corporation

- CCL Industries Inc.

- Mettler Toledo International Inc.

- SICPA SA

- 3M Company

- Hologram Industries

- Tesa SE

- HID Global Corporation

- DigiSeal Inc.

- Brandprotect GmbH

Segments Covered in the Report

By Technology

- Holograms

- RFID

- Mass Encoding

- Forensic Markers

- Tamper Evidence

- Others

By Packaging Format

- Bottles & Jars

- Vials & Ampoules

- Blisters

- Trays

- Pouches & Sachets

- Tubes

- Syringes

By End-User

- Pharmaceuticals

- Food and Beverage

- Automotive

- Personal Care

- Electrical & Electronics

- Luxury Products

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Unlocking Market Insights through Data Excellence

The “Precedence Statistics” flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today’s dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit:

www.precedencestatistics.com