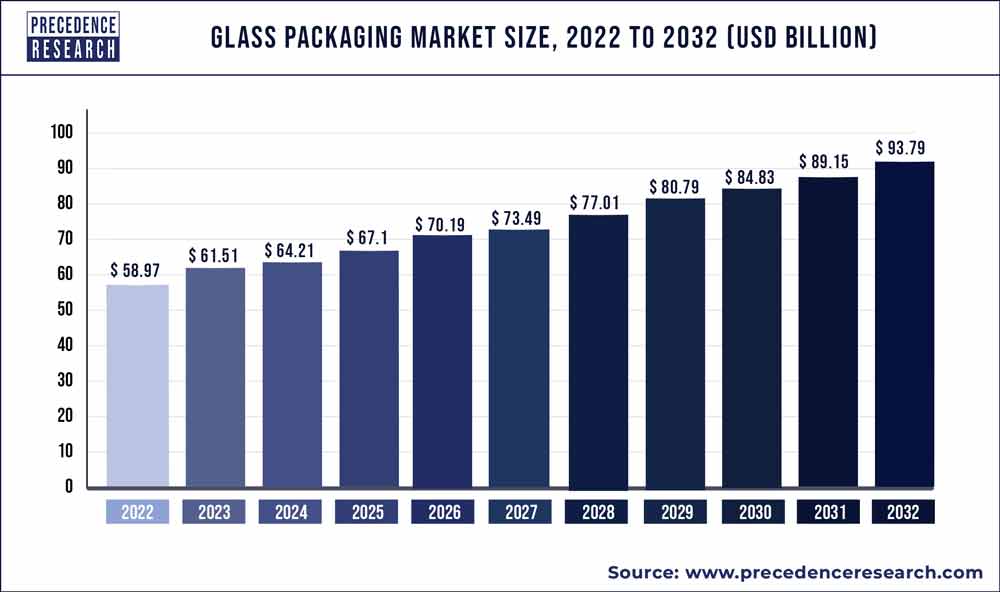

The global glass packaging market size was valued at USD 58.97 billion in 2022 and is expected to hit around USD 93.79 billion by 2032, growing at a CAGR of 4.8% from 2023 to 2032.

The glass packaging market has witnessed significant growth driven by several key factors. Glass packaging offers numerous advantages such as preservation of product integrity, recyclability, and aesthetic appeal, making it a popular choice across various industries including food and beverage, pharmaceuticals, cosmetics, and alcoholic beverages. The increasing demand for sustainable packaging solutions, coupled with growing consumer awareness regarding environmental issues, has propelled the adoption of glass packaging. Moreover, glass containers provide excellent protection against oxygen, moisture, and other external factors, ensuring the freshness and quality of packaged products.

Additionally, the rise of premium and luxury brands in sectors like spirits and cosmetics has further boosted the demand for high-quality glass packaging. Furthermore, advancements in glass manufacturing technologies, such as lightweighting and innovative designs, have enhanced the efficiency and versatility of glass packaging solutions, meeting diverse market needs. As industries continue to prioritize sustainability, product safety, and brand differentiation, the glass packaging market is expected to witness continued growth and innovation.

Key Takeaways

- In 2022, the food and beverage industry achieved its highest market share of over 48%.

- In 2022, the pharmaceutical industry held a 25% revenue share.

- In 2022, the bottles category dominated the worldwide market.

- Between 2023 and 2032, the jars and containers market is anticipated to grow at the quickest rate.

Get a Sample: https://www.precedenceresearch.com/sample/2796

Report Scope of the Glass Packaging Market:

| Report Coverage | Details |

| Market Size in 2023 | USD 61.51 Billion |

| Market Size by 2032 | USD 93.79 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 4.8% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Product and By End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Read More: Retort Packaging Market Size to Hit USD 6.23 Billion by 2032

Glass Packaging Market Dynamics

Driver

The glass packaging market is experiencing a surge in demand, particularly for premium packaging options. This increased demand can be attributed to several factors, including changing consumer preferences, rising disposable incomes, and the growing emphasis on sustainability and product presentation.

Premium packaging options in the glass packaging market offer a combination of aesthetic appeal, quality, and functionality that cater to the preferences of discerning consumers. These packaging solutions often feature elegant designs, innovative shapes, and intricate detailing, enhancing the visual appeal of the packaged products and conveying a sense of luxury and sophistication.

Moreover, premium glass packaging is valued for its superior quality and ability to preserve the freshness, flavor, and integrity of the packaged products. Glass containers are inert and impermeable, providing an effective barrier against moisture, oxygen, and other external factors that can compromise product quality.

Restraint

Navigating the costs and challenges of glass packaging presents a significant hurdle for stakeholders in the glass packaging market. While glass offers several advantages such as recyclability, inertness, and premium aesthetics, it also comes with inherent challenges that can contribute to higher production costs. The raw materials used in glass production, such as silica sand, soda ash, and limestone, can be expensive and subject to price fluctuations.

Moreover, the manufacturing process for glass packaging involves high energy consumption, specialized equipment, and stringent quality control measures, all of which contribute to elevated production costs. Additionally, the weight and fragility of glass packaging can result in higher transportation and handling expenses compared to alternative materials. To address these challenges, stakeholders in the glass packaging market must implement strategies to optimize manufacturing processes, improve energy efficiency, and explore sustainable sourcing options for raw materials. Collaborative efforts among industry players, regulatory bodies, and recycling organizations are also essential to promote recycling infrastructure and increase the recyclability of glass packaging, thereby mitigating costs and enhancing sustainability. By navigating these challenges effectively, stakeholders can capitalize on the enduring appeal and versatility of glass packaging while managing costs and driving innovation in the market.

Opportunity

Innovation in glass materials for packaging is reshaping the glass packaging market. With a focus on sustainability, durability, and design versatility, manufacturers are introducing new glass compositions and production techniques to meet evolving consumer and industry demands. These innovations include the development of lighter-weight glass formulations, which reduce transportation costs and environmental impact while maintaining the strength and integrity of traditional glass packaging.

Additionally, advancements in glass recycling technology are enhancing the circularity of glass packaging by facilitating the reuse of recycled glass in new packaging products. Furthermore, novel surface treatments and coatings are improving the functionality and aesthetics of glass packaging, offering features such as improved scratch resistance, enhanced branding opportunities, and customizable designs. As consumers increasingly prioritize sustainability and quality in their purchasing decisions, innovation in glass materials is driving growth and competitiveness in the glass packaging market.

Recent Developments

- APC Packaging, a leading provider of packaging solutions worldwide, stated in February 2023 that the Exploratorium at the 2023 Luxe Pack in Los Angeles would host the debut of its new line of double-walled glass jars specifically made for personal care and cosmetics items. The glass jars, which have 30 and 50 millilitre sizes, are made entirely of sustainable resources.

- Mktg Industry stated in July 2022 that a 30ml Vogue glass bottle packaging featuring a pump for beauty emulsions would be available. It is noted that the bottle can be substantially customised by colour shading, hot stamping, matte lacquering, and screen printing. The redesigned bottle packaging includes a flush top and an emulsion pump.

Segments Covered in the Report

By Product

- Bottes

- Jars & Containers

- Ampoules Vials

- Others

By End-User

- Food & Beverages

- Pharmaceuticals

- Personal Care & Cosmetics

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Unlocking Market Insights through Data Excellence

The “Precedence Statistics” flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today’s dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit:

www.precedencestatistics.com