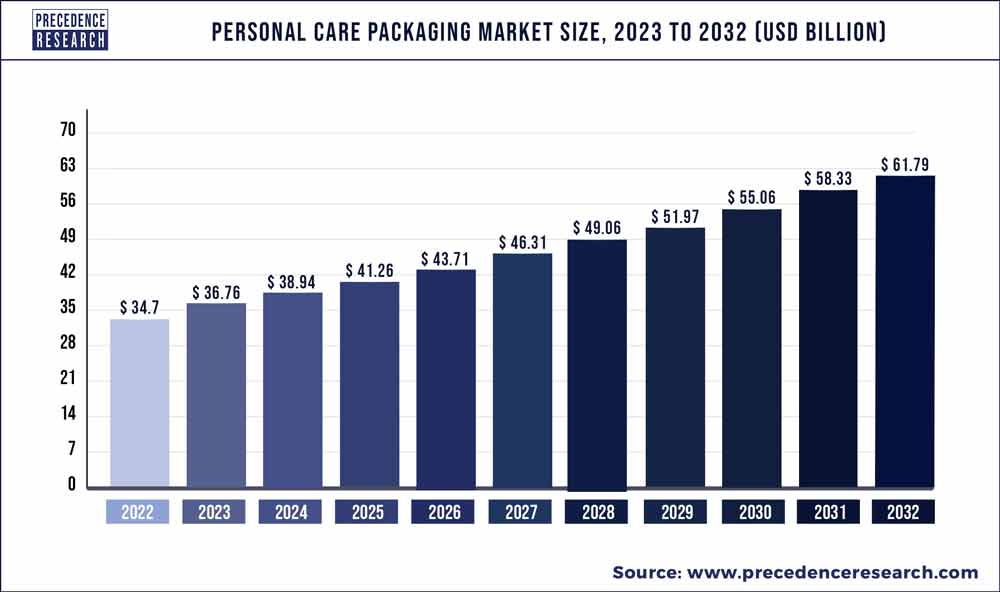

The global personal care packaging market size surpassed USD 34.7 billion in 2022 and is expected to hit around USD 61.79 billion by 2032, poised to grow at a CAGR of 5.95% from 2023 to 2032.

The personal care packaging market has seen substantial growth, influenced by various factors. Personal care products, including cosmetics, skincare, haircare, and toiletries, are essential items for consumers worldwide, driving demand for effective and attractive packaging solutions. The increasing emphasis on product safety, convenience, and brand differentiation has propelled innovation in personal care packaging. Manufacturers are focusing on creating packaging designs that enhance product visibility, functionality, and sustainability. Additionally, the rise of e-commerce and direct-to-consumer channels has led to the development of packaging solutions optimized for online retail, such as tamper-evident seals and travel-friendly formats.

Moreover, consumer preferences for eco-friendly packaging materials and refillable options have prompted the adoption of sustainable packaging practices within the personal care industry. As the personal care sector continues to evolve and diversify, the personal care packaging market is expected to witness sustained growth, driven by the intersection of convenience, aesthetics, and sustainability in packaging solutions.

Key Takeaways

- Between 2023 and 2032, the market is expected to continue to be dominated by the bottles sector.

- It is anticipated that between 2023 and 2032, the tube segment would increase at the quickest rate.

- In 2022, the rigid plastic market held a dominant position worldwide.

- It is anticipated that between 2023 and 2032, the flexible segment will hold the largest market share.

- In 2022, the skin care category held a dominant market share.

- The industry with the fastest growth rate between 2023 and 2032 is predicted to be the bath and shower segment.

Get a Sample: https://www.precedenceresearch.com/sample/2778

Report Scope of the Personal Care Packaging Market:

| Report Coverage | Details |

| Market Size in 2023 | USD 36.76 Billion |

| Market Size by 2032 | USD 61.79 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 5.95% |

| Largest Market | Asia Pacific |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Packaging Type, By Product Type, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Read More: Sustainable Packaging Market Size to Reach USD 211.51 Bn By 2032

Personal Care Packaging Market Dynamics

Driver

The personal care packaging market is experiencing a notable increase in demand for refillable and economical packaging solutions. This trend is driven by several factors, including growing consumer awareness of environmental sustainability, the desire for cost-effective options, and changing preferences for convenience and practicality.

