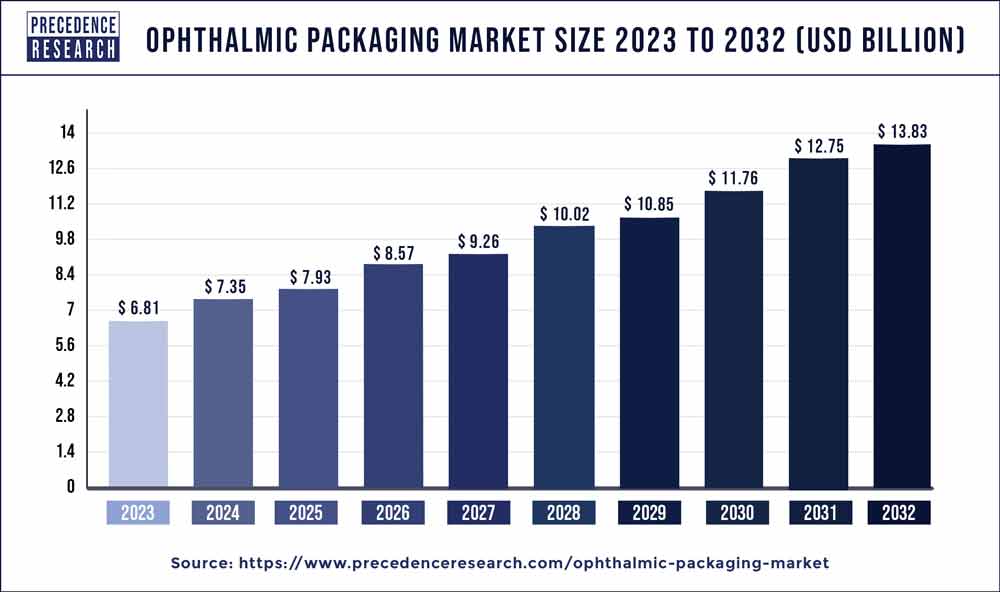

The global ophthalmic packaging market size was valued at USD 6.81 billion in 2023 and is expected to hit around USD 13.83 billion by 2032, growing at a CAGR of 8.2% from 2024 to 2032.

The ophthalmic packaging market has witnessed significant growth due to various factors. Ophthalmic packaging refers to specialized packaging solutions designed to protect and preserve products related to eye care, such as contact lenses, eyeglasses, eye drops, and ointments. With the increasing prevalence of eye-related disorders and the growing demand for vision correction products, there has been a corresponding rise in the need for high-quality and reliable packaging solutions in the ophthalmic industry. These packaging solutions offer benefits such as protection from contamination, light, and moisture, as well as ease of use, convenience, and tamper resistance. Moreover, advancements in packaging materials and technologies have led to the development of innovative and customizable packaging options that meet the specific requirements of ophthalmic products. Additionally, the rise of e-commerce and direct-to-consumer distribution channels has driven increased demand for ophthalmic packaging solutions that can withstand the rigors of shipping and handling while maintaining product integrity and safety.

Key Takeaways

- In 2023, North America accounted for around 36.85% of the revenue share.

- From 2024 to 2032, Asia Pacific is predicted to grow at the fastest CAGR.

- Prescriptions accounted for more than 56.89% of revenue share by application in 2023.

- In terms of material, the plastic category had the largest market share in 2023—roughly 53.84%.

Get a Sample: https://www.precedenceresearch.com/sample/3072

Ophthalmic Packaging Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2032 | CAGR of 8.2% |

| Market Size in 2023 | USD 6.81 Billion |

| Market Size by 2032 | USD 13.83 Billion |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2032 |

| Segments Covered | By Material, By Product Type, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Read More: Flexible Paper Packaging Market Size to Reach USD 127.33 Bn By 2033

Market Dynamics

Driver:

The ophthalmic packaging market is experiencing significant growth driven by several key factors. One of the primary drivers is the increasing prevalence of eye-related disorders and conditions such as cataracts, glaucoma, and age-related macular degeneration, driving demand for ophthalmic products and medications. As the global population ages and lifestyle factors such as prolonged screen time contribute to eye health issues, there is a growing need for safe, reliable, and convenient packaging solutions for ophthalmic products.

Additionally, advancements in ophthalmic drug delivery technologies, such as preservative-free formulations and innovative packaging designs, are driving market growth by improving patient compliance and treatment outcomes. Moreover, the expanding range of ophthalmic products including eye drops, contact lenses, and surgical implants is fueling demand for specialized packaging solutions that ensure product integrity, sterility, and user safety.

Restraint:

Despite its promising growth prospects, the ophthalmic packaging market faces certain challenges that could hinder its progress. One significant restraint is the stringent regulatory requirements and quality standards governing ophthalmic products and packaging materials. Regulatory compliance adds complexity to the packaging development process, requiring manufacturers to adhere to specific guidelines for labeling, sterilization, and product stability testing.

Moreover, concerns over contamination, particulate matter, and microbial growth pose challenges for packaging integrity and safety, particularly for sterile ophthalmic products. Additionally, the high cost of specialized packaging materials and technologies, such as barrier films and tamper-evident closures, can impact production costs and profit margins for manufacturers of ophthalmic packaging.

Opportunity:

Despite the challenges, the ophthalmic packaging market presents significant opportunities for innovation and growth. Manufacturers are increasingly focusing on developing advanced packaging solutions that enhance product safety, usability, and patient compliance. This includes the use of novel materials such as polymer blends and silicones for contact lens packaging, as well as innovative packaging formats such as unit-dose vials and multi-dose dispensers for ophthalmic medications. Moreover, advancements in labeling and printing technologies are enabling manufacturers to incorporate patient-friendly features such as braille instructions, color-coded labels, and dose indicators to improve accessibility and usability.

Furthermore, the growing trend towards personalized medicine and precision therapies in ophthalmology presents an opportunity for customized packaging solutions tailored to specific patient needs and treatment regimens. By leveraging these opportunities and addressing the challenges through collaboration, innovation, and adherence to regulatory standards, stakeholders in the ophthalmic packaging market can capitalize on market growth prospects and establish a competitive edge in providing safe and effective packaging solutions for ophthalmic products.

Recent Developments

- In July 2021, Nolato broadened its geographical scope by establishing an office in Baldwin, Wisconsin. This improvement would allow the business to meet the demand for medical products by increasing its manufacturing and storage capacity. Additionally, the extension was made to facilitate the production of pharmaceutical medication components and diagnostic instrument manufacturing.

- Amcor unveiled a novel lidding technique for the healthcare industry in August 2021. Combination items would benefit from the technology since they feature two or more regulated components.

Market Players

- Amcor

- West Pharmaceutical Services, Inc.

- Gerresheimer AG

- SCHOTT AG

- AptarGroup, Inc.

- Akorn, Inc.

- Johnson & Johnson Vision

- Mitotech, SA

- Bausch & Lomb Incorporated

- AERIE PHARMACEUTICALS, INC.

- Novartis AG

- Merck Sharp & Dohme Corp.

- Bayer AG

- F. Hoffmann-La Roche Ltd.

- ALLERGAN

- Santen Pharmaceutical Co.

- Teva Pharmaceutical Industries Ltd.

Segments Covered in the Report:

By Material

- Plastic

- Metal

- Glass

By Product Type

- Bottles & Vials

- Blister Packs

- Ampoules

- Squeezable Tubes

By Application

- Prescription Medication

- OTC Products

- Medical Devices

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/3072

Unlocking Market Insights through Data Excellence

The “Precedence Statistics” flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today’s dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit:

www.precedencestatistics.com