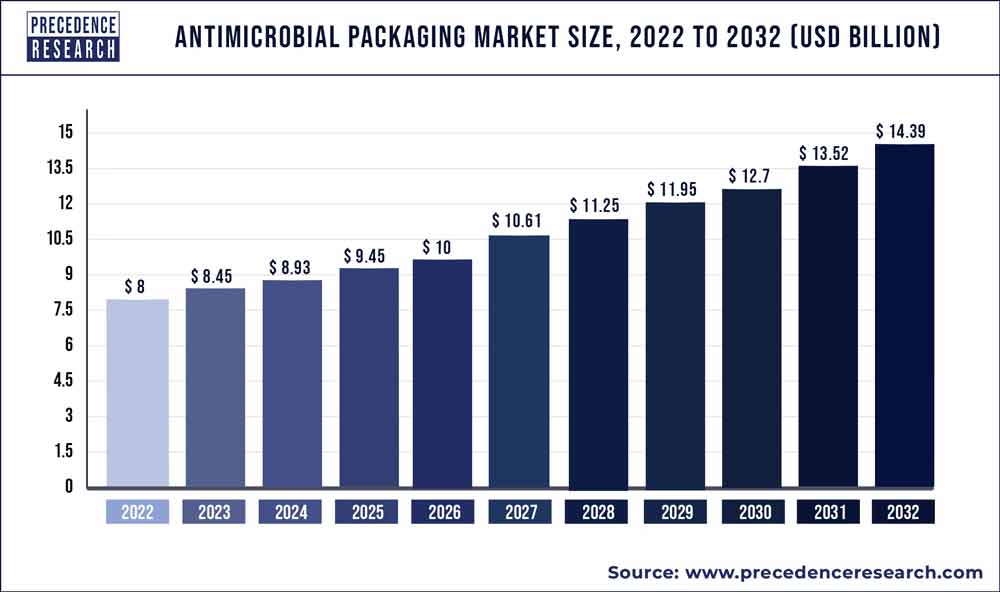

The global antimicrobial packaging market size surpassed USD 8 billion in 2022 and is expected to hit around USD 14.39 billion by 2032, poised to grow at a CAGR of 6.1% from 2023 to 2032.

The antimicrobial packaging market has experienced significant growth driven by various factors. Antimicrobial packaging refers to packaging materials and technologies designed to inhibit the growth of bacteria, fungi, and other microorganisms on the surface of packaged products, thereby extending shelf life and enhancing food safety. With increasing concerns about foodborne illnesses, spoilage, and the spread of infectious diseases, there has been a growing demand for antimicrobial packaging solutions across industries such as food and beverage, healthcare, and consumer goods. These solutions include antimicrobial additives, coatings, films, and active packaging systems embedded with antimicrobial agents such as silver ions, enzymes, or natural antimicrobial compounds.

Moreover, advancements in materials science, nanotechnology, and packaging technology have led to the development of innovative antimicrobial packaging solutions with improved efficacy, stability, and compatibility with different packaging formats. Additionally, the COVID-19 pandemic has highlighted the importance of hygienic and safe packaging solutions, driving increased adoption of antimicrobial packaging in sectors such as healthcare and personal protective equipment (PPE).

Furthermore, regulatory initiatives aimed at ensuring food safety and public health have further fueled market growth, driving businesses to adopt antimicrobial packaging solutions to meet regulatory requirements and consumer expectations for safer and longer-lasting products. As industries continue to prioritize hygiene, safety, and sustainability in packaging practices, the antimicrobial packaging market is expected to witness sustained growth, offering opportunities for innovation and advancement in antimicrobial technologies and packaging solutions.

Key Takeaways

- In 2022, the plastics segment held a 65.5% market share.

- The organic acid segment produced a revenue share of 37.8% in 2022.

- With a market share of 41% in 2022, the pouches segment is expected to increase at a compound annual growth rate (CAGR) of 5.7% from 2023 to 2032.

- By 2022, the food and beverage applications category held a 47% market share, and it continued to grow at a 5.6% compound annual growth rate.

Get a Sample: https://www.precedenceresearch.com/sample/2101

Report Scope of the Antimicrobial Packaging Market

| Report Coverage | Details |

| Market Size in 2023 | USD 8.45 Billion |

| Market Size by 2032 | USD 14.39 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 6.1% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Material Type, Agent Type, Pack Type, Technology, Application, and Geography |

Read More: Healthcare Packaging Market Size is Expanding to USD 199.3 Billion by 2032

Antimicrobial Packaging Market Dynamics

Driver

The antimicrobial packaging market is experiencing growth propelled by increasing consumer awareness of health-related issues. As consumers become more conscious of the potential health risks associated with foodborne pathogens, bacteria, and viruses, there is a growing demand for packaging solutions that offer additional protection against microbial contamination.

