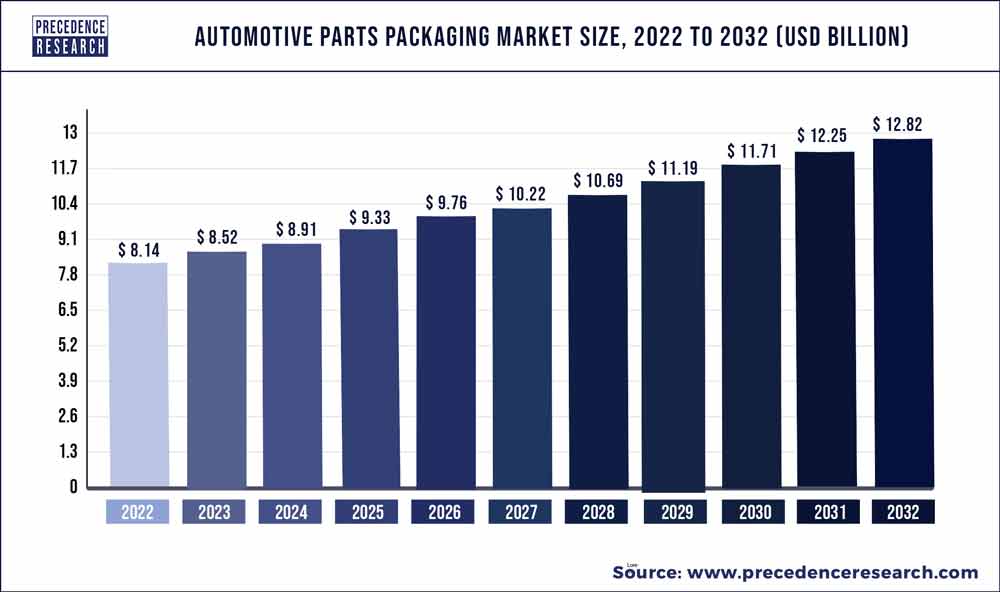

The global automotive parts packaging market size is anticipated to reach around USD 12.82 billion by 2032 from USD 8.14 billion in 2022 and is poised to grow at a CAGR of 4.65% during the forecast period from 2023 to 2032.

The automotive parts packaging market has experienced notable growth, influenced by several key factors. With the automotive industry’s expansion and diversification, there’s an increased demand for efficient and protective packaging solutions for various automotive components. Manufacturers are prioritizing packaging solutions that ensure the safe transportation and storage of parts while minimizing damage and maximizing space utilization.

Additionally, as the automotive sector embraces sustainability initiatives, there’s a growing emphasis on eco-friendly packaging materials and designs to reduce environmental impact. Furthermore, advancements in packaging technologies, such as RFID tracking and Just-In-Time delivery systems, have optimized supply chain management and inventory control processes within the automotive parts sector. As automotive production continues to evolve, the automotive parts packaging market is poised for sustained growth, driven by the intersection of industry expansion, sustainability trends, and innovative packaging solutions.

Key Takeaways

- Bulk cases and containers will hold the highest market share globally, but protective packaging is likely to constitute the largest market in terms of volume.

- Disposable packaging will have the biggest market share.

- The automotive parts packaging industry will be dominated by the lighting sector.

- The largest and fastest-growing automobile industries are in China.

Get a Sample: https://www.precedenceresearch.com/sample/2986

Report Scope of the Automotive Parts Packaging Market:

| Report Coverage | Details |

| Market Size in 2023 | USD 8.52 Billion |

| Market Size by 2032 | USD 12.82 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 4.65% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Product, By Packaging, and By Component |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Read More: Bottled Water Packaging Market Size to Reach USD 195.75 Bn By 2032

Automotive Parts Packaging Market Dynamics

Driver

The automotive parts packaging market is experiencing significant growth, largely driven by the ongoing trend of urbanization worldwide. As urban populations continue to expand, there is a corresponding rise in the demand for automobiles and automotive parts. This growth is fueled by factors such as increased consumer purchasing power, rising urban infrastructure development, and the need for efficient transportation solutions in urban areas. As a result, the automotive industry is witnessing heightened demand for packaging solutions that cater to the storage, transportation, and protection of various automotive components. Manufacturers in the automotive parts packaging market are innovating to meet these evolving needs, developing packaging solutions that prioritize durability, efficiency, and ease of handling.

