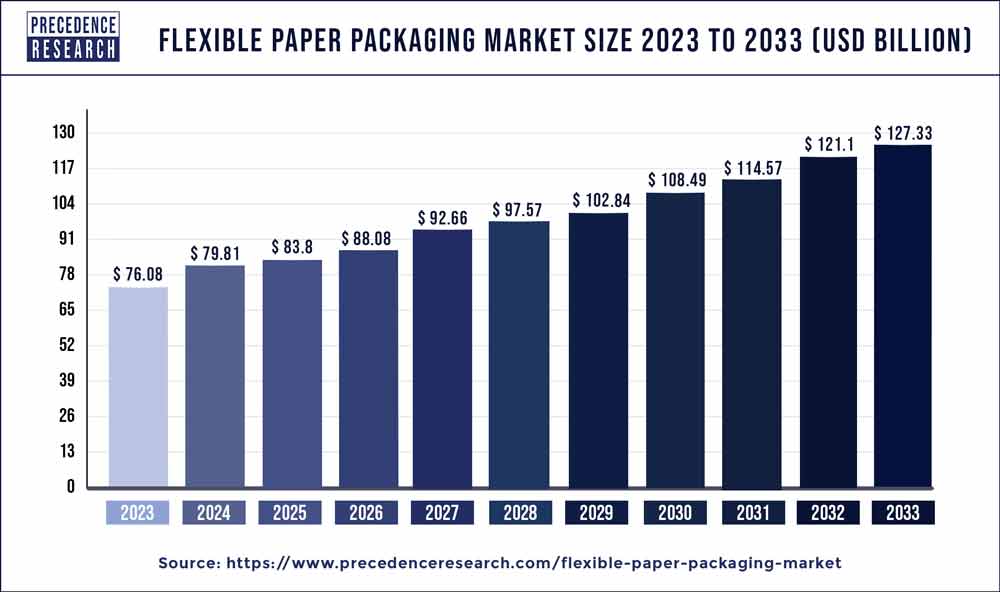

The global flexible paper packaging market size was estimated at USD 76.08 billion in 2023 and is projected to hit around USD 127.33 billion by 2033, growing at a CAGR of 5.33% from 2024 to 2033.

The flexible paper packaging market has experienced significant growth due to various factors. Flexible paper packaging refers to packaging solutions made from paper-based materials that offer versatility, sustainability, and convenience. With increasing consumer demand for eco-friendly and sustainable packaging options, there has been a growing adoption of flexible paper packaging across industries such as food and beverage, personal care, pharmaceuticals, and household products. These packaging solutions offer benefits such as lightweight, recyclability, biodegradability, and customization options for branding and product differentiation.

Moreover, advancements in paper processing and printing technologies have led to the development of high-quality, visually appealing flexible paper packaging options that meet the diverse needs of manufacturers and consumers. Additionally, the rise of e-commerce and on-the-go lifestyles has driven increased demand for flexible paper packaging formats such as pouches, sachets, and bags that are convenient, portable, and resealable.

Key Takeaways

- In terms of material revenue share, the paper segment has the largest share (43%), as of 2023.

- According to Material, over the forecast period, the bioplastics segment is expected to grow at a CAGR of 5.8%.

- In 2023, the films and wraps product category accounted for the largest market share, with 29%.

- Over the forecast period, the bags segment is predicted to increase at the quickest CAGR among all product categories.

- In terms of application, the food and beverage category held the biggest market share in 2023 with 57%.

- The pharmaceutical segment is anticipated to expand at the fastest CAGR throughout the projected period, according to application.