Antimicrobial packaging is designed to inhibit the growth of bacteria, fungi, and other microorganisms on the surface of packaged products, thereby helping to extend shelf life, maintain product freshness, and ensure food safety. This is particularly important in sectors such as food and beverage, healthcare, and pharmaceuticals, where microbial contamination can pose significant health risks.

The increasing consumer awareness of health-related issues is driving the adoption of antimicrobial packaging across various industries. Consumers are seeking reassurance that the products they purchase are safe, hygienic, and free from harmful pathogens, leading to a preference for packaging solutions that offer built-in antimicrobial protection.

Moreover, the global health crisis caused by the COVID-19 pandemic has further heightened awareness of the importance of hygiene and sanitation. As consumers pay closer attention to cleanliness and hygiene practices, there is a greater emphasis on the role of packaging in preventing the spread of infectious diseases and ensuring product safety.

Restraint

High material costs present a significant challenge for the antimicrobial packaging market. Antimicrobial packaging is designed to inhibit or prevent the growth of microorganisms on packaged products, thereby extending shelf life, preserving freshness, and enhancing safety. However, incorporating antimicrobial properties into packaging materials often requires the use of specialized additives, coatings, or treatments, which can be expensive.

The high material costs associated with antimicrobial packaging materials can impact the affordability and competitiveness of antimicrobial packaging solutions. Manufacturers may face challenges in balancing the benefits of antimicrobial properties with the increased production costs, especially for large-scale manufacturing or mass-market applications.

Moreover, the cost of antimicrobial additives or treatments may vary depending on factors such as efficacy, compatibility with packaging materials, and regulatory compliance requirements. Higher-quality antimicrobial agents or formulations that offer superior performance and safety profiles may come at a premium price, further contributing to the overall cost of antimicrobial packaging.

Opportunity

New approaches to food packaging are driving innovation in the antimicrobial packaging market. With a growing focus on food safety and preservation, manufacturers are developing packaging solutions that incorporate antimicrobial agents to inhibit the growth of bacteria and other pathogens on food surfaces. These antimicrobial packaging materials can help extend the shelf life of perishable foods, reduce the risk of foodborne illnesses, and maintain product quality and freshness.

One approach to antimicrobial packaging involves the incorporation of natural antimicrobial compounds derived from plant extracts, essential oils, or other organic sources. These compounds have been shown to exhibit antimicrobial properties against a wide range of pathogens while remaining safe for food contact.

Another approach involves the use of antimicrobial coatings or films applied to the surface of packaging materials. These coatings can create a barrier that prevents the growth of bacteria and other microorganisms on the packaging surface, helping to preserve the quality and safety of the packaged food.

Additionally, advances in nanotechnology have enabled the development of nanomaterials with antimicrobial properties that can be incorporated into packaging films or containers. These nanomaterials can provide enhanced antimicrobial efficacy while maintaining the transparency, flexibility, and other desirable properties of packaging materials.

Recent Developments

- An agreement between HeiQ and ICP Industrial Inc. was signed in March 2021, granting ICP Industrial the only worldwide right to utilize HeiQ Viroblock Technology. Both companies will be able to market their products using antimicrobial packaging as a result.

- A coating method dubbed Lock3, developed by Van Genechten Packaging and Varcotec, will be available in September 2020 and permanently eradicate infections, viruses, and bacteria. This will let the company create antimicrobial coating for the packaging sector that is fully functional.

Market Players

- BASF SE

- Dunmore Corporation

- BioCote Limited

- PolyOne Corporation

- Microban International

- Mondi PLC

- The DOW Chemical Company

- CSP Technologies

- Takex Labo Co. Ltd.

Segments Covered in the Report

By Material Type

- Paperboard

- Plastic

- Biopolymers

- Others

By Agent Type

- Plant Extracts

- Organic Acids

- Bacteriocins Enzymes

- Others

By Pack Type

- Bags

- Pouches

- Trays

- Carton packages

- Cups & lids

- Others

By Technology

- Controlled release packaging

- Active packaging

By Application

- Food & Beverages

- Healthcare & Pharmaceutical

- Personal Care

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/2101

Unlocking Market Insights through Data Excellence

The “Precedence Statistics” flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today’s dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit:

www.precedencestatistics.com