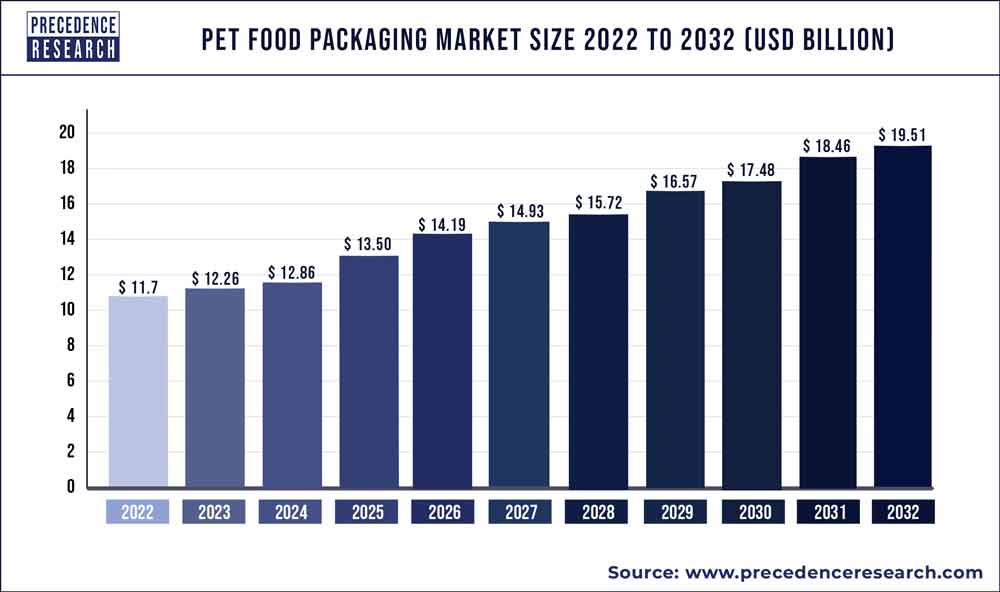

The global pet food packaging market size reached USD 11.7 billion in 2022 and is projected to surpass around USD 19.51 billion by 2032, expanding at a CAGR of 5.30% during the forecast period from 2023 to 2032.

Due to a number of important factors, the pet food packaging market has grown significantly. The need for premium and eye-catching packaging solutions has been stoked by the rise in pet ownership rates around the globe and the increased understanding of the value of nutritious pet food.

Expanding pet food markets have been fueled by rising disposable income as well as a move towards specialty and premium brands. Furthermore, as a result of the wider consumer trend towards ecologically conscious purchasing, the emphasis on sustainability in packaging materials—such as recyclable and eco-friendly options—has gained popularity. The pet food packaging market is anticipated to grow significantly as long as the pet care sector remains strong and innovative packaging materials and designs are used, along with a changing emphasis on convenience and freshness.

Key Takeaways

- North America contributed more than 46% of revenue share in 2022.

- The Asia-Pacific region is estimated to expand the fastest CAGR between 2023 and 2032.

- By Material Type, the plastic segment has held the largest market share of 36% in 2022.

- By Material Type, the paper and paperboard segment is anticipated to grow at a remarkable CAGR of 6.4% between 2023 and 2032.

- By Food Type, the dry food segment generated over 45% of revenue share in 2022.

- By Food Type, the other segment is expected to expand at the fastest CAGR over the projected period.

- By Animal Type, the dogs segment generated over 49% of revenue share in 2022.

- By Animal Type, the cats segment is expected to expand at the fastest CAGR over the projected period.

