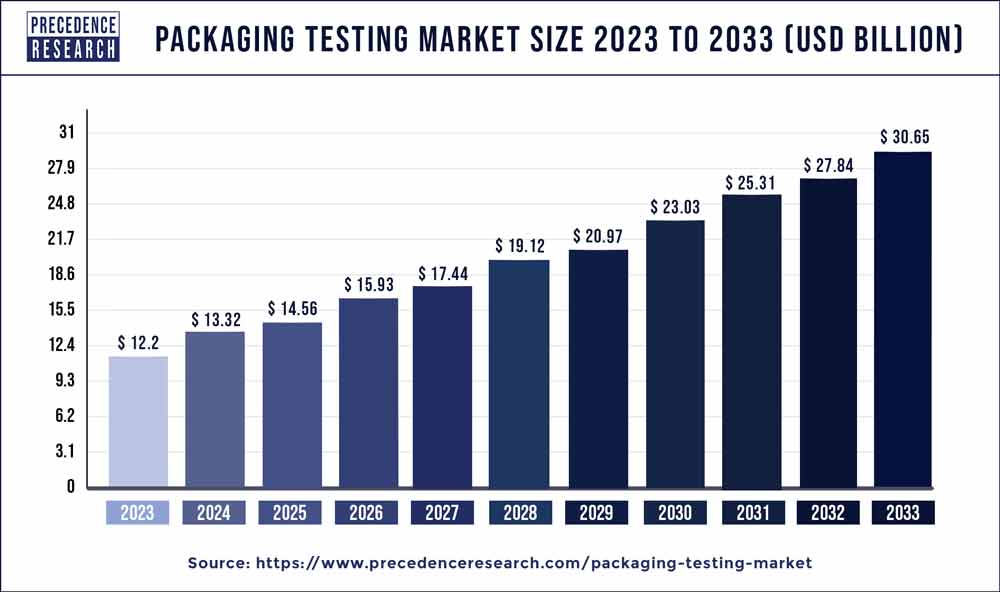

The global packaging testing market size reached USD 12.2 billion in 2023 and is projected to hit around USD 30.65 billion by 2033, expanding at a CAGR of 9.70% from 2024 to 2033.

The packaging testing market has experienced notable growth due to various factors. Packaging testing involves the evaluation and analysis of packaging materials and systems to ensure their compliance with regulatory standards, quality requirements, and performance specifications. With the increasing emphasis on product safety, sustainability, and consumer satisfaction, there has been a growing demand for comprehensive packaging testing services across industries such as food and beverage, pharmaceuticals, cosmetics, and consumer goods. These services encompass a wide range of testing methodologies, including mechanical testing, material testing, chemical analysis, microbiological testing, and performance testing, to assess factors such as strength, durability, barrier properties, shelf life, and product compatibility.

Moreover, advancements in testing technologies and equipment have enabled testing laboratories to offer more accurate, efficient, and reliable testing solutions that meet the evolving needs of manufacturers and regulatory agencies. Additionally, the globalization of supply chains and the proliferation of e-commerce platforms have driven increased demand for packaging testing services that ensure compliance with international standards and regulations.

Key Takeaways

- In terms of type, the chemical segment held the lion’s share of the market in 2023.

- According to type, it is anticipated that during the forecast period, the physical sector will experience a considerable share.

- In terms of material type, the packaging testing market was dominated by the plastic segment in 2023.

- During the forecast period, the paper and paperboard segment is anticipated to increase at the quickest rate among all material types.

- In terms of end users, the food and beverage category commanded the lion’s share of the market in 2023.

- The chemical and fertilizers segment is anticipated to increase at a significant rate by end-user.

Get a Sample: https://www.precedenceresearch.com/sample/3793

Market Dynamics

Driver:

The packaging testing market is experiencing robust growth driven by several key factors. One significant driver is the increasing emphasis on product safety, quality, and regulatory compliance across various industries, including food and beverage, pharmaceuticals, cosmetics, and consumer goods. With stringent regulations and standards governing packaging materials and performance, manufacturers are increasingly investing in comprehensive testing protocols to ensure the integrity and efficacy of their packaging solutions.

Additionally, the rise of e-commerce and global supply chains has heightened the need for packaging testing services to assess durability, transit stability, and environmental impact, further fueling market demand. As a result, packaging testing companies are witnessing growing opportunities to offer a wide range of testing services, including material analysis, performance testing, and regulatory compliance assessments, to meet the evolving needs of manufacturers and consumers.

Restraint:

Despite the growing demand for packaging testing services, the market faces certain restraints that may pose challenges to its growth. One such constraint is the cost associated with conducting comprehensive packaging testing, which can be prohibitive for small and medium-sized enterprises (SMEs) with limited budgets.

Additionally, the lack of standardized testing procedures and methodologies across different regions and industries may lead to inconsistencies in testing results and interpretations, impacting the reliability and comparability of test data. Overcoming these restraints requires packaging testing companies to innovate cost-effective testing solutions and collaborate with industry stakeholders to develop harmonized testing standards and protocols. Moreover, educating manufacturers about the importance of packaging testing in ensuring product safety and quality can help mitigate concerns about testing costs and foster greater adoption of testing services.

Opportunity:

The packaging testing market presents significant opportunities for growth and innovation driven by emerging trends and technological advancements. With the increasing focus on sustainability and environmental responsibility, there is a growing demand for testing services that assess the recyclability, biodegradability, and eco-friendliness of packaging materials and designs.

Moreover, the advent of new packaging technologies such as smart packaging and active packaging requires specialized testing methodologies to evaluate their functionality and performance. By diversifying their service offerings and investing in state-of-the-art testing equipment and expertise, packaging testing companies can capitalize on these opportunities and position themselves as trusted partners in ensuring the safety, quality, and sustainability of packaging solutions across industries.

Read More: Halal Packaging Market Size to Worth USD 541.56 Bn by 2033

Recent Developments

- Leading supplier of packaging testing, safety, and compliance solutions, QIMA was purchased by Intertek in March 2022. Intertek’s TIC capabilities are enhanced by the acquisition.

- To guarantee the quality and safety of medical packaging, Intertek introduced Protek healthcare packaging testing in March 2022. Both medication efficacy and patient safety are enhanced by the new testing. London, England serves as the headquarters of the global assurance, inspection, product testing, and certification business Intertek Group plc. It is a component of the FTSE 100 Index and is listed on the London Stock Exchange.

Packaging Testing Market Players

- Intertek Group PLC

- Eurofins Scientific SE

- SGS SA

- Bureau Veritas SA

- TUV SUD AG

- Campden BRI

- IFP Institute for Product Quality GmbH

- DDL Inc. (Integreon Global)

- Turner Packaging Limited

- Nefab Group

- ALS Limited

- TUV SUD AG

- Microbac Laboratories Inc.

- National Technical Systems Inc.

- EMSL Analytical Inc

- Krones AG

- Qualitest International Inc.

- L.A.B. Equipment Inc.

- Marchesini Group S.p.A.

- Coesia S.p.A.

- AMETEK Inc.

- PackTest Machines Inc.

Segments Covered in the Report

By Type

- Physical

- Chemical

- Microbiological

By Material Type

- Plastic

- Paper and Paperboard

- Glass

- Metal

- Wood

- Others

By End-user Industry

- Food & Beverage

- Industrial

- Automotive

- Healthcare

- Chemical and Fertilizers

- Personal Care and Cosmetic

- Electrical and Electronics

- Other end-user industries

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/3793

Unlocking Market Insights through Data Excellence

The “Precedence Statistics” flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today’s dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit:

www.precedencestatistics.com