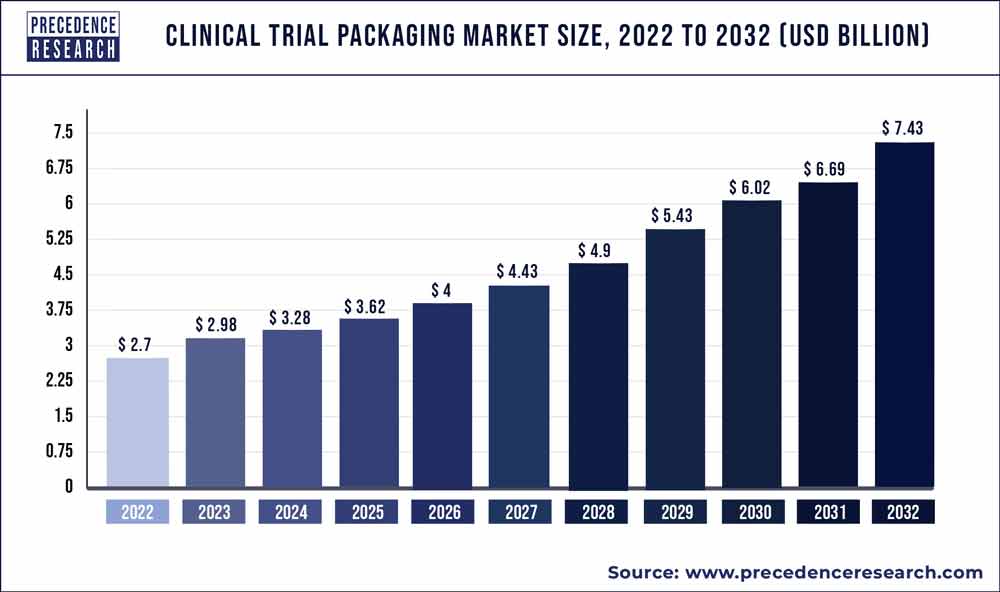

The global clinical trial packaging market size reached USD 2.7 billion in 2022 and is projected to hit around USD 7.43 billion by 2032, expanding at a CAGR of 10.7% from 2023 to 2032.

The clinical trial packaging market has witnessed significant growth due to several factors. Clinical trial packaging involves the packaging and labeling of investigational drugs and medical devices used in clinical trials to ensure compliance with regulatory requirements and the safety of participants. With the increasing number of clinical trials conducted worldwide, driven by advancements in medical research and the development of novel treatments and therapies, there has been a growing demand for specialized packaging solutions tailored to the unique needs of clinical trials. These packaging solutions are designed to maintain product integrity, protect against contamination, and facilitate efficient distribution and administration of investigational products.

Moreover, regulatory agencies such as the FDA and EMA have stringent guidelines and requirements for clinical trial packaging, driving the need for compliant packaging solutions and services.Additionally, advancements in packaging technologies, such as smart packaging, RFID tracking, and temperature-controlled packaging, have further enhanced the capabilities and reliability of clinical trial packaging, ensuring the safety and efficacy of investigational products throughout the trial process.

Furthermore, the COVID-19 pandemic has highlighted the importance of efficient and reliable supply chain logistics in clinical trials, driving increased demand for innovative packaging solutions that can adapt to changing requirements and timelines. As the pharmaceutical and biotechnology industries continue to innovate and expand their clinical trial activities, the clinical trial packaging market is expected to witness sustained growth, offering opportunities for packaging manufacturers, contract research organizations (CROs), and logistics providers.

Key Takeaways

- In 2022, the bags and pouches segment had the greatest revenue share of any packaging type, at over 35%.

- In terms of material revenue share in 2022, the plastics segment held a 37% share.

- The research laboratories section had the biggest revenue share by end user in 2022, reaching 44%.

Get a Sample: https://www.precedenceresearch.com/sample/2067

Report Scope of the Clinical Trial Packaging Market

| Report Coverage | Details |

| Market Size in 2023 | USD 2.98 Billion |

| Market Size by 2032 | USD 7.43 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 10.7% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Clinical Trial Type, Packaging Type, Material, End User and Geography |

Read More: Aluminium Cans Market Size to Reach USD 85.92 Bn By 2032

Clinical Trial Packaging Market Dynamics

Driver

The clinical trial packaging market is experiencing growth driven by the development of new drugs and creative ideas in the pharmaceutical industry. As pharmaceutical companies continue to innovate and introduce novel therapeutics, there is a corresponding need for packaging solutions that can meet the unique requirements of clinical trials.

The development of new drugs often involves complex formulations, specialized dosing regimens, and stringent regulatory requirements. Clinical trial packaging plays a critical role in ensuring the safe, secure, and efficient delivery of investigational products to trial sites and patients participating in clinical studies.

