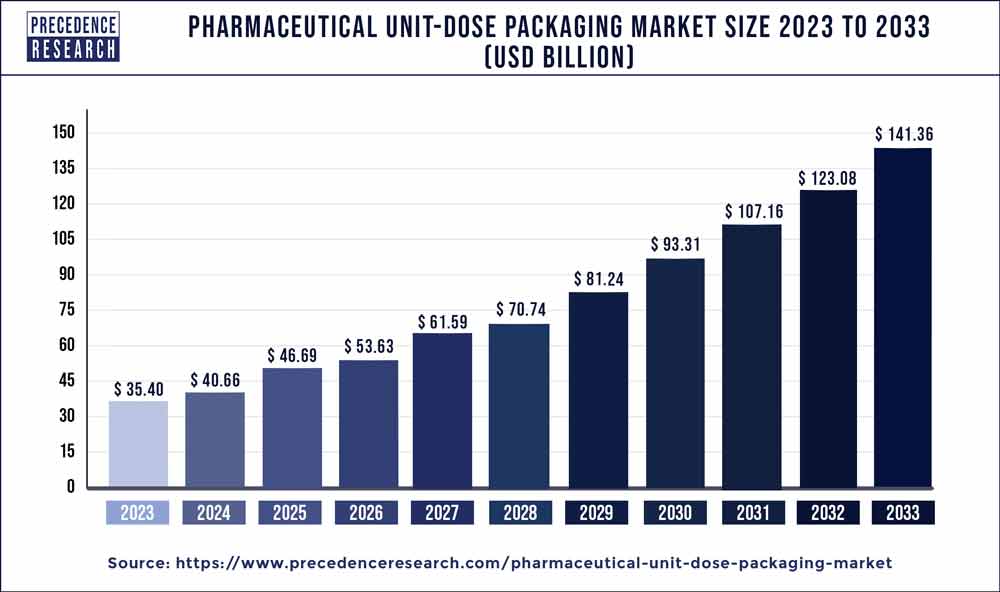

The global pharmaceutical unit-dose packaging market size surpassed USD 35.40 billion in 2023 and is estimated to hit around USD 141.36 billion by 2033 with a CAGR of 14.85% from 2024 to 2033.

The pharmaceutical unit-dose packaging market has experienced notable growth due to various factors. Unit-dose packaging refers to packaging solutions designed to contain a single dose of pharmaceutical product, typically in the form of tablets, capsules, or liquid doses. With the increasing emphasis on patient safety, medication adherence, and regulatory compliance in the pharmaceutical industry, there has been a growing demand for unit-dose packaging solutions that offer convenience, accuracy, and tamper-evidence. These packaging solutions help to reduce medication errors, prevent dosage mix-ups, and improve patient compliance by providing pre-measured doses that are easy to administer and track.

Moreover, unit-dose packaging helps to extend the shelf life of pharmaceutical products by minimizing exposure to moisture, light, and air, thereby ensuring the efficacy and stability of medications. Additionally, the rise of home healthcare and telemedicine trends has driven increased demand for unit-dose packaging solutions that are suitable for self-administration and remote monitoring.

Key Takeaways

- In terms of material, the plastics category held a dominant market share of 48% in 2023.

- The glass material category commands a substantial market share in terms of materials.

- As far as product categories go, the vials category holds the biggest market share (30%) in 2023.

- Blisters is the product category that is expected to grow at the fastest rate over the projection period.

- In 2023, the oral end-use category held a dominant market position.

Get a Sample: https://www.precedenceresearch.com/sample/3896

Pharmaceutical Unit-dose Packaging Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 14.85% |

| Global Market Size in 2023 | USD 35.40 Billion |

| Global Market Size by 2033 | USD 141.36 Billion |

| U.S. Market Size in 2023 | USD 8.43 Billion |

| U.S. Market Size by 2033 | USD 33.64 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Material, By Product, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Read More: Anti-counterfeit Cosmetic Packaging Market Size to Worth USD 449.54 Bn by 2032

Market Dynamics

Driver:

The pharmaceutical unit-dose packaging market is witnessing substantial growth driven by several key factors. One primary driver is the increasing demand for patient-centric packaging solutions that enhance medication adherence, safety, and convenience. Unit-dose packaging offers pre-measured doses of medication in individualized packaging, reducing the risk of medication errors and improving patient compliance, particularly for elderly patients and those with complex medication regimens.

Additionally, regulatory requirements mandating unit-dose packaging for certain medications, particularly controlled substances and high-risk drugs, further drive market demand. Moreover, advancements in packaging technologies such as blister packaging, strip packaging, and pouch packaging are expanding the applications of unit-dose packaging in the pharmaceutical industry, driving market growth.

Restraint:

Despite its promising growth prospects, the pharmaceutical unit-dose packaging market faces certain challenges that could hinder its progress. One significant restraint is the cost associated with implementing unit-dose packaging solutions, particularly for pharmaceutical manufacturers operating on tight budgets and thin profit margins. Unit-dose packaging materials and production processes can be more expensive than traditional bulk packaging formats, impacting overall production costs and drug pricing.

Additionally, concerns over environmental sustainability and packaging waste pose challenges for manufacturers in balancing the benefits of unit-dose packaging with environmental considerations. Moreover, the complexity of medication regimens and dosage forms in healthcare settings poses challenges for developing standardized unit-dose packaging solutions that meet the diverse needs of patients and healthcare providers.

Opportunity:

Despite the challenges, the pharmaceutical unit-dose packaging market presents significant opportunities for innovation and growth. Manufacturers are increasingly focusing on developing cost-effective and sustainable unit-dose packaging solutions that meet regulatory requirements and address patient needs. This includes the adoption of recyclable materials, lightweighting, and optimized packaging designs to reduce environmental impact and packaging waste. Moreover, advancements in packaging automation and serialization technologies offer opportunities to streamline unit-dose packaging operations, reduce labor costs, and improve production efficiency.

Furthermore, the growing trend towards personalized medicine and specialty pharmaceuticals presents an opportunity for customized unit-dose packaging solutions tailored to specific patient populations and treatment regimens. By leveraging these opportunities and addressing the challenges through collaboration, innovation, and market education, stakeholders in the pharmaceutical unit-dose packaging market can capitalize on market growth prospects and establish a competitive edge in serving the evolving needs of the healthcare industry.

Recent Developments

- The chiral form of the anti-ulcerant medication omeprazole, known as “es-omeprazole,” was introduced by Sun Pharmaceutical Industries Ltd. in December 2023. This medication is thought to be more effective than the molecule itself and has fewer adverse effects.

- Gerresheimer Gx Solutions is creating injectable medicine packaging solutions in 2023. The main packaging option for injectable pharmaceuticals that are sensitive is being developed by Gerresheimer Gx Solutions. The company combined knowledge in the specialist group called Gx Solutions.

Market Players

- Pfizer Inc

- Bristol-Myers Squibb Company

- Merck & Co. Inc.

- AbbVie Inc.

- Gerresheimer AG

- Comar LLC

- Amcor Plc.

- Johnson & Johnson

- UDG Healthcare Plc

- Berry Global, Inc.

Segments Covered in the Report

By Material

- Plastics

- Glass

- Paper and Paperboard

- Metal

By Product

- Vials

- Syringe and cartridge

- Ampoules

- Blisters

By End-use

- Ophthalmic

- Injectable

- Biologics

- Wound Care

- Respiratory Therapy

- Orals

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/3896

Unlocking Market Insights through Data Excellence

The “Precedence Statistics” flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today’s dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit:

www.precedencestatistics.com