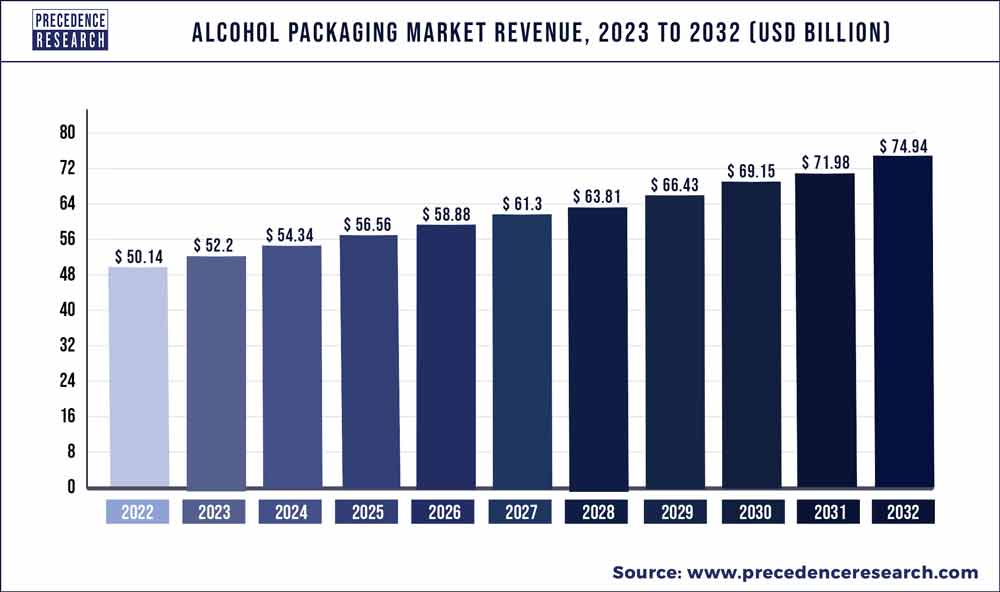

The global alcohol packaging market size was valued at USD 50.14 billion in 2022 and is expected to hit around USD 74.94 billion by 2032, growing at a CAGR of 4.10% from 2023 to 2032.

The alcohol packaging market has undergone significant growth, influenced by various factors. As the alcohol industry continues to expand globally, packaging plays a critical role in brand differentiation, product protection, and consumer engagement. The rising demand for premium and craft beverages has driven the adoption of high-quality and aesthetically pleasing packaging solutions, including glass bottles, cans, and innovative designs.

Moreover, the increasing emphasis on sustainability has led to the development of eco-friendly packaging materials and practices within the alcohol industry, addressing environmental concerns and consumer preferences. Additionally, regulatory requirements regarding alcohol labeling, safety, and transportation have influenced packaging standards and innovations. With the continuous evolution of consumer tastes, marketing strategies, and regulatory landscapes, the alcohol packaging market is poised for sustained growth, characterized by a blend of creativity, functionality, and sustainability in packaging solutions.

Key Takeaways

- For the food and beverage business, plastic bottles and containers are more in demand than other materials because of their simplicity of use and flexibility.

- Oversight of the primary packaging market is global.

- Beer is projected to lead the worldwide alcohol packaging industry, with roughly two-thirds of the market value going to it.

Get a Sample: https://www.precedenceresearch.com/sample/2859

Report Scope of the Alcohol Packaging Market:

| Report Coverage | Details |

| Market Size in 2023 | USD 52.2 Billion |

| Market Size by 2032 | USD 74.94 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 4.10% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Material, By Packaging Type and By End Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Read More: Milk Packaging Market Size to Hit USD 73.88 Billion by 2032

Alcohol Packaging Market Dynamics

Driver

The milk packaging market is witnessing a significant shift driven by rising preferences for sustainability in packaging. As consumers become increasingly aware of environmental issues and seek eco-friendly alternatives, there is growing demand for sustainable packaging solutions in the milk industry. Sustainable packaging options such as recyclable materials, biodegradable packaging, and renewable resources are gaining traction as consumers prioritize environmental responsibility in their purchasing decisions.

