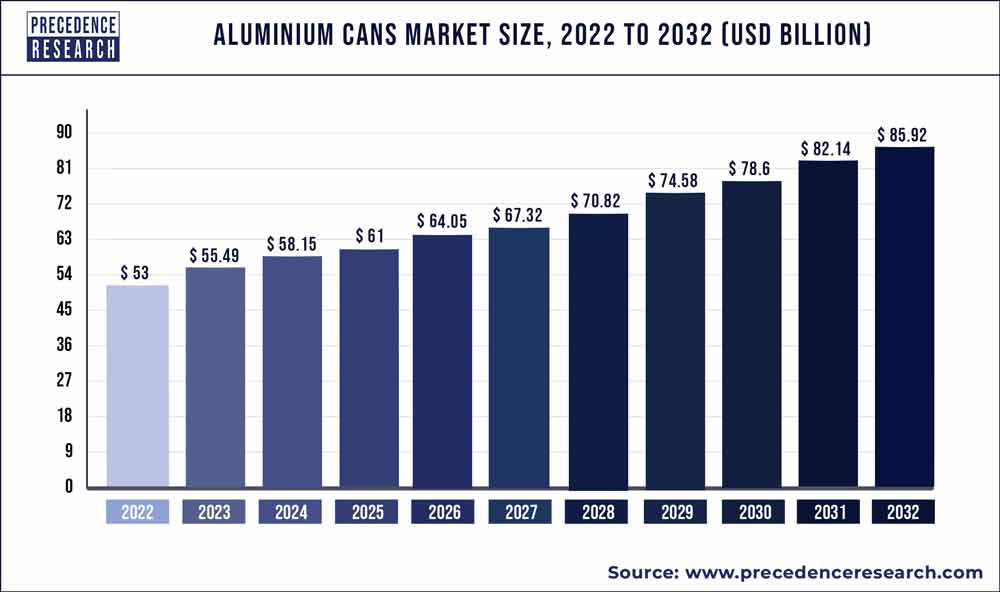

The global aluminium cans market size surpassed USD 53 billion in 2022 and is expected to hit around USD 85.92 billion by 2032, poised to grow at a CAGR of 4.98% from 2023 to 2032.

The aluminum cans market has experienced significant growth, driven by various factors. Aluminum cans are widely used for packaging beverages such as carbonated soft drinks, beer, energy drinks, and ready-to-drink beverages due to their lightweight, durability, and recyclability. With the increasing demand for convenient and sustainable packaging solutions, there has been a growing adoption of aluminum cans across the beverage industry. These cans offer benefits such as resistance to corrosion, protection from light and air, and the ability to be easily recycled and reused.

Moreover, advancements in manufacturing processes and design technologies have led to the development of innovative aluminum can formats, including slim cans, sleek cans, and shaped cans, catering to changing consumer preferences and market trends. Additionally, the rise of environmental awareness and government regulations aimed at reducing single-use plastics and promoting recycling have further fueled the demand for aluminum cans as a sustainable packaging option.

Furthermore, the COVID-19 pandemic has highlighted the importance of hygienic and convenient packaging solutions, driving increased adoption of single-serve and on-the-go beverage formats packaged in aluminum cans. As the beverage industry continues to innovate and evolve, driven by changing consumer behaviors and preferences, the aluminum cans market is expected to witness sustained growth, offering opportunities for innovation and expansion in packaging solutions.

Get a Sample: https://www.precedenceresearch.com/sample/2077

Report Scope of the Aluminium Cans Market

| Report Coverage | Details |

| Market Size in 2023 | USD 55.49 Billion |

| Market Size by 2032 | USD 85.92 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 4.98% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Product, Type, Capacity, End User and Geography |

Read More: Internet of Packaging Market Size to Hit USD 45.22 Billion by 2032

Aluminium Cans Market Dynamics

Driver

The growth of the beverages industry is fueling expansion in the aluminum cans market. As the demand for beverages, including carbonated soft drinks, energy drinks, ready-to-drink teas and coffees, and alcoholic beverages, continues to rise globally, there is a corresponding increase in the need for packaging solutions to meet this demand.

