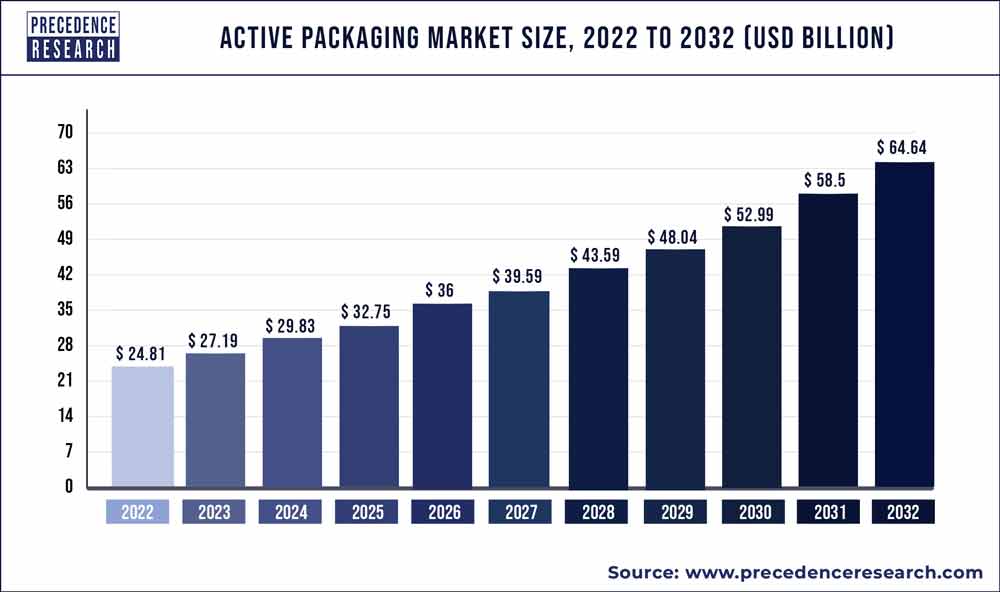

The global active packaging market size reached USD 24.81 billion in 2022 and is projected to hit around USD 64.64 billion by 2032, expanding at a CAGR of 10.1% from 2023 to 2032.

The active packaging market has witnessed significant growth driven by various factors. Active packaging refers to packaging solutions that interact with the internal environment of packaged products to extend shelf life, improve safety, and enhance product quality. With increasing consumer demand for fresher, safer, and more convenient food and beverage products, there has been a growing interest in active packaging technologies across industries such as food and beverage, pharmaceuticals, and healthcare. These technologies include oxygen scavengers, moisture absorbers, antimicrobial agents, and temperature indicators embedded within packaging materials to actively regulate the conditions inside the package. Moreover, advancements in materials science, nanotechnology, and food science have led to the development of active packaging solutions with improved functionality, performance, and sustainability.

Additionally, the rise of e-commerce and global supply chains has further fueled the demand for active packaging solutions as businesses seek to ensure product integrity and safety during transportation and storage. Furthermore, regulatory initiatives aimed at reducing food waste and enhancing food safety have contributed to market growth, driving adoption of active packaging solutions that extend product shelf life and minimize spoilage. As industries continue to prioritize innovation, sustainability, and consumer safety, the active packaging market is expected to witness sustained growth, offering opportunities for collaboration and advancement in packaging technologies.

Key Takeaways

- North America led the global market with the highest market share in 2022.

- By Application, the food and beverages segment has held the largest market share in 2022.

- By Type, the oxygen scavengers segment captured the biggest revenue share in 2022.

Get a Sample: https://www.precedenceresearch.com/sample/2292

Scope of the Active Packaging Market

| Report Coverage | Details |

| Market Size in 2023 | USD 27.19 Billion |

| Market Size by 2032 | USD 64.64 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 10.1% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Type, Application, and Geography |

| Companies Mentioned | R. Grace and Company (U.S.), Ampacet Corporation (U.S.), Ball Corporation (U.S.), Graham Packaging Company Inc. (U.S.), Rexam plc. (U.K.), Amcor Limited (Australia), Landec Corporation (U.K.), Bemis Company, Inc. (U.S.), Constar International Inc. (U.S.), Mitsubishi Gas Chemical Company (Japan), Crown Holdings Incorporated (U.S.), Klockner Pentaplast (Subsidiary Of Blackstone Group) (U.S.) |

Read More: Biodegradable Packaging Market Size to Reach USD 814.35 Bn By 2032

Active Packaging Market Dynamics

Driver

The active packaging market is experiencing a surge in demand, driven by the growing preference for sustainable and long-lasting packaging products. As consumers become increasingly environmentally conscious and seek products that minimize waste and environmental impact, there is a heightened focus on adopting sustainable packaging solutions.