Get a Sample: https://www.precedenceresearch.com/sample/3422

Flexible Paper Packaging Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 5.33% |

| Market Size in 2023 | USD 76.08 Billion |

| Market Size by 2033 | USD 127.33 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Material, By Product, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Read More: Packaging Coatings Market Size to Worth USD 7.86 Bn by 2032

Market Dynamics

Driver:

The flexible paper packaging market is witnessing significant growth driven by several key factors. One of the primary drivers is the increasing demand for sustainable and eco-friendly packaging solutions across various industries. Flexible paper packaging offers a renewable and biodegradable alternative to traditional plastic packaging, aligning with consumer preferences for environmentally responsible packaging options. Moreover, advancements in papermaking technologies and coating formulations have improved the performance and versatility of flexible paper packaging, making it suitable for a wide range of applications including food and beverage, personal care, and pharmaceuticals.

Additionally, the lightweight and flexible nature of paper-based packaging materials make them ideal for e-commerce and on-the-go consumption, driving market growth. Furthermore, the emphasis on convenience and product differentiation is fueling demand for innovative packaging designs and formats, driving innovation and market expansion in the flexible paper packaging segment.

Restraint:

Despite its promising growth prospects, the flexible paper packaging market faces certain challenges that could hinder its progress. One significant restraint is the competition from alternative packaging materials such as plastics, metals, and glass. While flexible paper packaging offers environmental advantages, it may not always meet the specific requirements for certain packaging applications, particularly those demanding high barrier properties or moisture resistance. This can limit the adoption of flexible paper packaging in certain industries and applications.

Additionally, concerns over the cost and availability of raw materials, particularly specialty paper grades and coatings, can impact the production costs and profit margins for manufacturers of flexible paper packaging. Moreover, stringent regulatory requirements and compliance standards for food safety and packaging materials pose challenges for manufacturers in meeting regulatory requirements and ensuring product quality and safety.

Opportunity:

Despite the challenges, the flexible paper packaging market presents significant opportunities for innovation and growth. Manufacturers are increasingly focusing on developing sustainable and high-performance paper-based packaging solutions to address environmental concerns and meet consumer preferences for eco-friendly packaging options. This includes the development of bio-based and recycled paper materials, as well as innovative coating technologies to enhance barrier properties and extend shelf life. Moreover, the growing trend towards e-commerce and online retailing presents an opportunity for flexible paper packaging manufacturers to develop packaging solutions optimized for shipping and handling, ensuring product integrity and consumer satisfaction.

Additionally, the expansion of the food and beverage industry, particularly in emerging markets, offers new avenues for market penetration and growth, as companies seek packaging solutions that offer superior protection and aesthetics for their products. By leveraging these opportunities and addressing the challenges through collaboration, innovation, and sustainability initiatives, stakeholders in the flexible paper packaging market can capitalize on market growth prospects and establish a competitive edge in the dynamic packaging industry.

Recent Developments

- The deal for Amcor plc to buy Gujarat, India-based Phoenix Flexibles, a producer of flexible packaging, was completed in 2023. Amcor already has four packaging plants in India, so this strategic acquisition would strengthen the company’s presence in the market and expand its capabilities there.

- Together with Unilever, Mondi developed a cutting-edge packaging solution in 2020 with the goal of advancing the circular economy. Their dedication to environmentally responsible packaging and sustainable packaging is demonstrated by their relationship.

Market Players

- Mondi Group

- Smurfit Kappa Group

- Amcor plc

- DS Smith Plc

- Tetra Pak International S.A.

- WestRock Company

- BillerudKorsnäs AB

- Sonoco Products Company

- UPM-Kymmene Corporation

- Nippon Paper Industries Co., Ltd.

- Georgia-Pacific LLC

- Huhtamaki Oyj

- Stora Enso Oyj

- KapStone Paper and Packaging Corporation

- International Paper Company

Segments Covered in the Report

By Material

- Plastic

- Paper

- Metal

- Bioplastics

- Others

By Product

- Pouches

- Bags

- Films & Wraps

- Others

By Application

- Food & Beverage

- Pharmaceutical

- Cosmetics

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/3422

Unlocking Market Insights through Data Excellence

The “Precedence Statistics” flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today’s dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit:

www.precedencestatistics.com