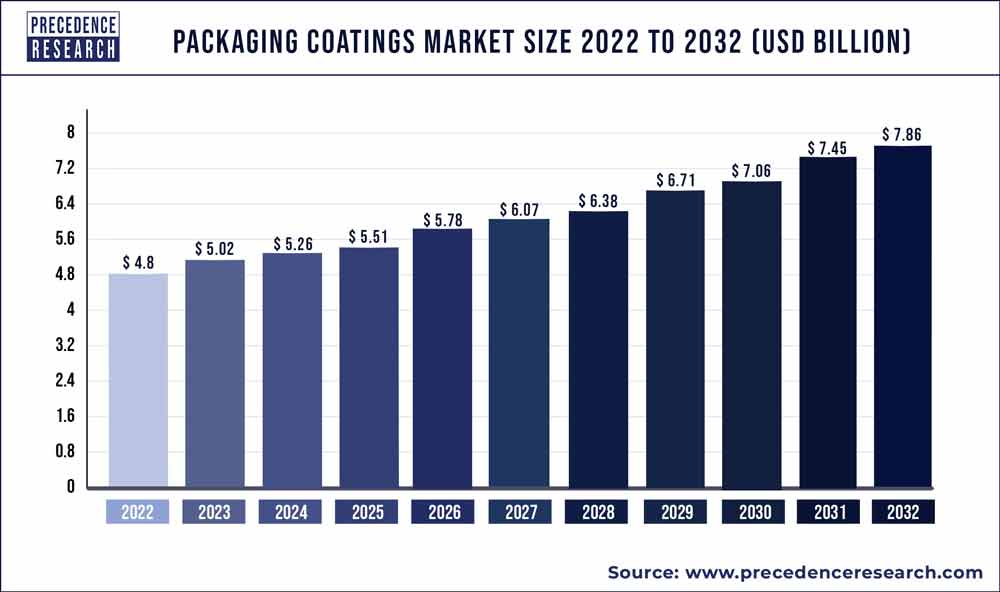

The global packaging coatings market size reached USD 4.8 billion in 2022 and is projected to hit around USD 7.86 billion by 2032, expanding at a CAGR of 5.1% from 2023 to 2032.

The packaging coatings market has experienced significant growth due to various factors. Packaging coatings are specialized materials applied to packaging surfaces to enhance their performance and appearance. With the increasing demand for functional and aesthetically pleasing packaging solutions across industries such as food and beverage, pharmaceuticals, cosmetics, and consumer goods, there has been a growing adoption of innovative coatings technologies. These coatings offer benefits such as protection against moisture, oxygen, light, and abrasion, as well as improved printability, adhesion, and barrier properties.

Moreover, advancements in coating formulations have led to the development of eco-friendly and sustainable coatings options that minimize environmental impact and meet regulatory standards for food safety and product sustainability. Additionally, the rise of e-commerce and online shopping trends has driven increased demand for packaging coatings that can withstand the rigors of shipping and handling while maintaining product integrity and presentation.

Key Takeaways

- In 2022, the beverage cans segment had a revenue share of almost 43% by application.

- During the projection period, promotional packaging is expected to rise at a notable CAGR of 7.8% by application.

- In terms of type, the epoxy thermoset sector had the highest market share in 2022—29%.

- Over the estimated period, the urethane segment is expected to increase at a spectacular CAGR by type.

- In 2022, the food and beverage industry had the highest revenue share (46.8%) among all end users.

- Over the forecast period, the consumer electronics segment is anticipated to increase at a noteworthy CAGR by end user.

Get a Sample: https://www.precedenceresearch.com/sample/3444

Packaging Coatings Market Scope

| Report Coverage | Details |

| Growth Rate from 2023 to 2032 | CAGR of 5.1% |

| Market Size in 2023 | USD 5.02 Billion |

| Market Size by 2032 | USD 7.86 Billion |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Application, By Type, and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Read More: Packaging Inks and Coatings Market Size to Hit USD 6.71 Billion by 2032

Market Dynamics

Driver:

The packaging coatings market is experiencing significant growth driven by several key factors. One of the primary drivers is the increasing demand for high-performance coatings to enhance the aesthetic appeal, functionality, and sustainability of packaging materials. Packaging coatings play a crucial role in protecting packaged goods from external factors such as moisture, UV radiation, and mechanical damage, thereby extending shelf life and preserving product quality.