Manufacturers in the milk packaging market are responding to this trend by investing in innovative packaging materials and technologies that minimize environmental impact while maintaining product freshness and safety. These efforts include the development of plant-based packaging, compostable materials, and lightweight packaging designs that reduce carbon emissions and waste.

Restraint

Harmful packaging waste poses a significant challenge for the alcohol packaging market. Packaging materials such as glass bottles, aluminum cans, and plastic containers contribute to solid waste accumulation, which can have detrimental effects on the environment if not managed properly. Improper disposal of alcohol packaging waste can lead to littering, pollution of water bodies, and harm to wildlife.

Additionally, certain packaging materials may take centuries to decompose, exacerbating the problem of waste accumulation. To address this challenge, stakeholders in the alcohol packaging market must prioritize sustainable packaging solutions, such as recyclable, biodegradable, or reusable materials. Implementing effective recycling programs, advocating for responsible consumer behavior, and exploring innovative packaging technologies are essential steps to minimize the environmental impact of alcohol packaging waste. Collaboration among industry players, regulatory bodies, and consumers is crucial to address harmful packaging waste and promote a more sustainable approach to alcohol packaging.

Opportunity

The alcohol packaging market is witnessing several new trends that are reshaping the industry landscape. One notable trend is the rise of sustainable packaging solutions driven by increasing environmental awareness and consumer demand for eco-friendly options. This includes the use of recycled materials, biodegradable packaging, and lightweight designs to reduce carbon footprint and minimize waste. Another emerging trend is the focus on premiumization, with brands investing in high-quality packaging materials, innovative designs, and unique finishes to enhance the perceived value of their products. Customization and personalization are also gaining traction, allowing brands to create packaging that resonates with specific target audiences and reinforces brand identity.

Additionally, technological advancements are influencing packaging design, with features such as smart labels, NFC tags, and augmented reality experiences offering interactive and engaging elements to consumers. Overall, these new packaging trends reflect a shift towards sustainability, premiumization, and innovation within the alcohol packaging market, driving growth and differentiation in a competitive industry landscape.

Recent Developments

- March 2022: Canadian glass bottle maker United Bottles and Packaging was acquired by hybrid packaging company Berline Packaging for an undisclosed sum. By strengthening its position in the Canadian food and beverage sector and expanding its glass capabilities throughout North America, Berline Packaging will benefit from the acquisition.

- June 2022 – Swiss aseptic packaging provider SIG finalised the acquisition of flexible packaging business Scholle IN. SIG and Scholle IP reached an agreement to join in February of this year, with an enterprise value of USD 1.53 billion and an equity value of USD 1.2 billion. Eco-friendly packaging systems and solutions for the food, retail, beverage, institutional, and industrial markets are offered by Scholle IPN, a firm situated in Northlake, Illinois.

Alcohol Packaging Market Players

- Amcor plc.

- Bemis Manufacturing Company, Nampak Ltd.

- Crown

- Sidel Group

- ProAmpac.

- Ardagh Group S.A.

- Sonoco Products Company

- BALL CORPORATION

- Krones AG

- Diageo PLC

- Berry Global Inc.

- Saint-Gobain Group.

- Brick Packaging

- Tetra Pak Group

- O-I Glass, Inc.

- Orora Packaging Australia Pvt Ltd.

- Vetreria Etrusca

- Creative Glass

Segments Covered in the Report

By Material

- Glass

- Plastic

- Metal

- Others

By Packaging Type

- Primary

- Secondary

- By End Use

- Beer

- Wine

- Spirit

- Other

By End Use

- Beer

- Wine

- Spirit

- Other

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Unlocking Market Insights through Data Excellence

The “Precedence Statistics” flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today’s dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit:

www.precedencestatistics.com