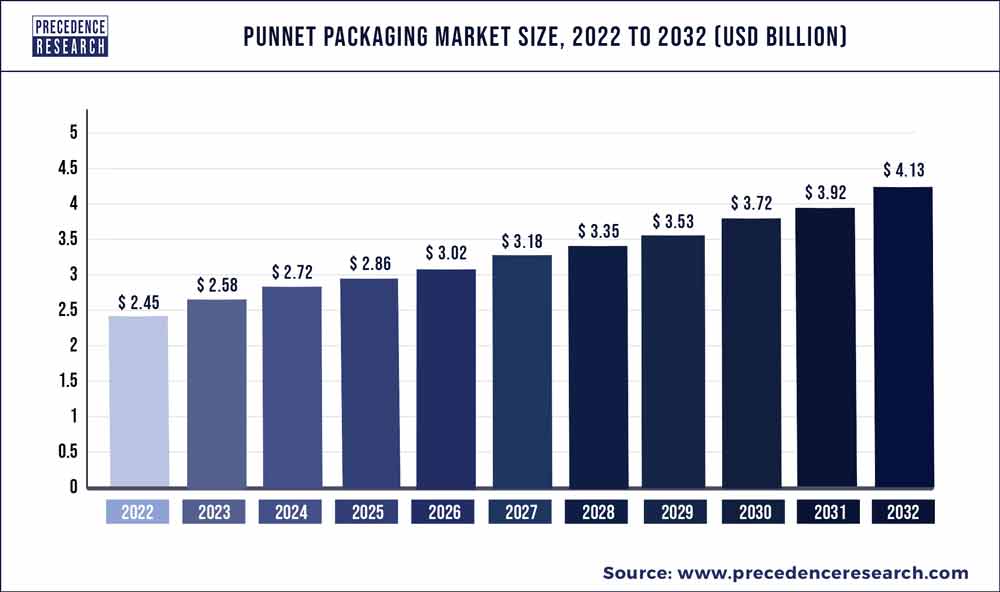

The global punnet packaging market size was valued at USD 2.45 billion in 2022 and is expected to hit around USD 4.13 billion by 2032, growing at a CAGR of 5.36% from 2023 to 2032.

The punnet packaging market has experienced noteworthy growth in recent years, propelled by various factors. The rising demand for convenient and sustainable packaging solutions in the food industry, particularly for fresh produce, has driven the adoption of punnet packaging. Consumers’ increasing preference for portion-controlled and easy-to-carry packaging options has further fueled the market expansion.

Additionally, heightened awareness of environmental concerns has led to a surge in the use of eco-friendly materials for punnet packaging, contributing to the market’s growth. The emphasis on extended shelf life and protection of perishable goods has also played a crucial role in driving the adoption of punnet packaging across various sectors, including fruits and vegetables. As the food packaging landscape continues to evolve, the punnet packaging market is expected to sustain its growth trajectory, driven by the intersection of convenience, sustainability, and effective product protection.

Key Takeaways

- Asia-Pacific now holds a dominant position in the worldwide market and is expected to experience significant expansion in the coming years.

- The market was driven by the plastic packaging segment.

- Punnet packaging was mostly sold in containers weighing between 301 and 500 grammes.

- In the market, the application segment headed by fruits and vegetables.

Get a Sample: https://www.precedenceresearch.com/sample/2998

Report Scope of the Punnet Packaging Market:

| Report Coverage | Details |

| Market Size in 2023 | USD 2.58 Billion |

| Market Size by 2032 | USD 4.13 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 5.36% |

| Largest Market | Asia-Pacific |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Material, By Capacity, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Read More: Cut Flower Packaging Market Size to Hit USD 5.96 Billion by 2032

Punnet Packaging Market Dynamics

Driver

The punnet packaging market is witnessing a notable upswing in demand, driven by an increasing preference for sustainable alternatives to traditional plastic packaging. Consumers and businesses alike are recognizing the environmental impact of plastic waste, leading to a growing demand for eco-friendly solutions in the punnet packaging sector. This shift is underpinned by a collective commitment to reducing the carbon footprint and promoting a more sustainable approach to packaging.

