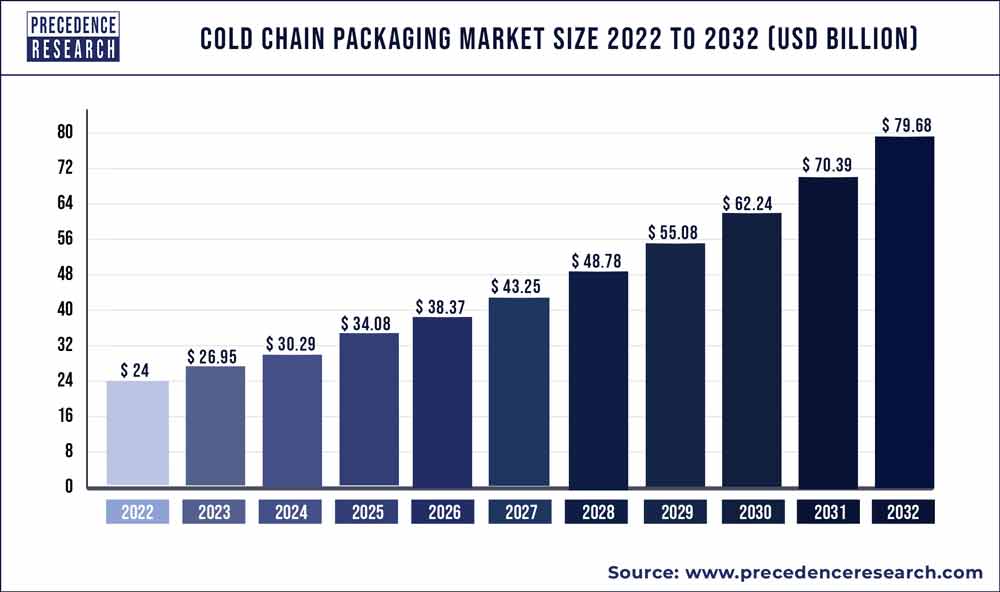

The global cold chain packaging market size reached USD 26.95 billion in 2023 and is projected to hit around USD 79.68 billion by 2032, expanding at a CAGR of 12.80% from 2023 to 2032.

The cold chain packaging market has witnessed substantial growth driven by various factors. Cold chain packaging refers to specialized packaging solutions designed to maintain the integrity and quality of temperature-sensitive products throughout the supply chain, particularly those requiring refrigeration or freezing conditions. With the increasing globalization of supply chains and the growing demand for perishable goods such as food, pharmaceuticals, and biologics, there has been a rising need for efficient and reliable cold chain packaging solutions. These solutions help preserve the freshness, efficacy, and safety of products during storage, transportation, and distribution, thereby minimizing the risk of spoilage, contamination, and product loss.

Moreover, advancements in packaging materials, insulation technologies, and temperature-monitoring devices have improved the performance and efficiency of cold chain packaging, enabling longer transit times and wider distribution networks for perishable products. Additionally, regulatory requirements and quality standards in industries such as food and pharmaceuticals have further driven the adoption of cold chain packaging solutions to ensure compliance with safety and quality regulations.

Furthermore, the COVID-19 pandemic has heightened the importance of cold chain logistics, particularly for the distribution of vaccines and other medical supplies, driving increased investment in cold chain infrastructure and packaging solutions. As industries continue to prioritize product integrity, safety, and sustainability in their supply chain operations, the cold chain packaging market is expected to witness sustained growth, offering opportunities for innovation and collaboration in packaging technologies and solutions.

Key Takeaways

- From 2023 to 2032, the cold pack market is projected to expand at a compound annual growth rate (CAGR) of 22%.

- Fruits and vegetables are expected to expand at a compound annual growth rate (CAGR) of 21% between 2023 and 2032.

- In 2023–2032, the processed food market is expected to grow at a compound annual growth rate of 21.5%.