Additionally, the trend towards urbanization is also driving the adoption of sustainable packaging practices within the automotive industry, as urban populations increasingly prioritize environmental sustainability. Overall, the growing urbanization trend is playing a significant role in shaping the automotive parts packaging market, driving innovation and adaptation to meet the demands of an increasingly urbanized world.

Restraint

The automotive parts packaging market encounters significant challenges due to strict government regulations. Government regulations impose various requirements and standards on automotive parts packaging to ensure safety, quality, and environmental compliance. These regulations may dictate specific materials, labeling requirements, packaging designs, and handling procedures, adding complexity and costs to packaging operations.

Failure to comply with these regulations can result in penalties, product recalls, or even legal liabilities, thereby affecting the reputation and bottom line of automotive parts manufacturers and suppliers. To navigate this regulatory landscape effectively, stakeholders in the automotive parts packaging market must stay abreast of evolving regulations, invest in compliance measures, and collaborate closely with regulatory authorities to ensure adherence to standards while balancing cost-efficiency and operational effectiveness.

Opportunity:

The automotive parts packaging market is witnessing a notable uptick driven by the rising trend of direct consumer sales through e-commerce platforms. As more consumers turn to online channels for purchasing automotive parts, there’s a growing need for effective packaging solutions tailored to meet the requirements of e-commerce shipping and handling. Packaging plays a critical role in ensuring the safe and secure delivery of automotive parts to consumers, protecting them from damage during transit. Moreover, with the shift towards direct consumer sales, packaging also serves as a branding and marketing tool, influencing purchasing decisions and enhancing brand perception.

As e-commerce continues to reshape the automotive parts market, packaging manufacturers are innovating to meet the unique challenges posed by online retail, such as the need for durable, protective packaging that is also visually appealing and easy to handle. This trend presents significant opportunities for packaging suppliers to develop customized solutions that cater to the specific needs of e-commerce platforms, driving growth in the automotive parts packaging market.

Recent Developments

- Pregis, a protective packaging firm based in the US, made its European debut in March 2023 with their high-performance AirSpeed Ascent air cushioning technology. High-pressure air systems are used in the creation of hybrid cushioning (HC), which has a square design that is patented. This improves the overall protection of the goods by increasing the surface area that absorbs shocks. Pregis’s AirSpeed HC Renew film is composed of at least 30% post-consumer recycled material and is manufactured in compliance with Circular Economy Flexible Packaging (CEFLEX) regulations. CEFLEX hopes to have circular flexible packaging across Europe by 2025. Pregis claims that the ‘compact’ design of the AirSpeed Ascent, which saves floor space, and its maximum speed of 30 m/min will benefit users. Because the Ascent has no exposed parts and may be used for one-person roll changes, packer safety is increased.

- Furthermore, Ascent’s architecture has clever logic that can determine and adjust the ideal system parameters for movies that are being put into the device. This “load and go” efficiency streamlines machine operations without affecting them in an effort to minimise human error. Pregis provides customers with equipment systems, surface protection solutions, flexible packaging, and protective items. The company is based in Chicago, Illinois.

- Volvo Cars appointed Richard Campbell and Anders Zobbe as global heads of inbound logistics engineering and packaging, respectively, in September 2022. Zobbe will be in charge of the commercial expansion and strategic network design for the incoming transportation of all manufactured parts for all Volvo facilities. He had previously worked for Carlsberg Group for 16 years in a range of executive logistics roles, the latest of which was director of customer supply chain for the Baltics. He had previously worked in logistics at Toyota. Zobbe started leading the Volvo logistics teams in the Asia-Pacific, the Americas, and the wider European region, with a focus on logistics engineering, international business, and strategic network design.

Market Players

- Knauf Industries

- DS Smith plc

- Mondi plc

- Primex Plastics Corporation (ICC Industries Inc.)

- Nefab AB

- Schoeller Allibert Services B.V.

- Signode India Ltd.

- Sealed Air Corporation

- Smurfit Kappa Group plc

- Sunbelt Paper & Packaging Inc.

- Sonoco Products Company

- WestRock Company

Segments Covered in the Report

By Product

- Crates

- Pallets

- Bags & Pouches

- Bulk Containers & Cases

- Folding Carton

- Trays

- Corrugated Products

- Protective Packaging

By Packaging

- Reusable

- Disposable

By Component

- Cooling system

- Battery

- Underbody components

- Automotive filter

- Engine components

- Lighting Components

- Electrical components

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Unlocking Market Insights through Data Excellence

The “Precedence Statistics” flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today’s dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit:

www.precedencestatistics.com