Moreover, as the pharmaceutical industry embraces personalized medicine and targeted therapies, there is a growing demand for customized packaging solutions tailored to specific drug formulations, patient populations, and therapeutic indications. Creative ideas in clinical trial packaging include innovative designs, materials, and technologies that optimize drug stability, dosing accuracy, and patient compliance while enhancing trial efficiency and data integrity.

Restraint

The clinical trial packaging market faces challenges due to the absence of a centralized or standardized drug registration process. Clinical trials are critical for evaluating the safety and efficacy of new drugs and medical treatments before they can be approved for commercial use. Proper packaging and labeling of investigational drugs are essential to ensure compliance with regulatory requirements, protect patient safety, and maintain data integrity during clinical trials.

However, the lack of a centralized or standardized drug registration process poses challenges for clinical trial packaging stakeholders, including pharmaceutical companies, contract research organizations (CROs), and packaging suppliers. Without a uniform process for registering investigational drugs with regulatory authorities, such as the Food and Drug Administration (FDA) in the United States or the European Medicines Agency (EMA) in Europe, stakeholders may encounter inconsistencies, delays, and inefficiencies in the packaging and labeling of clinical trial materials.

One of the primary challenges is navigating the complex and fragmented regulatory landscape across different regions and jurisdictions. Each country or regulatory agency may have its own requirements, procedures, and documentation standards for drug registration and clinical trial approval. This can result in duplication of efforts, redundant paperwork, and varying interpretation of regulatory guidelines, leading to increased costs and timelines for clinical trial packaging projects.

Additionally, the absence of a centralized drug registration process may hinder interoperability and data exchange between stakeholders involved in clinical trials, such as sponsors, investigators, and regulatory authorities. Without standardized data formats and systems for sharing drug registration information, stakeholders may struggle to access accurate and up-to-date information on investigational drugs, leading to potential errors or discrepancies in packaging and labeling.

Opportunity

Expanding the market for pharmaceutical packaging products is crucial for the clinical trial packaging market. Clinical trials are essential for testing the safety and efficacy of new drugs and medical treatments, and effective packaging solutions play a vital role in ensuring the integrity, stability, and traceability of pharmaceutical products throughout the trial process.

One of the key drivers for growing the market for pharmaceutical packaging products in the clinical trial packaging market is the increasing number of clinical trials being conducted worldwide. As pharmaceutical companies continue to develop new drugs and therapies to address a wide range of medical conditions, there is a growing demand for packaging solutions that meet the stringent requirements of clinical trials, including regulatory compliance, product protection, and patient safety.

Moreover, the complexity of clinical trial protocols and the need for specialized packaging solutions for different phases of clinical trials further contribute to the demand for pharmaceutical packaging products. From initial investigational drug packaging to final product labeling and distribution, pharmaceutical companies require packaging solutions that can accommodate the unique requirements of each stage of the clinical trial process.

Recent Developments

- Amcor’s most recent innovation, the New AmSkyTM blister system, has the potential to accelerate the sustainable growth of healthcare packaging. In April of 2021, it was disclosed.

- Ashfield, a branch of UDG Healthcare Plc, suggested establishing three distinct business divisions in January 2021 in order to improve and diversify its healthcare offerings.

Clinical Trial Packaging Market Players

- Bilcare

- Fisher Clinical Services

- WuXi AppTec

- PCI Pharma Services

- Almac Group

- PharMaterials

- PAREXEL

- Schreiner MediPharm

- Sharp Packaging

- The Coghlan Group

- Rubicon

- Westrock

- Xerimis

- Catalent

- Piramal Pharma Solutions

- Corden Pharma

- DMB Consultancy

- Sentry BioPharma

- NextPharma

- Mawdsleys

Segments Covered in the Report

By Clinical Trial Type

- Therapeutic and Prevention

- Vaccines

- Drug Discovery and Development

- Therapeutic Devices

- Biosimilars

- Therapeutic Assays

- Therapeutic Procedures

- Diagnostics

- Diagnostic Assay

- Diagnostic Devices

By Packaging Type

- Syringes

- Vials & Ampoules

- Blisters

- Cold Forming

- Thermoforming

- Tubes

- Bottles

- Bags & Pouches

- Sachets

- Kits or Packs

- Others

By Material

- Plastic

- PVC

- PE

- HDPE

- LDPE

- PP

- Others

- Glass

- Metal

- Paper

- Corrugated Fiber

By End User

- Research Laboratories

- Clinical Research Organizations

- Drug Manufacturing Facilities

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/2067

Unlocking Market Insights through Data Excellence

The “Precedence Statistics” flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today’s dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit:

www.precedencestatistics.com