As awareness about environmental issues continues to rise, manufacturers in the punnet packaging market are responding by developing and offering sustainable packaging options. These alternatives often involve the use of biodegradable materials, recycled content, or other environmentally friendly innovations. This surge in demand for sustainable solutions reflects a broader global movement towards responsible and eco-conscious packaging practices in the pursuit of a greener and more sustainable future.

Restraint

The punnet packaging market faces a notable challenge stemming from the slower adoption of technological advancements and the simultaneous rise in the cost of raw materials. The packaging industry’s traditional methods may hinder the integration of innovative technologies, such as smart packaging or sustainable materials, which could enhance efficiency and environmental friendliness.

Additionally, the increasing costs of raw materials for punnet production pose economic constraints for manufacturers. The reliance on these materials, subject to market fluctuations, can lead to elevated production expenses that may, in turn, affect the overall affordability and competitiveness of punnet packaging. To navigate this scenario successfully, stakeholders in the punnet packaging industry need to prioritize investments in technological upgrades and explore sustainable sourcing alternatives to mitigate the impact of rising raw material costs, ensuring long-term viability and competitiveness in the market.

Opportunity

The punnet packaging market is experiencing a notable surge in demand, driven by the growing consumer preference for exotic packaging of fruits and vegetables. This trend reflects a shift in consumer behavior towards more visually appealing and innovative packaging solutions for fresh produce. As people increasingly seek unique and attractive presentations, the punnet packaging market stands to benefit from the demand for packaging that not only preserves the freshness of fruits and vegetables but also enhances their aesthetic appeal on store shelves. The desire for convenience and portability further contributes to the rise in popularity of punnet packaging, as it provides a convenient and easily transportable solution for consumers. This growing interest in exotic packaging not only meets consumer expectations but also provides opportunities for market players to differentiate their products and capitalize on the evolving preferences within the fruits and vegetables packaging sector.

Recent Developments

- The UK government implemented The Plastic Packaging Tax in February 2022. The new rule states that any plastic packaging produced or imported into the UK that contains less than 30% recycled plastic would be subject to a tax of £200 per tonne. Unless the opposite can be shown, it will likewise be presumed that a plastic packaging part contains less than 30% recycled plastic. In order to help customers comply with the impending strict tax system, PET punnet manufacturer and exporter AVI Global Plast introduced ready-to-adopt rPET or recycled PET punnets with 30% post-consumer recycled content, typically recycled bottles. This was confirmed by international certification and testing company InterTek. These punnets can all be recycled.

- An investment of €11 million was given to Solidus’s Future range of packaging solutions, which includes punnets, skin packaging and modified atmosphere packaging (MAP), in January 2023. Benelux, Germany, France, Poland, the UK, and Spain had already received the product line. The company claims that its skin and MAP packaging solutions require at least 80% less plastic and are easily detached, making it possible to recycle the paper-based components after usage. With just slight adjustments to the packaging technology currently in place, the trays allow the transition from plastic to paper packaging. Compared to other techniques, skin packaging is more affordable since it uses deep vacuum technology to increase the product’s shelf life and decrease the need for protective packaging fillers.

Punnet Packaging Market Players

- Coveris Holdings SA

- LC Packaging International BV

- Smurfit Kappa Group Plc.

- Groupe Guillin SA

- Leeways Packaging Services Ltd.

- Paccor Netherlands BV

- Tacca Industries Pty Ltd.

- InfiaS.r.l.

- Raptis Pax Pty Ltd.

- Alta Global

Segment Covered in the Report:

By Material

- Paper

- Plastic

By Capacity

- 150 gm

- 151-300 gm

- 301-500 gm

- over 500gm

By Application

- Vegetables And Fruits

- Frozen Food

- Poultry

- Meat And Sea Food

- Ready-To-Eat Food

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Unlocking Market Insights through Data Excellence

The “Precedence Statistics” flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today’s dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit:

www.precedencestatistics.com