Get a Sample: https://www.precedenceresearch.com/sample/3518

Pet Food Packaging Market Scope

| Report Coverage | Details |

| Growth Rate from 2023 to 2032 | CAGR of 5.30% |

| Market Size in 2023 | USD 12.26 Billion |

| Market Size by 2032 | USD 19.51 Billion |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Material Type, By Food Type, and By Animal Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Pet Food Packaging Market Dynamics

Driver

A number of significant reasons have contributed to the market’s notable expansion for pet food packaging. Global pet ownership rates are on the rise, and pet nutrition is becoming increasingly important, which has increased demand for aesthetically pleasing and high-quality packaging solutions. Further driving market expansion has been a trend towards premium and specialty pet food options and an increase in discretionary income.

Furthermore, the focus on sustainability in packaging materials—that is, recyclable and eco-friendly options—has become more prominent, mirroring the broader trend among consumers to make environmentally responsible decisions. Innovation in materials and packaging design, along with a shifting emphasis on convenience and freshness, are anticipated to be key growth drivers in the pet food packaging market as the pet care sector continues to thrive.

Restraint

Cost concerns play a pivotal role in shaping the dynamics of the pet food packaging market, influencing both manufacturers and consumers. Manufacturers are driven to optimize production processes and explore cost-effective packaging materials without compromising product quality or safety.

As consumers become more price-sensitive, particularly in the face of economic uncertainties, there is an increasing demand for affordable pet food options and cost-efficient packaging solutions. This has led to a focus on lightweight materials, efficient manufacturing techniques, and streamlined logistics, allowing companies to balance cost-effectiveness with sustainability. Striking the right balance between affordability and quality in pet food packaging remains a critical consideration as the market continues to evolve, responding to the economic factors that influence purchasing decisions among pet owners.

Opportunity

Portion control and convenience are driving transformative trends in the pet food packaging market, reflecting the evolving lifestyles of pet owners. With an increasing emphasis on pet health and nutrition, packaging solutions have adapted to offer pre-portioned servings, facilitating precise feeding and helping owners manage their pets’ dietary requirements.

Additionally, the demand for convenient packaging formats, such as resealable bags and single-serve pouches, is on the rise, aligning with the fast-paced lifestyles of consumers. This trend not only enhances the ease of feeding but also reduces food waste. Manufacturers are responding by incorporating user-friendly features, ensuring that pet food packaging meets the dual criteria of portion control and convenience, ultimately catering to the preferences and needs of modern pet owners.

Recent Developments in the Pet Food Packaging Market

- Sonoco acquired Ball Metalpack in January 2022, which was the largest aerosol can maker in North America and a well-known developer of environmentally friendly metal packaging for food and home goods. This acquisition was a major one for Sonoco. With this calculated move, Sonoco added more sustainable packaging to its offering and integrated Ball Metalpack, which was previously owned by Ball Corporation and Platinum Equity.

- Constantia Flexibles expanded in August 2022 when it acquired FFP Packaging Solutions, gaining its first consumer factory in the UK. Producing recyclable laminates for flow wraps, lidding films, and pre-made pouches, this plant accounts for more than 80% of the company’s sustainable packaging sales in the United Kingdom.

- For their Protein Boost pet food product line, Coveris and Ultra-Premium Direct, a well-known French manufacturer of premium all-natural pet food, partnered in May 2022 to create recyclable polyethylene (PE) bags made of a single substance.

Pet Food Packaging Market Players

- Amcor

- Sonoco

- Constantia Flexibles

- Coveris

- Silgan Holdings

- Berry Global Inc.

- Ardagh Group

- Bemis Company Inc.

- Mondi Group

- Huhtamaki Oyj

- ProAmpac

- Sealed Air Corporation

- Winpak Ltd.

- Tetra Pak International S.A.

- Printpack Inc.

Segments Covered in the Report

By Material Type

- Paper and Paperboard

- Plastic

- Metal

By Food Type

- Dry Food

- Wet Food

- Others

By Animal Type

- Dogs

- Cats

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

You can place an order or ask any questions, please feel free to contact us at

sales@precedenceresearch.com | +1 650 460 3308

Unlocking Market Insights through Data Excellence

The “Precedence Statistics” flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today’s dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit:

www.precedencestatistics.com