Additionally, the growing emphasis on brand differentiation and consumer engagement is driving demand for coatings that offer unique finishes, textures, and effects, enabling brands to stand out on retail shelves and capture consumer attention. Moreover, advancements in coating technologies, such as water-based, UV-curable, and high-barrier coatings, are expanding the capabilities and applications of packaging coatings, driving market growth. Furthermore, the increasing focus on sustainability and environmental responsibility is fueling demand for eco-friendly coatings made from renewable, biodegradable, and recyclable materials, driving innovation and market expansion.

Restraint:

Despite its promising growth prospects, the packaging coatings market faces certain challenges that could hinder its progress. One significant restraint is the volatility in raw material prices, particularly for key components such as resins, pigments, and additives. Fluctuations in raw material costs can impact the production costs and profit margins for coating manufacturers, posing challenges for pricing strategies and profitability.

Additionally, stringent regulatory requirements and compliance standards for packaging materials and coatings can add complexity to the manufacturing process, leading to increased costs and longer lead times. Moreover, concerns over the environmental impact of coating formulations, including emissions of volatile organic compounds (VOCs) and hazardous substances, pose challenges for manufacturers in meeting regulatory requirements and addressing consumer preferences for eco-friendly packaging solutions.

Opportunity:

Despite the challenges, the packaging coatings market presents significant opportunities for innovation and growth. Manufacturers are increasingly focusing on developing sustainable and environmentally friendly coating formulations to address regulatory requirements and meet consumer preferences for eco-friendly packaging solutions. This includes the development of bio-based, low-VOC, and water-based coatings, as well as the adoption of innovative technologies such as UV-curable and high-barrier coatings to enhance performance and reduce environmental impact.

Moreover, the growing demand for flexible packaging solutions, driven by trends such as e-commerce and convenience, presents an opportunity for coating manufacturers to develop coatings optimized for flexible substrates such as films and pouches. Additionally, the expansion of the food and beverage industry, particularly in emerging markets, offers new avenues for market penetration and growth, as companies seek packaging coatings that offer superior protection and aesthetics for their products. By leveraging these opportunities and addressing the challenges through collaboration, innovation, and sustainability initiatives, stakeholders in the packaging coatings market can capitalize on market growth prospects and establish a competitive edge in the dynamic packaging industry.

Recent Developments

- PPG will begin providing electrocoating (e-coat) services for original equipment manufacturer (OEM) aviation parts in 2023 thanks to a partnership with Satys, a French industrial organization that specializes in sealing, painting, and surface treatment for aircraft.

- 2021 saw PPG successfully acquire the well-known Finnish paint and coatings manufacturer Tikkurila. Through this acquisition, PPG was able to expand its product line to include industrial coatings, decorative paints, and architectural coatings, strengthening its position in the Nordic region. It enhanced PPG’s standing in the coatings industry globally and put the business in a better position to provide clients in the Nordic region and beyond with a wider range of coatings solutions.

Market Players

- Akzo Nobel N.V.

- PPG Industries, Inc.

- Sherwin-Williams Company

- Axalta Coating Systems

- RPM International Inc.

- Kansai Paint Co., Ltd.

- Jotun Group

- Tikkurila Oyj

- Nippon Paint Holdings Co., Ltd.

- Altana AG

- Fujikura Kasei Co., Ltd.

- Toyo Ink SC Holdings Co., Ltd.

- Dymax Corporation

- Michelman, Inc.

- Follmann GmbH & Co. KG

Segments Covered in the Report

By Application

- Food Cans

- Beverage Cans

- Caps & Closures

- Aerosols & Tubes

- Industrial Packaging

- Promotional Packaging

- Specialty Packaging

By Type

- Epoxy Thermoset

- Urethane

- UV-Curable

- BPA Free

- Soft Touch UV-Curable & Urethane

By End User

- Food & Beverages

- Cosmetics

- Pharmaceuticals

- Consumer Electronics

- Automotive Components

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/3444

Unlocking Market Insights through Data Excellence

The “Precedence Statistics” flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today’s dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit:

www.precedencestatistics.com