Aluminum cans are a popular choice for packaging beverages due to their numerous advantages. Firstly, aluminum cans are lightweight yet durable, making them easy to transport, handle, and store. This lightweight nature also helps to reduce transportation costs and environmental impact compared to heavier packaging materials.

Secondly, aluminum cans offer excellent protection against light, oxygen, and moisture, helping to preserve the freshness and flavor of beverages for longer periods. This ensures that consumers enjoy high-quality beverages with every sip, enhancing their overall drinking experience.

Additionally, aluminum cans are highly recyclable, with a high recycling rate compared to other packaging materials. The recycling process for aluminum cans is efficient and cost-effective, allowing manufacturers to reuse recycled aluminum to produce new cans, thus reducing the need for virgin materials and minimizing environmental impact.

Restraint

The aluminum cans market faces challenges due to the availability of alternative packaging options. Aluminum cans are widely used for packaging beverages such as soda, beer, and energy drinks due to their lightweight, recyclability, and ability to preserve product freshness. However, the availability of alternative packaging materials and formats presents competition and potential limitations for the aluminum cans market.

One alternative to aluminum cans is PET (polyethylene terephthalate) bottles, which are lightweight, shatter-resistant, and offer flexibility in design and labeling. PET bottles are commonly used for bottled water, juices, and sports drinks, providing consumers with a convenient and portable packaging option. Additionally, glass bottles offer a premium packaging solution for certain beverages, appealing to consumers looking for a more upscale or environmentally friendly option.

Another alternative packaging format is pouches or flexible packaging, which offer benefits such as lightweight, space-saving, and customizable designs. Pouches are increasingly used for packaging juices, sauces, and snack products, providing manufacturers with opportunities for innovation and differentiation in the market.

Furthermore, the rise of alternative beverage formats such as boxed or carton packaging for products like wine, water, and dairy beverages presents competition for aluminum cans. Boxed packaging offers sustainability benefits, as it often uses renewable materials and requires less energy and resources to produce compared to aluminum cans.

Opportunity

The aluminum cans market is experiencing a growing demand for lightweight and durable options. This trend is being driven by several factors that make lightweight and durable aluminum cans highly desirable for both consumers and businesses.

Firstly, lightweight aluminum cans offer significant benefits in terms of transportation and logistics. Their lighter weight reduces fuel consumption and transportation costs, making them a more sustainable and cost-effective packaging solution for beverage manufacturers. Additionally, lightweight cans are easier to handle and stack, improving efficiency in storage and distribution.

Secondly, durability is a key attribute of aluminum cans that contributes to their popularity. Aluminum is a highly durable material that offers superior protection for beverages, ensuring product integrity and freshness throughout the supply chain. This durability also makes aluminum cans resistant to damage during handling, transportation, and storage, reducing the risk of product spoilage and waste.

Moreover, the demand for lightweight and durable packaging options aligns with consumer preferences for convenience and sustainability. Lightweight aluminum cans are portable and easy to carry, making them a popular choice for on-the-go consumption. Additionally, aluminum is infinitely recyclable, and recycled aluminum cans can be used to produce new cans, reducing the environmental impact of packaging waste.

Recent Development

- 2019 saw PepsiCo declare that aluminum cans, a superior substitute for plastic bottles, would be used in the US for Aquafina.

Aluminium Cans Market Players

- Crown Holdings Inc.

- CCL Industries Inc.

- CPMC Holdings Inc.

- Ball Corporation

- Ardagh Group S.A.

- Silgan Containers LLC

- Toyo Seikan Co., Ltd.

- Nampak Ltd.

Segments Covered in the Report

By Product

- 1 Piece cans

- 2 Piece cans

- 3 Piece cans

By Type

- Slim

- Sleek

- Standard

By Capacity

- Up to 200 ml

- 201 to 450 ml

- 451 to 700 ml

- 701 to 1000 ml

- more than 1000 ml

By End User

- Food

- Fruits & Vegetables

- Ready-to-eat

- Meat, Poultry, & Seafood

- Pet Food

- Bakery & Confectionery

- Others

- Beverages

- Alcoholic

- Non-alcoholic

- Pharmaceutical

- Personal Care and Cosmetics

- Paints and Lubricants

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/2077

Unlocking Market Insights through Data Excellence

The “Precedence Statistics” flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today’s dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit:

www.precedencestatistics.com