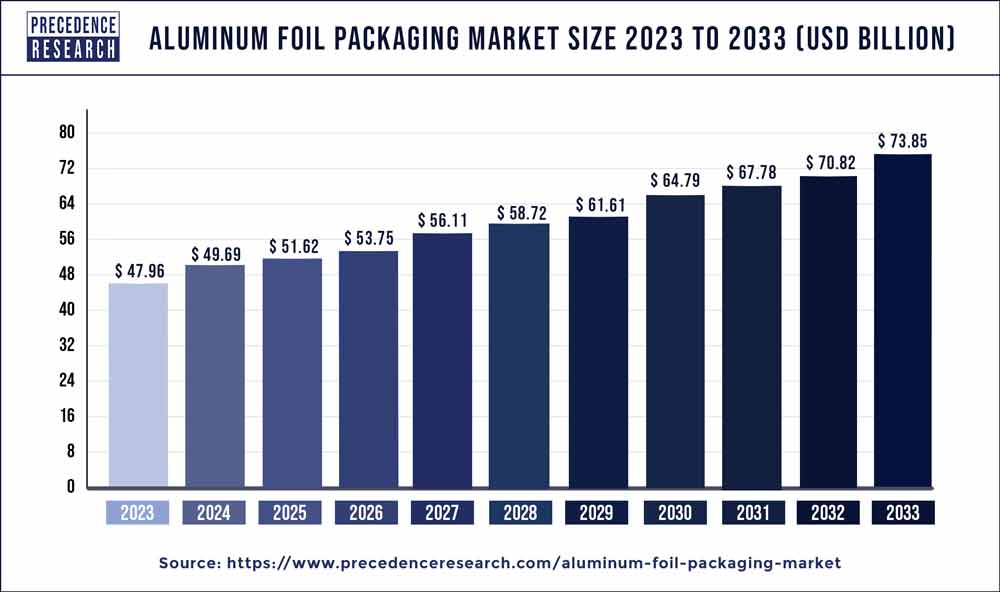

The global aluminum foil packaging market size reached USD 46.4 billion in 2022 and is projected to hit around USD 64.79 billion by 2030, expanding at a CAGR of 4.39% from 2023 to 2030.

The aluminum foil packaging market has experienced significant growth due to various factors. Aluminum foil packaging is widely used for packaging food, beverages, pharmaceuticals, and other consumer goods due to its properties such as barrier protection, heat resistance, and flexibility. With the increasing demand for convenient and sustainable packaging solutions, there has been a growing adoption of aluminum foil packaging across industries. These packaging solutions offer benefits such as preservation of freshness, extended shelf life, and protection against external factors such as moisture, light, and odors.

Moreover, advancements in aluminum foil manufacturing processes, including thinner gauges and enhanced coatings, have improved the performance and cost-effectiveness of aluminum foil packaging, making it an attractive choice for manufacturers and consumers alike. Additionally, the rise of e-commerce and on-the-go consumption trends has further fueled demand for aluminum foil packaging solutions that are lightweight, portable, and easy to use.

Furthermore, the COVID-19 pandemic has highlighted the importance of hygienic and tamper-evident packaging solutions, driving increased adoption of aluminum foil packaging for essential goods such as food, pharmaceuticals, and personal care products. As industries continue to prioritize efficiency, sustainability, and consumer safety, the aluminum foil packaging market is expected to witness sustained growth, offering opportunities for innovation and expansion in packaging solutions.

Key Takeaways

- In 2022, the revenue share contributed by the Asia Pacific area exceeded 40%.

- The market for aluminum foil packaging is led by the product category that generates the largest revenue share: wraps made of aluminum foil.

- In terms of end-use, the food and beverage industry had the largest revenue share in 2022—48 percent.

Get a Sample: https://www.precedenceresearch.com/sample/1608

Report Scope of the Aluminum Foil Packaging Market:

| Report Coverage | Details |

| Market Size in 2023 | USD 47.96 Billion |

| Market Size by 2032 | USD 64.79 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 4.39% |

| Largest Market | Asia Pacific |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Product, By End-Use, By Packaging Type, By Foil Type, and By Thickness |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Read More: Cold Chain Packaging Market Size to Hit USD 79.68 Billion by 2032

Aluminum Foil Packaging Market Dynamics

Driver

The aluminum foil packaging market is experiencing rising adoption by the food industry across the globe. As food manufacturers and retailers seek packaging solutions that offer superior barrier properties, durability, and versatility, aluminum foil packaging has emerged as a preferred choice for a wide range of food products.