Refillable packaging offers consumers the ability to reuse containers by refilling them with product, reducing the need for single-use packaging and minimizing waste. This appeals to environmentally conscious consumers who seek to reduce their environmental footprint and minimize plastic waste.

Additionally, refillable packaging can offer economic benefits to both consumers and manufacturers. Consumers can save money by purchasing refill packs or bulk quantities of products, while manufacturers can reduce packaging costs and improve resource efficiency by using refillable packaging formats.

Restraint

Improper supply chain management presents a significant challenge for the personal care packaging market. The personal care industry relies on efficient and reliable supply chains to ensure the timely delivery of packaging materials, components, and finished products to manufacturers, distributors, and retailers. However, issues such as inventory shortages, transportation delays, quality control failures, and communication breakdowns can disrupt the supply chain, leading to production delays, increased costs, and customer dissatisfaction.

Additionally, the global nature of the personal care market and the complexity of sourcing materials from multiple suppliers further compound supply chain management challenges. To address this issue, stakeholders in the personal care packaging market must prioritize robust supply chain management practices, including demand forecasting, inventory optimization, vendor management, and logistics coordination. Implementing technology solutions such as supply chain visibility tools, track-and-trace systems, and real-time communication platforms can help improve transparency, efficiency, and responsiveness throughout the supply chain. Furthermore, fostering collaboration and partnerships among supply chain partners, including packaging manufacturers, raw material suppliers, and logistics providers, is crucial to address supply chain management challenges collectively and ensure the seamless flow of materials and products within the personal care packaging market.

Opportunity

The personal care packaging market is undergoing a significant transformation with the rise of digitization. This trend reflects the increasing adoption of digital technologies throughout the packaging industry to enhance efficiency, sustainability, and consumer engagement. Digitization in personal care packaging encompasses various aspects, including smart packaging solutions, digital printing technologies, and interactive packaging experiences. Smart packaging integrates sensors, QR codes, and RFID tags to provide consumers with real-time information about product ingredients, usage instructions, and expiration dates. Digital printing technologies enable brands to create customized packaging designs, reduce lead times, and minimize waste compared to traditional printing methods.

Moreover, interactive packaging experiences, such as augmented reality (AR) and near-field communication (NFC), allow consumers to engage with products in innovative ways, fostering brand loyalty and enhancing the overall user experience. As the demand for personalized, sustainable, and technologically advanced packaging grows, the rise of digitization in the personal care packaging market is poised to continue, driving innovation and market expansion.

Recent Developments

- OnTop Cosmetics introduced its Renewal Oil Cream in July 2022; this is the brand’s first product with Eastman Cristal packaging. In order to provide its Chinese customers with cutting-edge recyclable packaging, OnTop Cosmetics has partnered with Eastman and WWP Beauty.

- Olive Natural Skincare, a skin care and baby care products firm based in New Zealand, announced in April 2022 the launch of its new packaging, which is entirely recyclable. The company is also looking into innovative ways to use recycled plastic.

Personal Care Packaging Market Players

- Amcor Limited

- Berry Global Group, Inc.

- Gerresheimer AG

- AptarGroup, Inc.

- RPC Group Plc

- Mondi Group

- Silgan Holdings Inc.

- Albea S.A.

- HCP Packaging

- Quadpack Industries

Segments Covered in the Report

By Packaging Type

- Bottles

- Cartons

- Jars

- Tubes

- Cans

By Product Type

- Metal

- Flexible

- Paper

- Rigid plastic

- Glass

- Others

By Application

- Skin care

- Hair care

- Bath & shower

- Cosmetics

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Unlocking Market Insights through Data Excellence

The “Precedence Statistics” flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today’s dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit:

www.precedencestatistics.com