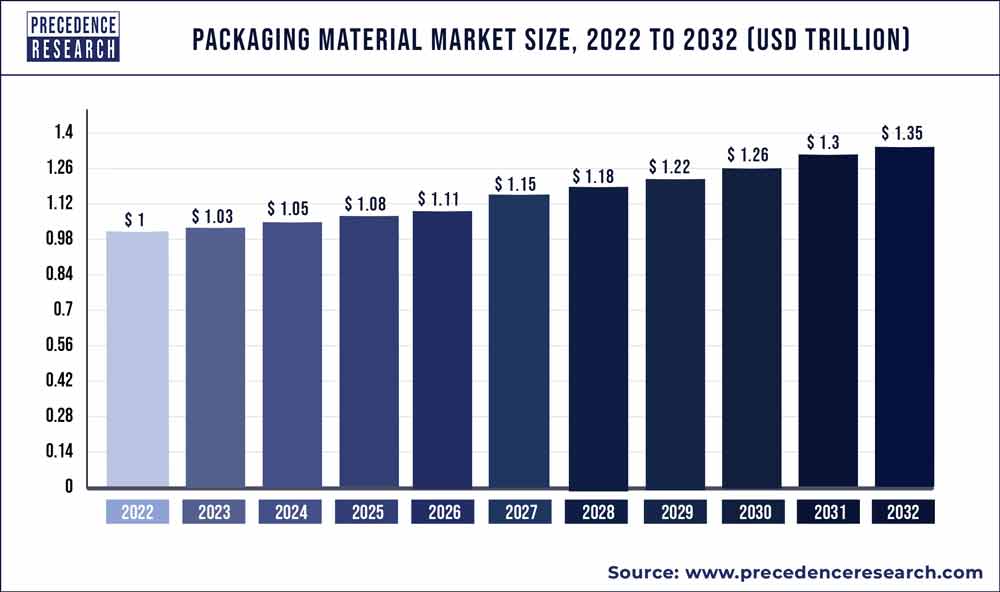

The global packaging material market size was estimated at USD 1 trillion in 2022 and is projected to hit around USD 1.35 trillion by 2032, growing at a CAGR of 3.1% from 2023 and 2032.

The packaging material market has witnessed significant growth driven by various factors. Packaging materials serve a crucial role in protecting, preserving, and promoting products across diverse industries such as food and beverage, pharmaceuticals, cosmetics, and consumer goods. The increasing demand for convenience, sustainability, and product differentiation has fueled innovation in packaging materials, leading to the development of a wide range of options including plastics, paper and paperboard, glass, metals, and biodegradable materials.

Moreover, advancements in manufacturing technologies and processes have enhanced the functionality, efficiency, and sustainability of packaging materials, addressing evolving market needs and regulatory requirements. Additionally, the rising awareness of environmental issues has driven the adoption of eco-friendly and recyclable packaging materials, aligning with consumer preferences and corporate sustainability goals. As industries continue to prioritize product safety, shelf appeal, and environmental stewardship, the packaging material market is expected to witness continued growth and innovation, offering diverse solutions to meet evolving industry demands.

Key Takeaways

- Over the course of the forecast period, the paper sector is anticipated to dominate the global market.

- In 2022, the market share created by the rigid plastic segment was noteworthy.

- In 2022, the market was led by the bottles category.

- In 2022, the global market was dominated by the food and beverage segment.

- It is anticipated that the domestic items category will command a sizeable market share.

Get a Sample: https://www.precedenceresearch.com/sample/2858

Report Scope of the Packaging Material Market:

| Report Coverage | Details |

| Market Size in 2023 | USD 1.03 Trillion |

| Market Size by 2032 | USD 1.35 Trillion |

| Growth Rate from 2023 to 2032 | CAGR of 3.1% |

| Largest Market | Asia Pacific |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Material, By Product, and By End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Read More: Alcohol Packaging Market Size to Reach USD 74.94 Bn By 2032

Packaging Material Market Dynamics

Driver

The packaging material market is experiencing significant growth, propelled by the rising e-commerce food delivery industry. As consumers increasingly turn to online platforms for food purchases and delivery services, there is a corresponding surge in demand for packaging materials that ensure the safe and efficient transportation of food items.

E-commerce food delivery platforms require packaging materials that can maintain the freshness, integrity, and safety of food products throughout the delivery process. This includes a wide range of packaging solutions, such as insulated containers, tamper-evident packaging, and eco-friendly materials.

Restraint

Environmental concerns represent a significant challenge for the packaging material market. The production, usage, and disposal of packaging materials contribute to various environmental issues, including resource depletion, pollution, and waste accumulation. Common packaging materials such as plastics, paper, glass, and metals may involve intensive manufacturing processes, resource extraction, and energy consumption, leading to greenhouse gas emissions and environmental degradation.

Additionally, improper disposal of packaging waste can result in littering, landfills, and marine pollution, further exacerbating environmental concerns. To address these challenges, stakeholders in the packaging material market must prioritize sustainability by adopting eco-friendly materials, reducing packaging waste through innovative designs and lightweight, and promoting circular economy principles such as recycling, reuse, and composting. Collaboration among industry players, policymakers, consumers, and environmental organizations is essential to drive systemic change and transition towards more environmentally responsible packaging solutions.

Opportunity

The packaging material market is experiencing a significant increase in demand for customized packaging solutions. This rise in demand is driven by several factors, including the growing emphasis on brand differentiation, the need to cater to diverse consumer preferences, and the rise of e-commerce. Customized packaging allows brands to stand out on crowded shelves, create memorable brand experiences, and connect with consumers on a more personal level.

Moreover, with the expansion of e-commerce, customized packaging plays a crucial role in enhancing the unboxing experience and creating a positive impression among online shoppers. Additionally, advancements in digital printing and manufacturing technologies have made it more accessible and cost-effective for brands to create customized packaging designs in smaller quantities. This enables brands to respond quickly to market trends, launch limited-edition products, and target niche consumer segments effectively. As a result, the demand for customized packaging solutions is expected to continue rising, driving innovation and growth in the packaging material market.

Recent Developments

- Cruz Foam announced in February 2023 the introduction of foam packaging material, a new environmentally friendly packaging technology. Shipment of delicate and temperature-sensitive commodities is the goal of the new packaging option. Cruz Foam is designed to take the place of other plastic packaging options such as bubble wrap and bubble mailers.

- Stora Enso announced in March 2023 the introduction of “Cupforma Natura Aqua+,” a recyclable fiber-based material for food service paper lids. The company claims that the new packaging material is resilient to heat, lightweight, and strong.

Packaging Material Market Players

- Amcor

- Ball Corporation

- Crown Holdings

- International Paper

- Reynolds Group

- Mondi

- Stora Enso

- WestRock

- Bemis

Segments Covered in the Report:

By Material

- Paper

- Cardboard

- Rigid plastic

- Flexible plastic

- Wood

- Textile

- Glass

- Metal

By Product

- Bag

- Pouch

- Box

- Bottles

- Cans and Jars

- Containers

- Wraps

- Drums

- IBCs

By End-User

- Food & Beverage

- Healthcare

- Household products

- Chemicals

- Cosmetics

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Unlocking Market Insights through Data Excellence

The “Precedence Statistics” flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today’s dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit:

www.precedencestatistics.com