One of the key drivers behind the increasing adoption of aluminum foil packaging in the food industry is its excellent barrier properties. Aluminum foil acts as an effective barrier against moisture, oxygen, light, and contaminants, helping to preserve the freshness, flavor, and quality of packaged food products. This makes aluminum foil packaging particularly suitable for perishable foods such as meat, seafood, dairy products, and bakery items.

Moreover, aluminum foil packaging offers versatility in packaging design and format. It can be easily shaped, folded, and sealed to create a variety of packaging formats, including pouches, wraps, trays, and containers. This flexibility allows food manufacturers to customize packaging solutions to meet specific product requirements and consumer preferences, enhancing shelf appeal and convenience.

Restraint

The aluminum foil packaging market faces concerns regarding the adverse health effects associated with aluminum foil. Aluminum foil is widely used in food packaging due to its properties such as flexibility, durability, and heat resistance. However, there are concerns about the potential health risks posed by aluminum exposure, particularly when used in direct contact with food.

One of the primary concerns is the potential for aluminum to leach into food during storage, cooking, or reheating processes. Aluminum is a reactive metal, and acidic or high-temperature conditions can accelerate the leaching of aluminum ions into food. Prolonged exposure to high levels of aluminum intake has been associated with adverse health effects, including neurological disorders such as Alzheimer’s disease and other cognitive impairments.

Furthermore, there are concerns about the migration of other harmful substances from aluminum foil coatings or additives into food. Aluminum foil may be coated or treated with chemicals to enhance its properties, such as improving barrier properties or increasing strength. However, these coatings or additives may contain harmful substances such as bisphenol A (BPA) or perfluorinated compounds (PFCs), which can leach into food and pose health risks, including endocrine disruption and developmental effects.

Opportunity

There is a growing emphasis on sustainability within the aluminum foil packaging market. With increasing awareness of environmental issues and consumer demand for eco-friendly products, companies in the aluminum foil packaging industry are focusing on sustainable practices and materials.

One key aspect of this emphasis on sustainability is the use of recycled aluminum in foil packaging production. Recycled aluminum requires significantly less energy and resources to produce compared to virgin aluminum, reducing carbon emissions and minimizing environmental impact. By incorporating recycled content into their products, manufacturers can help conserve natural resources and reduce waste.

Additionally, efforts are being made to improve the recyclability of aluminum foil packaging. Innovations in packaging design and recycling infrastructure aim to make it easier for consumers to recycle aluminum foil products effectively. This includes initiatives such as increasing collection and recycling facilities for aluminum foil, educating consumers about proper recycling practices, and promoting the recyclability of aluminum foil packaging.

Furthermore, companies are exploring alternative materials and packaging formats to reduce the environmental footprint of aluminum foil packaging. This includes developing bio-based or compostable alternatives to traditional aluminum foil, as well as exploring innovative packaging designs that use less material or incorporate renewable resources.

Recent Developments

- Camvac announced in February 2023 the release of Camfoil, a multi-layered, flexible metalized laminate that replaces traditional films with the company’s exclusive protective coating technology. The method removes the possibility of holes brought on by film laminates while providing the same functionality as film laminate. Thus, it seeks to guarantee the safety and maximum shelf life of the goods it packs, which ought to comprise dry food and powder as well as goods that are extremely susceptible to oxygen and/or moisture. For this approach, the characteristics of the barrier coating probably offer a “extreme” gas and water vapor barrier. To improve its supply chain, laminate is also said to use raw materials that are sourced locally. Compared to laminate that is based on sheets, it seeks to shorten delivery times and require less order amounts.

- In order to increase the circularity of flexible packaging that uses aluminum foil, CEFLEX stated in September 2022 that it would be launching circular design standards for polyolefin-based structures while adhering to a special value chain partnership. The CELFLEX UK Research and Innovation project, which was completed in cooperation with FPE and EAFA, supports the revised rules.

Aluminum Foil Packaging Market Players

- China Hongqiao Group Limited

- Amcor Ltd.

- United Company RUSAL PLC.

- Ess Dee Aluminum Ltd

- Novelis Inc.

- Alcoa Corporation

- Penny Plate LLC

- Wyda Packaging Ltd.

- Nicholi Food Packaging

- Alufoil Products Pvt. Ltd

Segments Covered in the Report

By Product

- Foil Wraps

- Pouches

- Blisters

- Containers

- Others

By End Use

- Food & Beverage

- Tobacco

- Pharmaceuticals

- Cosmetic

- Others

By Packaging Type

- Rigid

- Flexible

- Semi-Rigid

By Foil Type

- Printed

- Unprinted

By Thickness

- 0.007 mm – 0.09 mm

- 0.09 mm – 0.2 mm

- 0.2 mm – 0.4 mm

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1608

Unlocking Market Insights through Data Excellence

The “Precedence Statistics” flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today’s dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit:

www.precedencestatistics.com