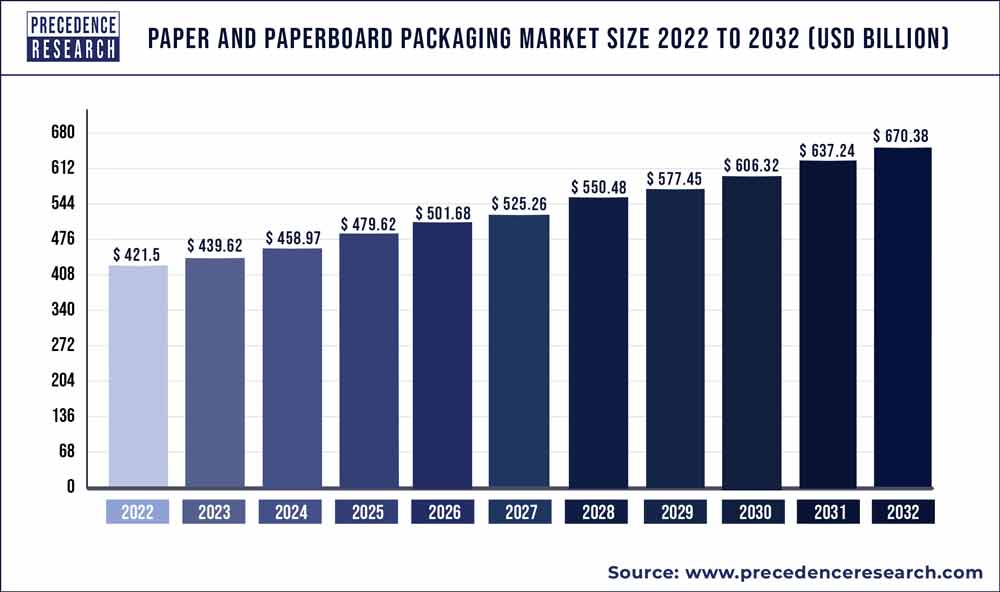

The global paper and paperboard packaging market size was valued at USD 421.5 billion in 2022 and is expected to hit around USD 670.38 billion by 2032, growing at a CAGR of 4.80% from 2023 to 2032.

The paper and paperboard packaging market has witnessed significant growth due to various factors. Paper and paperboard packaging refer to packaging solutions made from paper or paperboard materials, which are versatile, lightweight, recyclable, and biodegradable. With increasing concerns about environmental sustainability and the need to reduce plastic waste, there has been a growing demand for paper and paperboard packaging across industries such as food and beverage, pharmaceuticals, personal care, and consumer goods. These packaging solutions offer benefits such as affordability, versatility, and compatibility with various printing and finishing techniques for branding and product differentiation. Moreover, advancements in paper and paperboard manufacturing technology have led to the development of more sustainable and eco-friendly packaging options, including recycled paper and paperboard materials, as well as responsibly sourced and certified paper products. Additionally, the rise of e-commerce and online shopping trends has driven increased demand for paper and paperboard packaging solutions that can withstand the rigors of shipping and handling while protecting products during transit.

Key Takeaways

- In terms of product type, the paper and paperboard packaging market in 2022 was dominated by the folding cartons segment, which accounted for 53% of the market.

- Over the forecast period, the corrugated boxes segment is anticipated to rise at a noteworthy CAGR of 7.1% by product type.

- In 2022, the food and beverage segment held the highest market share, accounting for 69% of all end users.

- During the forecast period, the personal care category is expected to increase at a spectacular CAGR by end-user.

