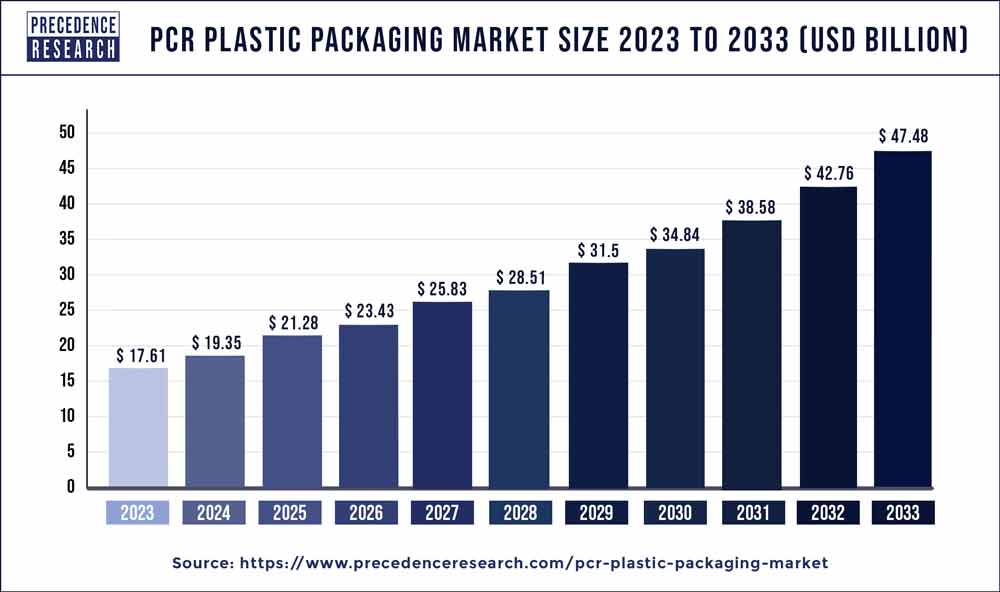

The global PCR plastic packaging market size was valued at USD 17.61 billion in 2023 and is expected to hit around USD 47.48 billion by 2033, growing at a CAGR of 10.49% from 2024 to 2033.

The PCR plastic packaging market has experienced significant growth due to various factors. PCR, or post-consumer recycled, plastic packaging refers to packaging materials made from recycled plastic that has been collected from consumers and processed for reuse. With increasing awareness of environmental sustainability and the need to reduce plastic waste, there has been a growing demand for PCR plastic packaging solutions across industries such as food and beverage, personal care, and household products. These solutions offer benefits such as reduced environmental impact, conservation of natural resources, and support for circular economy initiatives. Moreover, advancements in recycling technologies and improvements in collection and sorting systems have led to increased availability and quality of PCR plastic materials, further driving the adoption of PCR plastic packaging. Additionally, the rise of regulations and initiatives aimed at reducing single-use plastics and promoting recycling has spurred companies to incorporate PCR plastic packaging into their product lines.

Key Takeaways

- In terms of material, the PET category accounted for 33% of the total share in 2023.

- Regarding Material, during the estimated period of time, the PVC sector is anticipated to rise at a noteworthy CAGR.

- In terms of product, the bottle segment had the biggest share in 2023 (42.78%).

- The food and beverage sector held the highest share of 57.18% in the PCR plastic packaging market by end-user in 2023.

- Over the estimated period, the end-user cosmetics segment is anticipated to increase at a notable compound annual growth rate (CAGR).

Get a Sample: https://www.precedenceresearch.com/sample/3476

PCR Plastic Packaging Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 10.49% |

| Market Size in 2023 | USD 17.61 Billion |

| Market Size by 2033 | USD 47.48 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Material, By Product, and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Read More: Plastic Corrugated Packaging Market Size to Hit USD 37.81 Billion by 2033

Market Dynamics

Driver:

The PCR (Post-Consumer Recycled) plastic packaging market is experiencing significant growth driven by several key factors. One of the primary drivers is the growing awareness and emphasis on sustainability across various industries. As companies strive to reduce their environmental footprint and meet sustainability goals, there is an increasing demand for packaging solutions made from recycled materials. PCR plastic packaging offers a sustainable alternative to traditional plastic packaging by utilizing post-consumer recycled materials, thereby reducing the reliance on virgin plastics and minimizing waste generation.

Additionally, stringent regulations and initiatives aimed at promoting recycling and circular economy principles are further driving the adoption of PCR plastic packaging among manufacturers and brand owners. Moreover, consumer preferences for eco-friendly products and packaging are driving market growth as more individuals seek out environmentally responsible choices, thus fueling demand for PCR plastic packaging solutions.

Restraint:

Despite the growing momentum towards sustainability, the PCR plastic packaging market faces certain challenges that could hinder its growth trajectory. One significant restraint is the limited availability and quality of post-consumer recycled materials. Obtaining high-quality PCR resin suitable for packaging applications can be challenging due to variability in material composition, contamination issues, and limited collection and recycling infrastructure in certain regions. This can result in supply chain disruptions and higher production costs for manufacturers of PCR plastic packaging.

Additionally, concerns over the performance and safety of PCR plastic packaging compared to traditional virgin plastics may deter some companies from adopting PCR solutions, especially in industries with stringent regulatory requirements or specific packaging performance criteria.

Opportunity:

Despite the challenges, the PCR plastic packaging market presents significant opportunities for innovation and growth. Efforts to improve recycling infrastructure, increase collection rates, and enhance material sorting and processing technologies are expanding the availability and quality of post-consumer recycled materials, thereby addressing supply chain challenges and supporting market growth. Moreover, advancements in recycling and manufacturing technologies are enabling the production of high-performance PCR plastic packaging that meets or exceeds the performance standards of virgin plastics, further driving adoption across various industries.

Additionally, the growing consumer demand for sustainable products and packaging presents an opportunity for companies to differentiate their brands and gain a competitive edge by offering PCR plastic packaging solutions. By leveraging these opportunities and addressing the challenges through collaboration, innovation, and investment in sustainable practices, stakeholders in the PCR plastic packaging market can contribute to a more circular and environmentally responsible packaging ecosystem while capitalizing on market growth prospects.

Recent Developments

- In 2022, a transparent personal care bottle made completely of 100% post-consumer recycled plastic (PCR) was successfully constructed by the Design4Circularity initiative, which is made up of Clariant, Siegwerk, Borealis, and Beiersdorf. A printed drinkable complete body shrink sleeve is incorporated into this creative bottle design to provide unique branding and product differentiation. The personal care industry is working together to create circular packaging solutions that carefully take into account each step of the production process. This initiative’s main goals are to promote sustainable packaging through cutting down on plastic waste, lowering the need for virgin plastic resources, and lessening the environmental damage caused by the production of plastic.

Market Players

- Berry Global Group, Inc.

- Amcor Limited

- Plastipak Holdings, Inc.

- Sealed Air Corporation

- Mondi Group

- Sonoco Products Company

- Huhtamäki Oyj

- DS Smith Plc

- Winpak Ltd.

- Silgan Holdings Inc.

- Coveris Holdings S.A.

- Printpack, Inc.

- Greif, Inc.

- Constantia Flexibles Group GmbH

- ProAmpac Holdings, Inc.

Segments Covered in the Report

By Material

- PET

- PE

- PVC

- PP

- PS

By Product

- Bottles

- Trays

- Pouches

By End User

- Food, Beverage

- Healthcare

- Cosmetics

- Industrial

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/3476

Unlocking Market Insights through Data Excellence

The “Precedence Statistics” flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today’s dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit:

www.precedencestatistics.com