Active packaging refers to packaging materials and technologies that actively interact with the packaged product to extend shelf life, maintain freshness, and enhance product quality. In response to the demand for sustainability, active packaging solutions are being developed with eco-friendly materials and processes that minimize environmental impact.

Furthermore, there is a growing recognition of the importance of durability and longevity in packaging products. Consumers are increasingly seeking packaging solutions that offer protection and preservation benefits while also being resilient and long-lasting. This includes packaging materials that are resistant to damage, degradation, and deterioration over time, ensuring that products remain safe and fresh throughout their lifecycle.

Restraint

The active packaging market faces challenges due to supply chain complexity and limited shelf life. Active packaging, which incorporates functionalities such as moisture control, antimicrobial properties, or oxygen scavenging, offers benefits in terms of extending product shelf life, maintaining freshness, and ensuring product safety. However, the implementation of active packaging solutions can introduce complexities within the supply chain and present challenges related to shelf life limitations.

Supply chain complexity arises from the need to integrate active packaging components, such as absorbers, emitters, or indicators, into existing packaging materials and processes. This requires coordination among multiple stakeholders, including packaging manufacturers, suppliers of active agents, and product manufacturers. Ensuring compatibility, efficacy, and regulatory compliance of active packaging components throughout the supply chain adds layers of complexity to procurement, production, and distribution processes.

Moreover, active packaging solutions may have limited shelf life themselves, particularly if they rely on perishable active agents or require specific environmental conditions to remain effective. This poses challenges for inventory management, storage, and distribution, as companies must carefully monitor and manage the expiration dates and performance characteristics of active packaging materials.

Opportunity

There is significant potential in the food and beverage sector for the active packaging market. Active packaging refers to packaging solutions that go beyond the traditional role of containment and protection, actively interacting with the packaged product to extend shelf life, enhance safety, and maintain product quality. In the food and beverage industry, active packaging offers numerous benefits, including the preservation of freshness, inhibition of microbial growth, and prevention of spoilage. This is particularly important for perishable products such as fresh produce, meat, seafood, and dairy items.

Additionally, active packaging can help to reduce food waste by prolonging the shelf life of products, thereby improving supply chain efficiency and reducing environmental impact. With increasing consumer demand for fresher, safer, and more convenient food and beverage options, the adoption of active packaging solutions is expected to grow rapidly in the coming years. By leveraging advanced technologies such as oxygen scavengers, antimicrobial agents, and moisture absorbers, active packaging manufacturers can develop innovative solutions that meet the evolving needs of the food and beverage industry, driving growth and market penetration in this sector.

Recent Developments

- The Internet of Things will be scaled through the addition of atma.io as well as the development, design, and production of Wiliot tags, which will help create an intelligent and fully connected IoT. In May 2022, Avery Dennison announced a strategic alliance with Wiliot, a provider of digital ID technologies.

- Amcor PLC made an investment in April 2022 to increase the thermoforming capacity of its medical packaging at its Sligo, Ireland-based healthcare packaging facility. The multimillion dollar investment would help Amcor’s sterile packaging business grow while providing customers in North America and Europe with access to yet another location offering comprehensive healthcare services.

Active Packaging Market Players

- R. Grace and Company (U.S.)

- Ampacet Corporation (U.S.)

- Ball Corporation (U.S.)

- Graham Packaging Company Inc. (U.S.)

- Rexam plc. (U.K.)

- Amcor Limited (Australia)

- Landec Corporation (U.K.)

- Bemis Company Inc. (U.S.)

- Constar International Inc. (U.S.)

- Mitsubishi Gas Chemical Company (Japan)

- Crown Holdings Incorporated (U.S.)

- Klockner Pentaplast (Subsidiary Of Blackstone Group) (U.S.)

Segments Covered in the Report

By Type

- Oxygen Scavenger

- Shelf-life sensing

- Time Temperature Indicator

- Moisture Absorber

- Others

By Application

- Food and Beverage

- Healthcare

- Pharmaceutical

- Personal Care

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Unlocking Market Insights through Data Excellence

The “Precedence Statistics” flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today’s dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit:

www.precedencestatistics.com