Get a Sample: https://www.precedenceresearch.com/sample/3474

Paper and Paperboard Packaging Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 439.62 Billion |

| Market Size by 2032 | USD 670.38 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 4.80% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Product Type and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Read More: PCR Plastic Packaging Market Size to Surpass USD 47.48 Billion By 2033

Market Dynamics

Driver:

The paper and paperboard packaging market is experiencing robust growth driven by several key factors. One of the primary drivers is the increasing emphasis on sustainability and environmental consciousness across various industries. Paper and paperboard packaging materials are renewable, recyclable, and biodegradable, making them an attractive choice for eco-conscious consumers and businesses looking to reduce their carbon footprint. Additionally, stringent regulations and initiatives aimed at reducing plastic usage and promoting sustainable packaging practices are further driving the adoption of paper and paperboard packaging solutions. Moreover, advancements in papermaking technologies and packaging design capabilities are enhancing the performance, versatility, and appeal of paper and paperboard packaging, thus expanding their applications across a wide range of end-use industries such as food and beverage, healthcare, cosmetics, and consumer goods.

Restraint:

Despite its widespread adoption, the paper and paperboard packaging market face certain challenges that could impede its growth trajectory. One significant restraint is the competition from alternative packaging materials such as plastics, metals, and glass. While paper and paperboard offer eco-friendly advantages, they may not always meet the specific requirements for certain packaging applications, particularly those demanding high barrier properties, moisture resistance, or durability. Additionally, fluctuations in raw material prices, particularly pulp and paperboard, can impact the production costs and profit margins for manufacturers of paper and paperboard packaging. Moreover, concerns over deforestation, water usage, and emissions associated with paper production may raise sustainability concerns among stakeholders and consumers, potentially affecting market demand.

Opportunity:

Despite the challenges, the paper and paperboard packaging market presents significant opportunities for innovation and growth. Manufacturers are increasingly investing in research and development to develop advanced paper and paperboard packaging solutions that offer enhanced performance, functionality, and sustainability. This includes the development of bio-based and recycled paperboard materials, as well as innovative coating and laminating technologies to improve barrier properties and moisture resistance. Moreover, the growing trend towards e-commerce and online retailing is driving demand for sustainable and cost-effective packaging solutions, providing an opportunity for paper and paperboard packaging to capture a larger share of the packaging market. Additionally, initiatives aimed at promoting circular economy principles and increasing recycling rates present opportunities for stakeholders to develop closed-loop packaging systems and improve the recyclability and sustainability of paper and paperboard packaging products. By leveraging these opportunities and addressing the challenges through collaboration, innovation, and sustainable practices, stakeholders in the paper and paperboard packaging market can capitalize on market growth prospects while contributing to a more sustainable and circular packaging ecosystem.

Recent Developments

- For USD 970 million plus debt assumption, WestRock Company successfully purchased Grupo Gondi’s remaining shareholding in 2022. Four paper mills, nine corrugated packaging facilities, and six high-end graphic factories in Mexico are all part of the deal. This enhances WestRock’s standing in the growing consumer products, paperboard, containerboard, and corrugated packaging sectors in Latin America.

- To form Mondi Turkey Oluklu Mukavva, Mondi completed the merger of Mondi Tire Kutsan and Mondi Olmuksan in 2022. Operating nine corrugated packaging factories, a containerboard mill in Tire, Turkey, and a wastepaper collection facility in Adana, Turkey, this new entity is a part of Mondi’s corrugated packaging industry. Mondi Turkey Oluklu Mukavva, which is listed on the Istanbul Stock Exchange (BIST) and has 1,600 employees, is owned by Mondi to the tune of 84.65%.

Market Players

- International Paper Company

- WestRock Company

- Smurfit Kappa Group

- Mondi Group

- DS Smith Plc

- Georgia-Pacific LLC

- Tetra Pak International S.A.

- Amcor plc

- Sonoco Products Company

- Sealed Air Corporation

- Huhtamaki Oyj

- Cascades Inc.

- Graphic Packaging Holding Company

- BillerudKorsnäs AB

- Mayr-Melnhof Karton AG

Segments Covered in the Report

By Product Type

- Folding Cartons

- Corrugated Boxes

- Others

By End-user

- Food

- Beverage

- Healthcare

- Personal Care

- Electrical

- Other

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/3474

Unlocking Market Insights through Data Excellence

The “Precedence Statistics” flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today’s dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit:

www.precedencestatistics.com