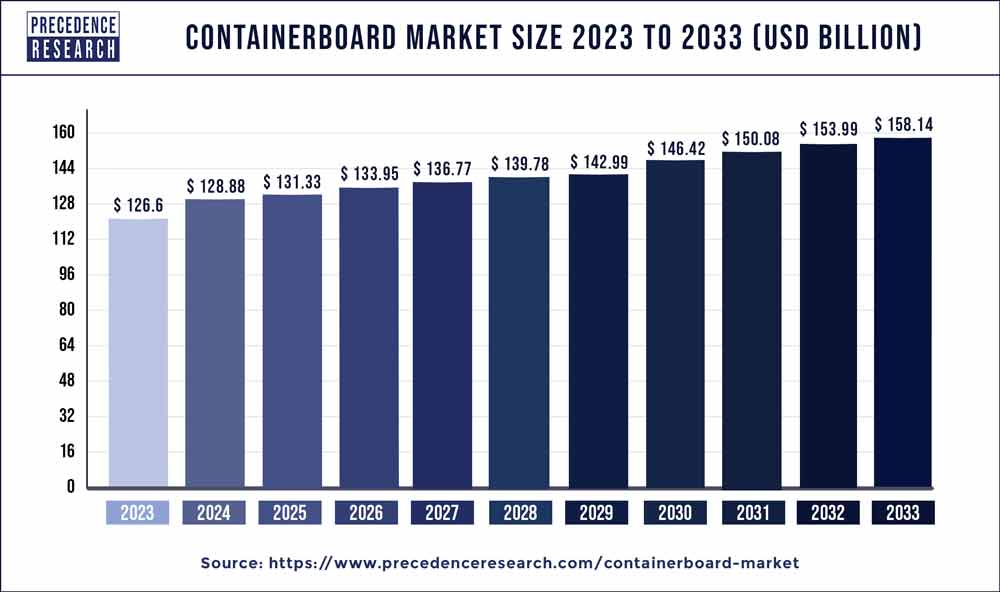

The global containerboard market size surpassed USD 126.6 billion in 2023 and is expected to hit around USD 158.14 billion by 2033, poised to grow at a CAGR of 2.30% from 2024 to 2033.

The containerboard market has experienced significant growth due to various factors. Containerboard refers to the paperboard material used to manufacture corrugated boxes and packaging containers. With the increasing demand for sustainable and cost-effective packaging solutions across industries such as e-commerce, food and beverage, consumer goods, and electronics, there has been a growing adoption of containerboard for packaging applications. Containerboard offers benefits such as strength, durability, versatility, and recyclability, making it an ideal choice for protecting and transporting a wide range of products.

Moreover, advancements in containerboard manufacturing technology and processes have led to the development of lighter-weight yet stronger materials, improving efficiency and reducing environmental impact. Additionally, the rise of e-commerce and online shopping trends has driven increased demand for corrugated packaging solutions, further boosting the containerboard market.

Key Takeaways

- The food and beverage category has the most market share, accounting for 32% of all end uses in 2023.

- The personal care and cosmetics end-use market is projected to expand at an impressive compound annual growth rate (CAGR) of 3.9% from 2024 to 2034.

- In 2023, the recycled material category accounted for approximately 56.45% of the market share.

- Over the estimated period, the virgin category is anticipated to grow at the fastest CAGR by material.

Containerboard Market Scope

| Report Coverage | Details |

| Global Market Size in 2023 | USD 126.6 Billion |

| Global Market Size by 2033 | USD 158.14 Billion |

| Asia Pacific Market Size in 2023 | USD 62.03 Billion |

| Asia Pacific Market Size by 2033 | USD 77.49 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By End-use and By Material |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Read More: Packaging Testing Market Size to Worth USD 30.65 Bn by 2033

Market Dynamics

Driver:

The containerboard market is experiencing steady growth driven by several key factors. One significant driver is the increasing demand for sustainable packaging solutions across various industries, including e-commerce, food and beverage, electronics, and consumer goods. Containerboard, with its versatility and recyclability, is being increasingly preferred by manufacturers and consumers alike as an environmentally friendly alternative to traditional packaging materials such as plastic and foam. Additionally, the growth of online retail and the rise of direct-to-consumer distribution channels have led to a surge in demand for corrugated packaging made from containerboard, as it offers superior protection and durability during transit. As a result, containerboard manufacturers are expanding their production capacities and investing in advanced technologies to meet the growing demand for sustainable packaging solutions.

Restraint:

Despite the growth opportunities, the containerboard market faces certain restraints that may hinder its full potential. One such restraint is the volatility of raw material prices, particularly for recycled fiber and pulp, which are key components of containerboard production. Fluctuations in raw material costs can impact profit margins for manufacturers and result in pricing pressures throughout the supply chain. Moreover, the capital-intensive nature of containerboard production requires significant investments in machinery, equipment, and infrastructure, posing barriers to entry for new market players and limiting market competitiveness. Overcoming these restraints necessitates proactive supply chain management strategies, including sourcing diversification and cost optimization, to mitigate the impact of raw material price fluctuations and ensure long-term sustainability and profitability for containerboard manufacturers.

Opportunity:

The containerboard market presents significant opportunities for growth and innovation driven by evolving consumer preferences and technological advancements. With increasing awareness about the environmental impact of packaging materials, there is a growing demand for sustainable packaging solutions that prioritize recyclability, biodegradability, and reduced carbon footprint. Containerboard manufacturers can capitalize on this trend by investing in research and development to develop innovative packaging designs and materials that meet sustainability goals while maintaining performance and cost-effectiveness. Furthermore, the adoption of digital printing technologies and customization capabilities allows containerboard manufacturers to offer personalized packaging solutions tailored to the unique branding and marketing requirements of their customers. By leveraging these opportunities and embracing sustainable and customer-centric approaches, containerboard manufacturers can strengthen their market position and drive continued growth in the packaging industry.

Recent Developments

- August 2021 saw the successful acquisition of a 75% share by SCGP (Siam Cement Group Packaging) in Intan Group, one of Indonesia’s top producers of corrugated containers. With the goal of strengthening its position in the ASEAN market and offering a wide variety of upstream to downstream manufacturing, supply chain, and packaging development services, SCGP made this calculated strategic move.

- Global packaging and paper manufacturer Mondi purchased a sizeable 90.38% share in Olmuksan International Paper Ambalaj Sanayi ve Ticaret A.Åž from International Paper in January 2021. This acquisition, which came with a total consideration of USD 74.9 million, puts Mondi in a better position to improve operations and take advantage of paper integration prospects by utilizing its global portfolio of virgin and recycled paper goods and its expertise.

Containerboard Market Players

- International Paper Company

- WestRock Company

- Smurfit Kappa Group

- Mondi Group

- DS Smith Plc

- Nine Dragons Paper Holdings Limited

- Georgia-Pacific LLC

- Oji Holdings Corporation

- Lee & Man Paper Manufacturing Ltd.

- Packaging Corporation of America

- Svenska Cellulosa AB (SCA)

- Rengo Co., Ltd.

- Pratt Industries, Inc.

- Siam Cement Group Packaging (SCGP)

- KapStone Paper and Packaging Corporation

Segments Covered in the Report

By End-use

- Food & Beverage

- Personal Care & Cosmetics

- Industrial

- Others

By Material

- Virgin

- Recycled

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/3667

Unlocking Market Insights through Data Excellence

The “Precedence Statistics” flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today’s dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit:

www.precedencestatistics.com