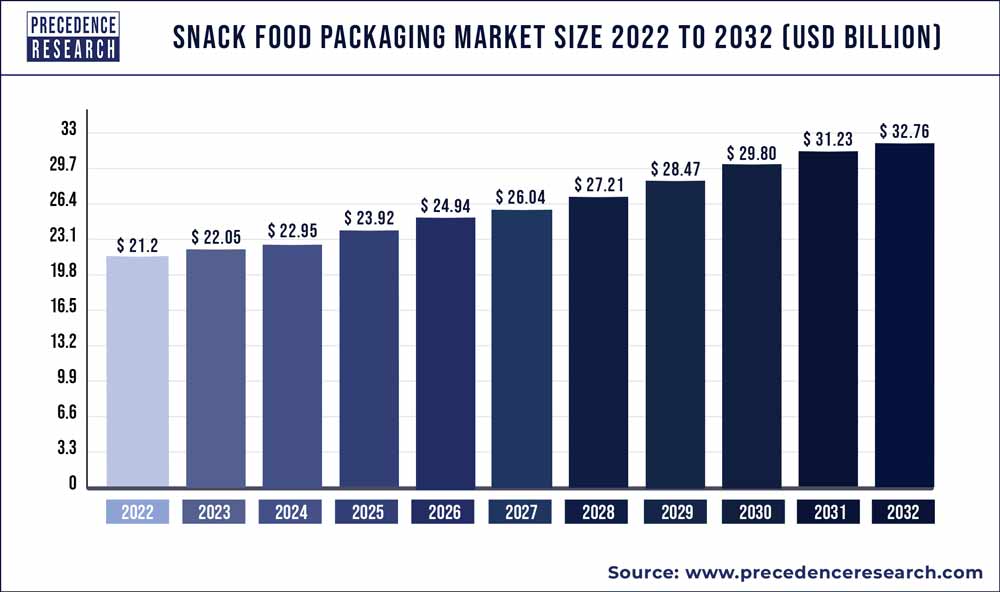

The globalsnack food packaging market size reached USD21.2 billion in 2022 and is projected to hit around USD 32.76 billion by 2032, expanding at a CAGR of 4.50% from 2023 to 2032.

The snack food packaging market has experienced significant growth due to various factors. Snack food packaging refers to the packaging solutions specifically designed to contain and preserve various types of snack foods, such as chips, pretzels, nuts, popcorn, and confectionery items. With the increasing demand for convenient, on-the-go snack options and the rising popularity of snacking occasions, there has been a growing adoption of innovative packaging solutions across the snack food industry. These packaging solutions offer benefits such as protection from moisture, oxygen, and light, as well as extended shelf life, freshness, and convenience for consumers. Moreover, advancements in packaging materials and technologies have led to the development of more sustainable and eco-friendly snack food packaging options, including recyclable plastics, compostable films, and bio-based packaging materials. Additionally, the rise of e-commerce and online grocery shopping trends has driven increased demand for snack food packaging solutions that are durable, tamper-resistant, and compatible with automated packaging processes.

Key Takeaways

- In 2022, the pouches and bags category of Packaging accounted for about 38% of total sales.

- Over the projected period, the packaging segment with the fastest compound annual growth rate (CAGR) is predicted to be boxes.

- In 2022, the plastic sector held the highest market share of approximately 41% based on material.

- From 2023 to 2032, the glass segment is expected to grow at the quickest compound annual growth rate (CAGR) among all segments.

- Wafers had the largest revenue share by application in 2022, accounting for 46.8% of total sales.

- It is projected that the food industry will increase significantly by application.

Get a Sample: https://www.precedenceresearch.com/sample/3447

Snack Food Packaging Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 22.05 Billion |

| Market Size by 2032 | USD 32.76 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 4.50% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Packaging, By Material, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Read More: Paper and Paperboard Packaging Market Size to Hit USD 670.38 Billion by 2032

Market Dynamics

Driver:

The snack food packaging market is being propelled by several key factors contributing to its growth trajectory. One of the primary drivers is the evolving consumer preferences and lifestyles. With an increasing number of consumers leading busy lives, there is a rising demand for convenient, portable, and on-the-go snack options. This demand has led to the proliferation of snack food products packaged in convenient formats such as single-serve pouches, resealable bags, and grab-and-go containers, driving the growth of the snack food packaging market. Additionally, the expanding variety of snack food offerings, including healthier options like fruit and nut mixes, as well as indulgent treats like chips and chocolates, is further fueling demand for diverse and innovative packaging solutions. Furthermore, the influence of social media and online food trends is driving packaging innovation as brands seek to create visually appealing and Instagram-worthy packaging designs to attract consumers.

Restraint:

Despite the promising growth, the snack food packaging market encounters certain challenges that could impede its progress. One significant restraint is the increasing scrutiny and pressure to address environmental concerns associated with packaging waste. While convenience is paramount for snack food packaging, the extensive use of single-use plastics raises concerns about sustainability and environmental impact. This has prompted regulatory bodies, consumers, and advocacy groups to push for more sustainable packaging alternatives, posing a challenge for manufacturers in the snack food industry to balance convenience with environmental responsibility. Additionally, fluctuating raw material prices and supply chain disruptions can impact packaging costs, affecting profit margins for snack food companies. Moreover, stringent regulations regarding food safety and labeling requirements add complexity to packaging design and production, potentially slowing down innovation and time-to-market for new products.

Opportunity:

Despite the challenges, the snack food packaging market offers ample opportunities for growth and innovation. One significant opportunity lies in the development of sustainable packaging solutions that address environmental concerns while maintaining product freshness and convenience. This includes the use of recyclable materials, lightweighting, and adopting circular economy principles to minimize packaging waste. Moreover, advancements in packaging technologies such as modified atmosphere packaging and active packaging systems present opportunities to extend the shelf life of snack foods, reducing food waste and enhancing product quality. Furthermore, the growing trend towards online shopping and e-commerce provides an opportunity for snack food brands to invest in packaging designs optimized for shipping and handling, ensuring product integrity and consumer satisfaction. By embracing sustainability, leveraging technology, and staying attuned to evolving consumer preferences, stakeholders in the snack food packaging market can navigate challenges and unlock new avenues for growth and differentiation in an increasingly competitive landscape.

Recent Developments

- Nestlé and Danimer Scientific collaborated in 2019 to develop a water bottle that degrades naturally. In an effort to promote environmentally friendly packaging options in the market, they will create bio-based resins for Nestlé’s water division using Danimer’s PHA polymer NodaxTM.

- With the successful US$6.8 billion acquisition of Bemis in 2019, Amcor cemented its leadership position in the global packaging sector and built a powerful packaging powerhouse that provides a wide range of packaging solutions globally.

Market Players

- Amcor Limited

- Berry Global Group, Inc.

- Mondi Group

- Sealed Air Corporation

- Sonoco Products Company

- Huhtamaki Group

- Bemis Company, Inc. (now part of Amcor)

- WestRock Company

- Constantia Flexibles Group

- ProAmpac Holdings, Inc.

- Winpak Ltd.

- Printpack, Inc.

- Ball Corporation

- Tetra Pak International S.A.

- DS Smith plc

Segments Covered in the Report

By Packaging

- Pouches & Bags

- Boxes

- Composite Cans

- Others

By Material

- Plastic

- Paper

- Metal

- Glass

- Others

By Application

- Wafers

- Nuts & Dry Fruits

- Baby Food

- Ready-to-Eat Food

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/3447

Unlocking Market Insights through Data Excellence

The “Precedence Statistics” flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today’s dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit:

www.precedencestatistics.com