Get a Sample: https://www.precedenceresearch.com/sample/1618

Report Scope of the Cold Chain Packaging Market

| Report Coverage | Details |

| Market Size by 2032 | USD 79.68 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 12.80% |

| North America Market Share in 2022 | 35% |

| Insulating Materials Market Share in 2022 | 66% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Product, Material, Application, Packaging Format, Geography |

Read More: Aseptic Processing Market to Worth USD 128.68 Bn by 2032

Cold Chain Packaging Market Dynamics

Driver:

Growing Demand for Temperature-Sensitive Products: The cold chain packaging market is driven by the increasing demand for temperature-sensitive products, such as pharmaceuticals, vaccines, perishable foods, and biologics. As global trade and e-commerce continue to expand, there is a growing need to maintain the integrity and safety of these products throughout the supply chain. Cold chain packaging solutions, including insulated containers, refrigerated trucks, and temperature-monitoring devices, play a crucial role in preserving product quality and efficacy during storage and transportation. This market driver is fueled by advancements in biotechnology, healthcare, and food industries, as well as stringent regulatory requirements for product safety and efficacy.

Restraint:

Complex Logistics and Regulatory Compliance Challenges: A significant restraint in the cold chain packaging market is the complexity of logistics and regulatory compliance challenges associated with maintaining temperature-controlled environments throughout the supply chain. Cold chain logistics involve multiple stakeholders, including manufacturers, distributors, logistics providers, and regulatory authorities, each with their own set of requirements and standards. Ensuring compliance with temperature regulations, maintaining product integrity during transit, and addressing issues such as temperature excursions and product recalls can pose significant challenges for stakeholders. Additionally, the high costs associated with cold chain infrastructure, including refrigeration systems and temperature-monitoring technologies, can further hinder market growth.

Opportunity:

Expansion in Emerging Markets and E-commerce: Emerging markets and the rapid growth of e-commerce present significant opportunities for the cold chain packaging market. As economies develop and consumer purchasing power increases, there is a growing demand for temperature-sensitive products in regions such as Asia-Pacific, Latin America, and Africa. Additionally, the proliferation of online shopping platforms and direct-to-consumer delivery models is driving the need for reliable cold chain logistics solutions to ensure product quality and safety during last-mile delivery. By expanding their presence in emerging markets and leveraging e-commerce channels, cold chain packaging companies can capitalize on these opportunities and drive market growth.

Recent Developments

- Automated Packaging Systems, Inc., a well-known provider of automated bagging systems, was fully acquired by Sealed Air in May 2019. The goal of this acquisition was to increase Sealed Air’s offering in the protective packaging market.

- Softbox Systems successfully acquired TP3 Global in January 2018, enhancing its market standing and diversifying its range of offerings.

Cold Chain Packaging Market Players

- Cascades Inc.

- Cold Chain Technologies

- Creopack

- Cryopak A TCP Company

- Intelsius

- Pelican Products, Inc.

- Softbox

- Sofrigam

- Sonoco ThermoSafs

- va-Q-tec

Segments Covered in the Report

By Product

- Insulated Container and Boxes

- Large

- Medium

- Small

- X-Small

- Petite

- Cold Packs

- Crates

- Dairy

- Pharmaceutical

- Fisheries

- Horticulture

- Temperature Controlled Pallet Shippers

- Labels

By Material

- Insulating Materials

- Expanded Polystyrene (EPS)

- Polyurethane rigid foam (PUR)

- Vacuum Insulated Panel (VIP)

- Cryogenic Tanks

- Others

- Refrigerants

- Fluorocarbons

- Hydrocarbon

- Inorganics

By Application

- Dairy Products

- Milk

- Butter

- Cheese

- Ice Cream

- Fruit and Pulp Concentrates

- Fish, Seafood, and Meat

- Processed Food

- Fruits and Vegetables

- Bakery and Confectioneries

- Pharmaceuticals

- Vaccines

- Blood Banking

- Others

By Packaging Format

- Reusable Packaging

- Disposable Packaging

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1618

Unlocking Market Insights through Data Excellence

The “Precedence Statistics” flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today’s dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit:

www.precedencestatistics.com